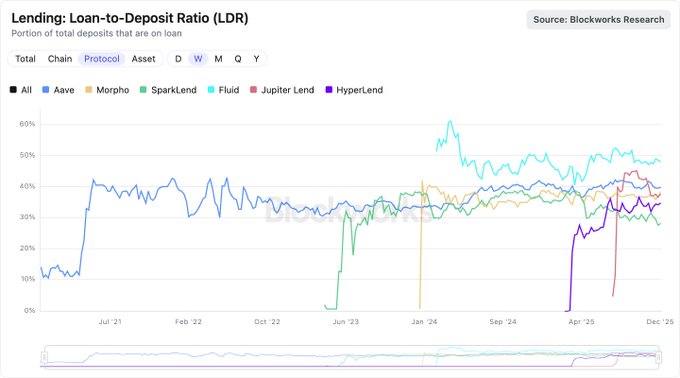

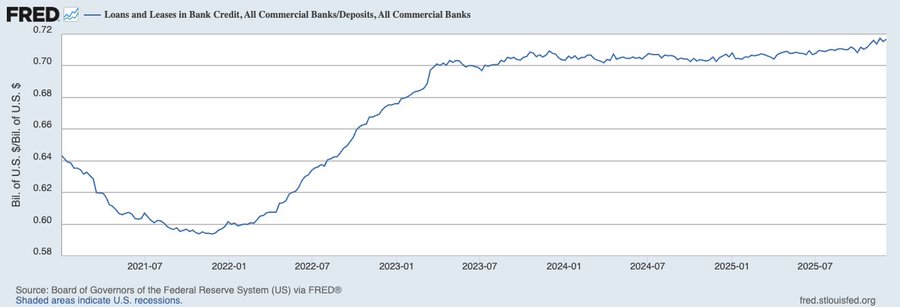

Fluid is pushing the boundaries of onchain lending. Loan-to-Deposit Ratios for onchain lenders have historically been low, averaging ~40%. By contrast, U.S. commercial banks have operated with average LDRs in the 70–75% range over the past few years. Monolithic lending markets can, in principle, push LDRs higher via collateral rehypothecation, but have historically taken a more conservative approach. Fluid’s LDR remains below that of traditional banks, but has been consistently above onchain peers since launch. Encouraging to see protocols pushing the limits of balance-sheet efficiency in DeFi.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content