Deng Tong, Jinse Finance

As 2025 draws to a close, Jinse Finance presents a series of articles titled "Looking Back at 2025" to mark the passing of the old year and the arrival of the new. This series reviews the progress of the crypto industry throughout the year and expresses the hope that the industry will overcome its winter and shine brightly in the new year.

In 2025, the global crypto regulatory landscape will undergo a significant transformation. Instead of relying on enforcement actions to shape the industry, different regulatory frameworks will be established in various regions. This article reviews the regulatory achievements of the crypto industry in major countries and regions around the world in 2025.

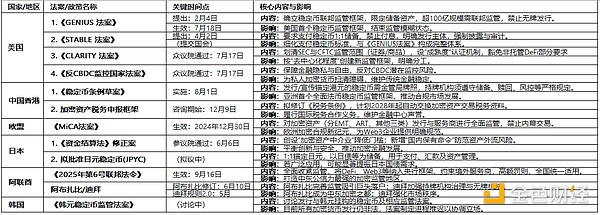

Summary of encryption policies in major countries and regions worldwide in 2025

I. United States

The US crypto regulation has benefited from favorable policies since Trump returned to the White House, making significant progress after years of legislative stagnation.

1. The Direction and Establishment of National Innovation for Stablecoins Act (GENIUS Act)

On February 4, the bill was introduced by Republican Senators Bill Hagerty of Tennessee, Tim Scott of South Carolina, Cynthia Loomis of Wyoming, and Kirsten Gillibrand of New York. On June 17, the U.S. Senate passed the bill, advancing the federal government's regulatory efforts on stablecoins and pressuring the House of Representatives to plan the next phase of national digital asset regulation. On July 18, the bill was signed into law by President Trump.

The bill limits reserve assets to low-risk assets such as US dollar cash and short-term US Treasury bonds. Once the issuance scale exceeds US$10 billion, it will be subject to federal supervision automatically. In the event of bankruptcy, the rights and interests of stablecoin holders will be given priority. At the same time, it prohibits unlicensed institutions from issuing stablecoins.

The enactment of this bill marks the first time the United States has formally established a regulatory framework for digital stablecoins. It clarifies the categories of reserve assets that stablecoins can hold and defines the tiered regulatory responsibilities between the federal and state governments. This ends the previous "wild" state of the stablecoin sector, characterized by ambiguous legal status and unclear regulatory responsibilities, providing clear compliance guidelines for stablecoin issuance, custody, and other related processes, and accelerating the formation of a global stablecoin regulatory system.

For details, please see the Jinse Finance special report , "What Impact Will the 'US Stablecoin Act' Have on the Crypto Industry?"

2. The Stablecoin Transparency and Accountability for a Better Ledger Economy Act (the STABLE Act)

The bill, formally introduced on April 2 by Republican Representatives Bryan Steil of Wisconsin and French Hill of Arkansas, aims to establish a federal framework for issuing stablecoins for payments. It was submitted to Congress by the House Financial Services Committee.

The bill refines the regulatory standards for payment stablecoins, requiring issuers to allocate licensed reserve assets at a 1:1 ratio and prohibiting interest payments to users; it clarifies that legitimate issuers include three categories: federally regulated banks, approved non-bank entities, etc.; it also mandates that issuers disclose redemption procedures and monthly reserve reports, which must be reviewed by a certified public accountant firm, and false certifications will face criminal penalties.

This bill complements the GENIUS Act, together building a comprehensive regulatory system for stablecoins across the entire supply chain.

For details, please see "Is a Turning Point for Stablecoins Coming? US House Makes Major Adjustments to the STABLE Bill"

3. The Clarity Act (Digital Asset Markets Act)

On May 29, French Hill, chairman of the House Financial Services Committee, introduced the Digital Asset Market Clarity Act, aiming to eliminate long-standing ambiguity in digital asset regulation by clarifying the responsibilities of the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). On June 23, the House Financial Services Committee and the Agriculture Committee submitted the bill, which defines digital commodities as digital assets whose value is "intrinsically linked" to the use of blockchain technology. It was passed by the House of Representatives on July 17.

The core of the bill is to define the regulatory scope of the SEC and CFTC: the SEC regulates "digital asset securities," while the CFTC regulates "digital goods." The bill classifies Bitcoin, Ethereum, and other cryptocurrencies as digital goods, and considers tokens issued during ICOs as investment contract assets. It establishes a blockchain "maturity" certification mechanism, allowing projects that meet the standards to subsequently be regulated by the CFTC. Furthermore, it exempts non-custodial DeFi services from traditional registration requirements and relaxes SEC registration restrictions for small-scale fundraising projects.

The Clarity Act no longer focuses on whether a cryptocurrency is a security, but rather on maturity—"How decentralized is it?" It clarifies the division of labor between the SEC and the CFTC, creating a completely new framework for the regulation of digital assets.

For details, please see "Focusing on the Clarity Act: A Comprehensive Analysis of its Content, Significance, and Industry Evaluation"

4. The Anti-CBDC Surveillance National Act

In February 2023, House Majority Whip Tom Emer first introduced the bill. On March 26, 2025, Texas Senator Ted Cruz also introduced the same bill in the Senate, and on July 17, the House of Representatives passed the bill by a vote of 219 to 210.

The core significance of this bill lies in protecting citizens' financial privacy and freedom. It also plays a positive role in removing obstacles to the development of private cryptocurrencies, maintaining the stability of the traditional US financial system, and mitigating the risks of politicizing monetary policy.

For details, please see "A Detailed Analysis of the US Congressional Crypto Week: Summary of Three Major Bills, Market Trends, and Industry Perspectives".

II. Hong Kong, China

1. Draft Stablecoin Regulations

On May 21, the Hong Kong Legislative Council formally passed the Stablecoin Bill at its third reading. It will officially take effect on August 1, marking Asia's first comprehensive regulatory framework for fiat-backed stablecoins.

The regulations stipulate that any entity issuing fiat currency stablecoins in Hong Kong, or any entity outside Hong Kong claiming to peg them to the Hong Kong dollar, must apply for a license from the Hong Kong Monetary Authority. Licensed issuers must comply with requirements such as reserve asset segregation and redemption at par value, as well as a series of regulations concerning anti-money laundering, risk management, and information disclosure. Furthermore, only licensed institutions may sell fiat currency stablecoins in Hong Kong, and only stablecoins issued by licensed issuers can be sold to retail investors; the promotion and marketing of unlicensed stablecoins is illegal. The Hong Kong Monetary Authority has also issued corresponding regulatory guidelines, clarifying the license application process and transitional arrangements.

For details, please see "Hong Kong's Compliant Stablecoins Are Coming: A Quick Overview of Their Development and Key Features".

2. Public consultation launched on the crypto asset reporting framework and related revisions to the common reporting standards.

On December 9, the Hong Kong Special Administrative Region Government launched a public consultation on the implementation of a reporting framework for crypto assets and related amendments to the Common Reporting Standard (CTBS). Secretary for Financial Services and the Treasury Christopher Hui stated that, to demonstrate Hong Kong's commitment to promoting international tax cooperation and combating cross-border tax evasion, and to fulfill its international obligations, the Government will amend the Inland Revenue Ordinance (Chapter 112) (the Ordinance) to implement the reporting framework and the newly revised CTBS. This measure is also crucial to maintaining Hong Kong's reputation as an international financial and business center. The Government plans to complete the necessary local legislative amendments by next year, aiming to automatically exchange tax information related to crypto asset transactions with relevant partner tax jurisdictions from 2028, and to implement the newly revised CTBS from 2029. Hong Kong will automatically exchange tax information with appropriate partners on a reciprocal basis, provided that the partners meet standards related to protecting information confidentiality and security.

For details, please refer to "Hong Kong: Proposed Automatic Exchange of Tax Information Related to Crypto Asset Transactions with Relevant Partner Tax Jurisdiction Starting in 2028".

III. European Union

On December 30, 2024, the EU’s Crypto Asset Market Regulation Act (MiCA Act) officially came into effect, marking a new era for the European crypto asset compliance framework.

This bill establishes a refined regulatory system, setting clear requirements for the issuance of crypto assets and related service providers, while also establishing regulatory exemption rules and market integrity protection clauses. MiCA defines crypto assets as digital representations of value or rights transmitted and stored through distributed ledger technology, categorizing them into three types: Electronic Money Tokens (EMTs); Asset Reference Tokens (ARTs); and other crypto assets, such as non-stablecoins like Bitcoin. The bill emphasizes differentiated regulation of crypto asset issuance, stipulates entry and operational standards for Crypto Asset Service Providers (CASPs), defines regulatory exemptions to avoid over-regulation stifling innovation, and explicitly prohibits insider trading to prevent market misconduct.

For details, please see "The EU MiCA Regulation Officially Takes Effect: A Comprehensive Explanation of the New Standards for Web3 Business Operations".

4. Japan

1. Amendment to the Payment Services Act

In March of this year, Japan's Financial Services Agency submitted an amendment to the bill to the Diet, the core of which is to strengthen market security and appropriately lower industry entry barriers.

On June 6, the Japanese House of Councillors passed an amendment to the Payment Services Act, establishing a new system for "crypto asset intermediaries." This amendment allows companies to provide matching services without registering as crypto asset exchange operators, aiming to lower market entry barriers and promote innovation in crypto finance. The amendment also adds a "domestic holding order" clause, granting the government the power to order platforms to retain a portion of user assets within Japan when necessary, to prevent asset outflow risks similar to those caused by the FTX bankruptcy. The new law is expected to take effect within one year of its promulgation.

For details, please see "Japan's House of Councillors Passes Amendment to the Payment Services Act, Establishing New Regulations for Crypto Asset Intermediaries".

2. Proposed approval for the issuance of a Japanese yen stablecoin

The Japanese yen stablecoin will be named JPYC, with 1 JPYC fixed at 1 yen (approximately 0.05 yuan). It will be backed by highly liquid assets such as yen deposits and Japanese government bonds. Individuals, businesses, and institutional investors can apply to purchase JPYC stablecoins and make payments. The stablecoins will then be transferred to their e-wallets. Application scenarios include remittances to overseas students, corporate payments, and blockchain-based asset management services.

A stablecoin for the Japanese yen could have a significant impact on the Japanese bond market. If JPYC becomes widely adopted, it will boost demand for Japanese government bonds, and JPYC is likely to begin purchasing large amounts of Japanese government bonds in the future.

For details, please see "Japan Plans to Approve Issuance of Yen Stablecoin".

V. United Arab Emirates

On September 16, Federal Decree No. 6 of 2025 came into effect, marking a major consolidation in the history of UAE financial regulation and comprehensively tightening the regulation of the crypto and related fields. Specific policies include: for the first time, the decree brings all blockchain infrastructure, including DeFi, Web3 projects, stablecoin protocols, decentralized exchanges, and cross-chain bridges, under the central bank's regulatory framework; even if a crypto service provider is located outside the UAE, it must comply with the law and apply for relevant licenses if its clients include UAE residents; entities conducting related business without a license may be fined between 50,000 and 1 billion dirhams (approximately US$13,600 to US$272 million), with some cases also involving imprisonment; the decree provides a one-year transition period for existing crypto and related operators, requiring relevant projects to complete compliance licensing applications and other adjustments by September 2026, with the central bank having the discretion to extend the transition period; previously, financial free zones in places like Dubai could issue virtual asset licenses independently, but the new decree explicitly states that its provisions also apply to financial free zones, and licenses issued by free zones cannot be exempted from the compliance requirements of the new law.

The UAE is striving to become the most well-structured and internationally credible cryptocurrency regulatory region in the Middle East.

1. Abu Dhabi

On June 10, the Abu Dhabi Global Markets Financial Services Authority (ADGM) announced revisions to its digital asset regulatory framework, effective immediately. The revisions focus on modifying the process for Abu Dhabi Global Markets (ADGM) to accept virtual assets (VAs) and use them as recognized virtual assets (AVAs), and setting corresponding capital requirements and fees for authorized entities (virtual asset companies) engaged in regulated activities related to virtual assets. The revisions also introduce specific product intervention rights for virtual assets and establish rules to affirm existing practices prohibiting the use of privacy tokens and algorithmic stablecoins within ADGM. Finally, the revisions expand the investment scope of venture capital funds.

Thanks to Abu Dhabi's increasingly sophisticated crypto regulatory environment, numerous crypto companies, including Circle, Tether, Binance, Ripple, Animoca Brands, GFO-X, and Bitcoin Suisse, have obtained licenses in Abu Dhabi this year. Abu Dhabi is becoming the crypto capital of the Middle East.

For more details, please see "Is Abu Dhabi the Real Crypto Capital? Why are Crypto Giants Like Binance, Tether, and Circle Choosing Abu Dhabi?"

2. Dubai

In May of this year, the Dubai Virtual Asset Regulatory Authority (VARA) released version 2.0 of its rulebook, expanding governance and reporting standards for all licensed virtual asset activities. VARA also continues to take significant civil enforcement action against unlicensed operators in Dubai, issuing cease and desist orders and fines on multiple platforms.

VI. South Korea

In May of this year, Lee Jae-myung formally proposed a plan to issue a stablecoin pegged to the Korean won at a policy discussion meeting.

In early December, South Korea's ruling party called on all ministries and the Financial Services Commission (FSC) to submit a bill regulating the won-denominated stablecoin by December 10th, but the FSC failed to submit the bill on time. An FSC spokesperson stated that the FSC needed more time to coordinate its position with relevant agencies, and rather than rushing to complete the proposal before the deadline, it was better to publish its proposal at the same time as submitting it to the National Assembly. The FSC stated that this move was to protect the public's right to know about the matter.

Therefore, the issuance of all forms of cryptocurrencies and stablecoins remains illegal in South Korea.