OMG. Using actual analysis and half a brain helped Cantor conclude that Adjusted market cap (a number in between Market Cap (Float) and FDV (not relevant)) is more accurate than what @coinbase , @binance, @coingecko and everyone else seems to be incapable of figuring out as they lazily keep throwing market cap and FDV out there despite these metrics being completely irrelevant in most cases.

(NOTE: I'm excluding @CoinMarketCap since they are actually committed to solving this problem x.com/KatieTalati/status/19919...…)

It's not rocket science people -- corporate tokens with fixed supply that amortize tokens are different than inflationary network tokens.... stop using the same "math" for both.

$HYPE $PURR

Jeff Dorman

@jdorman81

12-17

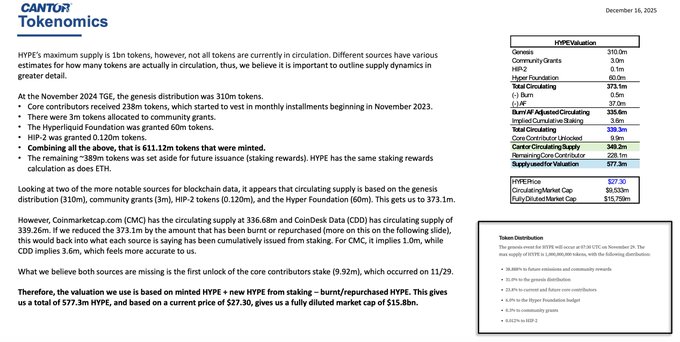

Perhaps the only thing good about DATs is that Wall Street can make money trading & banking the stocks, which means you get some actual research coverage and interest in the stock (and thus the token)

Good initiation on $PURR (and thus $HYPE) by Cantor

https://cantor2.bluematrix.com/links2/secure/pdf/869ec14c-ff67-46fa-aac8-3e0274838b55…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content