When Donald Trump returned to the White House, much of the crypto market anticipated a familiar scenario. Pro-crypto rhetoric, a more favorable regulatory environment, institutional capital inflows, and increased risk appetite were expected to combine to create a defining Bull market cycle.

When Donald Trump returned to the White House, much of the crypto market anticipated a familiar scenario. Pro-crypto rhetoric, a more favorable regulatory environment, institutional capital inflows, and increased risk appetite were expected to combine to create a defining Bull market cycle.

However, as 2025 drew to a close, the crypto market ended the year at a significant low, only about 20% of the peak reached during the Biden era.

Even with Trump, the crypto market was only 20% of what it was during the Biden era.

This contradiction is becoming the focus of a growing debate: whether crypto is stuck in a difficult phase, or whether something fundamental has truly broken down.

"It's time to admit that the crypto market is 'broken'," said Ran Neuner, analyst and host of Crypto Banter.

Neuner highlighted the unprecedented disconnect between fundamentals and prices. According to him, 2025 will have “all the necessary conditions for a Bull market”:

Ample liquidation .

The US government supports crypto.

ETF spot (especially Bitcoin and Ethereum),

The strong accumulation of Bitcoin by figures like Michael Saylor,

The involvement of states and national wealth funds,

Macroeconomic assets such as stocks and precious metals (gold, silver) are continuously reaching new highs.

“Even with all those factors,” Neuner said, “we would still end 2025 at a lower level, and only 20% of what we were under Biden.”

This shows that traditional explanations are no longer convincing. Theories revolving around the 4-year cycle, trapped liquidation , or the crypto 'IPO moment' are increasingly resembling justifications after the event, rather than the real answers.

According to Neuner, the market now has only two possible scenarios:

Either there is a hidden seller or mechanism suppressing the price,

Or crypto is preparing for what he calls "the biggest catch-up in history," when the market finally returns to equilibrium.

Not everyone thinks crypto is 'broken'.

Market commentator Gordon Gekko, a popular account on X, countered this view, arguing that the current pain is intentional and structural, not disordered.

“Nothing is broken; this is exactly how market makers want it. Sentiment is at its lowest point in years; leveraged traders are losing everything. The market wasn’t designed to be easy — only the strong are rewarded,” he wrote.

This Chia reflects a profound shift in how crypto operates compared to previous cycles. Under the first Trump administration (2017–2020), crypto thrived in a nearly unregulated environment.

Retail speculation prevailed, leverage was unchecked, and reflexive price movements pushed prices far above their fundamental value.

Conversely, under Biden, the market became more institutionalized. The “tightening through enforcement” approach limited risk, while ETFs, custodians, and compliance frameworks reshaped Capital flows and allocation.

Ironically, many of the most anticipated crypto breakthroughs have emerged during this period of constraint:

ETFs expand accessibility, but primarily for Bitcoin.

Organizations participate, but often defend and rebalance mechanically.

Liquidation exists, but it flows into TradFi structures instead of the on-chain ecosystem.

The result is increased scale, but a lack of responsiveness.

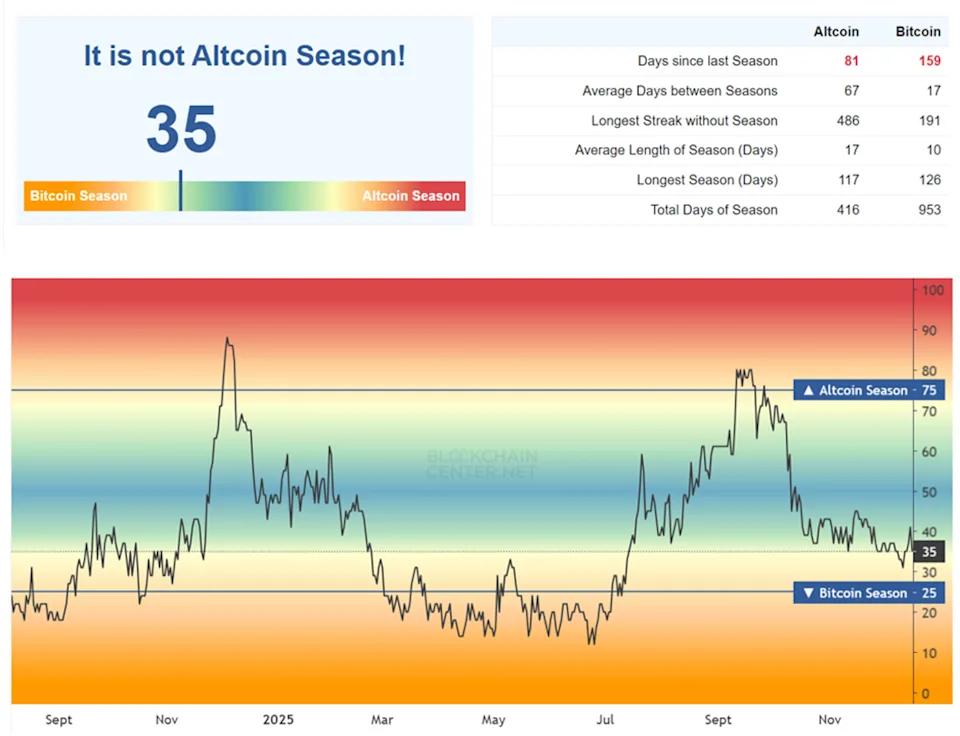

Bitcoin holds firm, altcoins collapse in the new crypto regime.

This structural shift is particularly damaging to altcoins. Many analysts and KOLs, including Shanaka Anslem, argue that the unified crypto market of the past no longer exists.

Instead, 2025 is Chia into “two games”:

Crypto is institutional: Bitcoin, Ethereum, and ETFs, with compressed volatility and a long-term outlook.

Crypto under scrutiny: where millions of Token compete for short-term liquidation and the majority collapse within days.

Capital no longer flows smoothly from Bitcoin to altcoins like in traditional "altseasons." Instead, it flows directly to where it aligns with its predetermined goals.

"Now you only have two options: play Institutional Crypto with patience and macro-level awareness, or play Attention Crypto with speed and infrastructure," Anslem wrote.

According to him, holding altcoins based on their underlying value for months is now the worst possible strategy.

"You don't have to arrive early for the altseason. You're waiting for a market structure that no longer exists," he added.

Lisa Edwards also supports this view, urging market participants to understand the flow of liquidation.

"Things change, cycles change, money moves in new ways. If you're still waiting for the old altseason, you'll miss out on what's happening right in front of you," she stated.

Quinten François also agreed, noting that the number of Token in 2025 has far exceeded previous cycles. With over 11 million Token in existence, the idea of a large-scale altseason like 2017 or 2021 is probably outdated.

Between Revaluation and Recovery: Crypto's Post-Institutional Test

Meanwhile, macroeconomic pressures continue to weigh on market sentiment. Nic Puckrin, investment analyst and co-founder of Coin Bureau, suggests that Bitcoin's slide toward its 100-week moving Medium reflects concerns about an AI bubble, uncertainty surrounding the Fed's future leadership, and year-end loss-making to optimize tax returns.

"This makes the end of 2025 look quite bleak," he told BeInCrypto, while warning that BTC could temporarily drop below $80,000 if selling pressure increases.

No one can be sure whether crypto is 'broken' or just undergoing a transformation, and investors need to conduct their own thorough research.

However, it is clear that Trump-era expectations are clashing with the market structures formed under Biden, and the old 'textbooks' are no longer relevant.

Discussions among economists and investors at major trading desks suggest the market could face a fierce revaluation or a violent catch-up rally — factors that could shape the post-institutional identity of crypto.