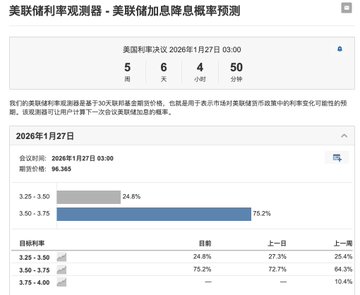

Tonight's data release reveals that the US economy is like a seriously ill person, yet the stock market is celebrating, because everyone is convinced the doctor (the Federal Reserve) is about to increase the dosage (interest rate cuts). 1. The October Jobs Drop: The most alarming aspect of this non-farm payrolls report isn't the November figure (64,000 new jobs, which is actually acceptable), but the October figure, which has been revised into a "disaster movie"—a direct loss of 105,000 jobs! This is the largest drop since the end of 2020, meaning the US labor market has experienced a net outflow over the past two months. This is a very clear signal of economic contraction. 2. The Market's Mindset: The Worse, the Better: Logically, a poor economy should lead to a stock market decline, but the logic is reversed. The Fed's previous tightening policies may have over-damaged the economy, and the market will immediately repric a significant interest rate cut. US Stocks Rebound: Given the poor state of the economy, the Fed dares not maintain high interest rates and may even have to cut rates significantly ahead of schedule to save the economy. The futures market immediately bets on a 25% probability of a rate cut in January. As long as there is an expectation of monetary easing, the stock market will rise. 3. The Only Good News: Labor Force Participation Rate Why hasn't the unemployment rate soaring to 4.6% triggered widespread panic? A 4.6% unemployment rate is generally considered a high point that triggers the "SAM Rule" recession warning. This is because the labor force participation rate has rebounded. In simpler terms: a high unemployment rate isn't just because people are being laid off, but also because people who were previously idle are now looking for work. This makes the Federal Reserve think that perhaps the labor market isn't beyond saving. In short: the US economy is teetering on the brink of a hard landing, but Wall Street is betting that the Federal Reserve will inject massive amounts of capital to prevent a crash. The current market logic is very simple and brutal: the worse the economy → the faster interest rates are cut → the more bullish the US stock market.

This article is machine translated

Show original

链研社

@NB

12-16

华尔街现在的心态很矛盾,核心逻辑是坏消息就是好消息。

市场信号:

黄金:微涨,说明大家想避险,但还没到恐慌的地步。

原油:下跌,暗示大家对未来经济需求没信心。

比特币:大跌,作为最敏感的资产,它率先反应了流动性收紧的风险。

重点关注今晚的 21:30

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content