In 2025, the US government is pursuing a pro-cryptocurrency policy. The US's goal is simple: to operate the existing crypto industry like traditional finance. So, what changes is the US attempting?

Key Takeaways

The United States is changing its system to incorporate the cryptocurrency industry into its infrastructure rather than absorbing it.

Over the past year, various agencies, including the legislature, SEC, and CFTC, have created or eliminated benchmarks to absorb the industry.

The United States is growing its industry by refining regulations within a structure where interests and checks and balances coexist between ministries.

1. The US is absorbing the cryptocurrency industry.

Since President Trump's reelection, he has implemented aggressive, cryptocurrency-friendly policies. This stands in stark contrast to the past, when the cryptocurrency industry was viewed as a target of control. We have entered an era unimaginable. The United States is absorbing the cryptocurrency industry at a pace approaching Trump's dictatorship. Everything is changing, from the shifting stances of the SEC and CFTC to the entry of traditional financial institutions into the cryptocurrency business.

Surprisingly, only a year has passed since President Trump's reelection. What institutional and policy changes have occurred in the United States since then?

Be the first to discover insights from the Asian Web3 market, read by over 22,000 Web3 market leaders.

2. Changes in the US stance on cryptocurrencies over the past year

US cryptocurrency policy in 2025 reached a major turning point with the inauguration of the Trump administration. The administration, Congress, and regulators all took action simultaneously to eliminate market uncertainty and integrate cryptocurrencies into the existing financial infrastructure.

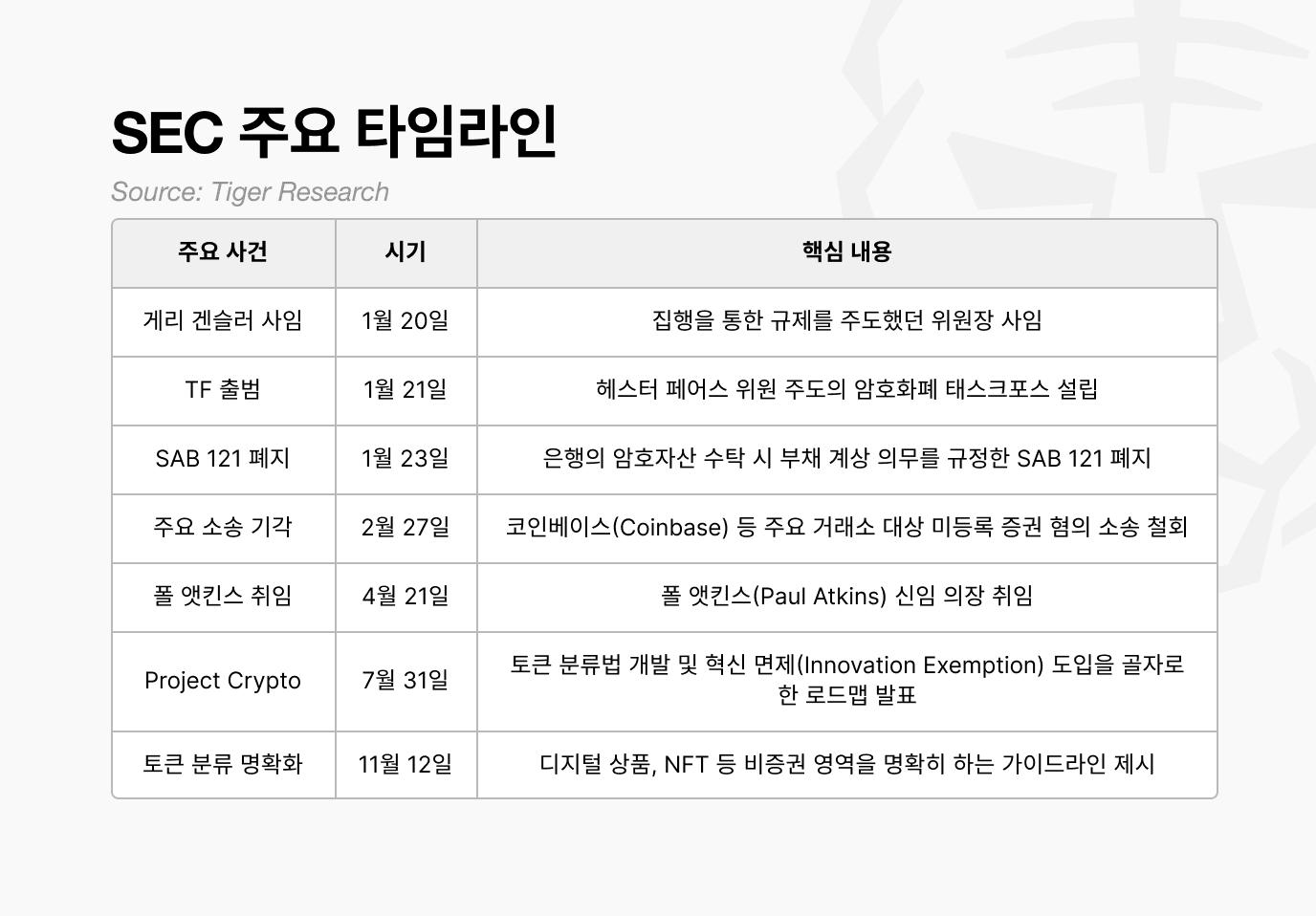

2.1. SEC (Securities and Exchange Commission)

In the past, the SEC has often initiated lawsuits when it comes to cryptocurrencies. In major cases like the Ripple, Coinbase, Binance, and Kraken staking cases, the SEC has failed to provide clear standards for the legal nature of tokens or permissible activities, relying instead on post-hoc interpretations to enforce the laws. Consequently, for cryptocurrency companies, it has become increasingly important to prepare for potential regulatory risks.

However, following the departure of Gary Gensler, who had been conservative toward the cryptocurrency industry, and the arrival of Paul Atkins, the SEC has become more open. Rather than relying on litigation for enforcement, the SEC has shifted its focus to embracing the cryptocurrency industry by establishing foundational regulations.

For example, the announcement of Project Crypto marked the beginning of a process of establishing clear standards for determining which tokens are securities and which are not. This marked the transformation of a regulatory body, once unpredictable, into an inclusive one.

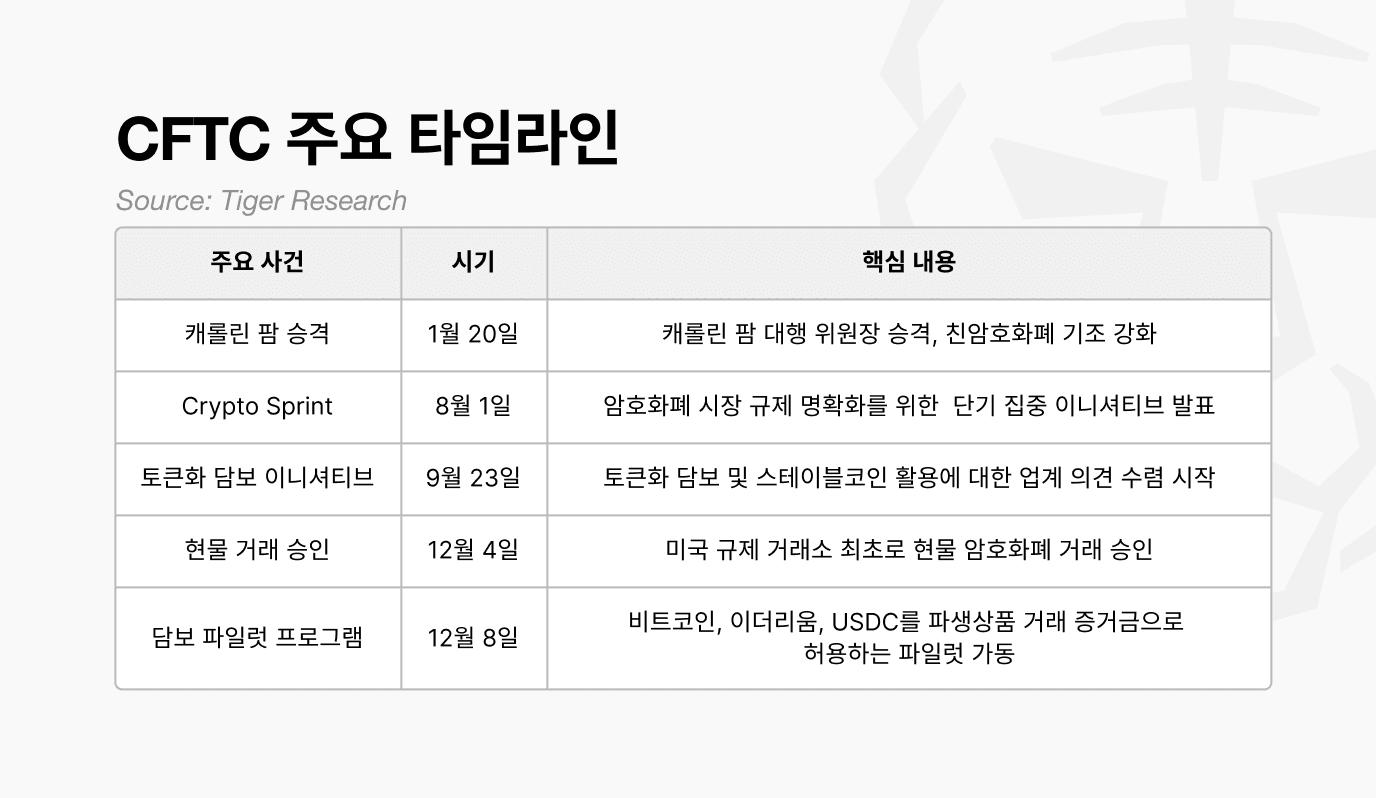

In the past, the CFTC's involvement in cryptocurrencies was limited to oversight of the derivatives market, but this year it has become more aggressive. This year, it recognized Bitcoin and Ethereum as commodities and supported their use by traditional institutions.

A representative example is the "Digital Asset Collateral Pilot Program," which recognized Bitcoin, Ethereum, and USDC as collateral for derivatives trading and began managing them in the same way as institutional assets by applying haircuts and risk management standards.

The CFTC also no longer views cryptocurrency assets as speculative assets, but rather recognizes them as stable assets that can be used as collateral like traditional assets.

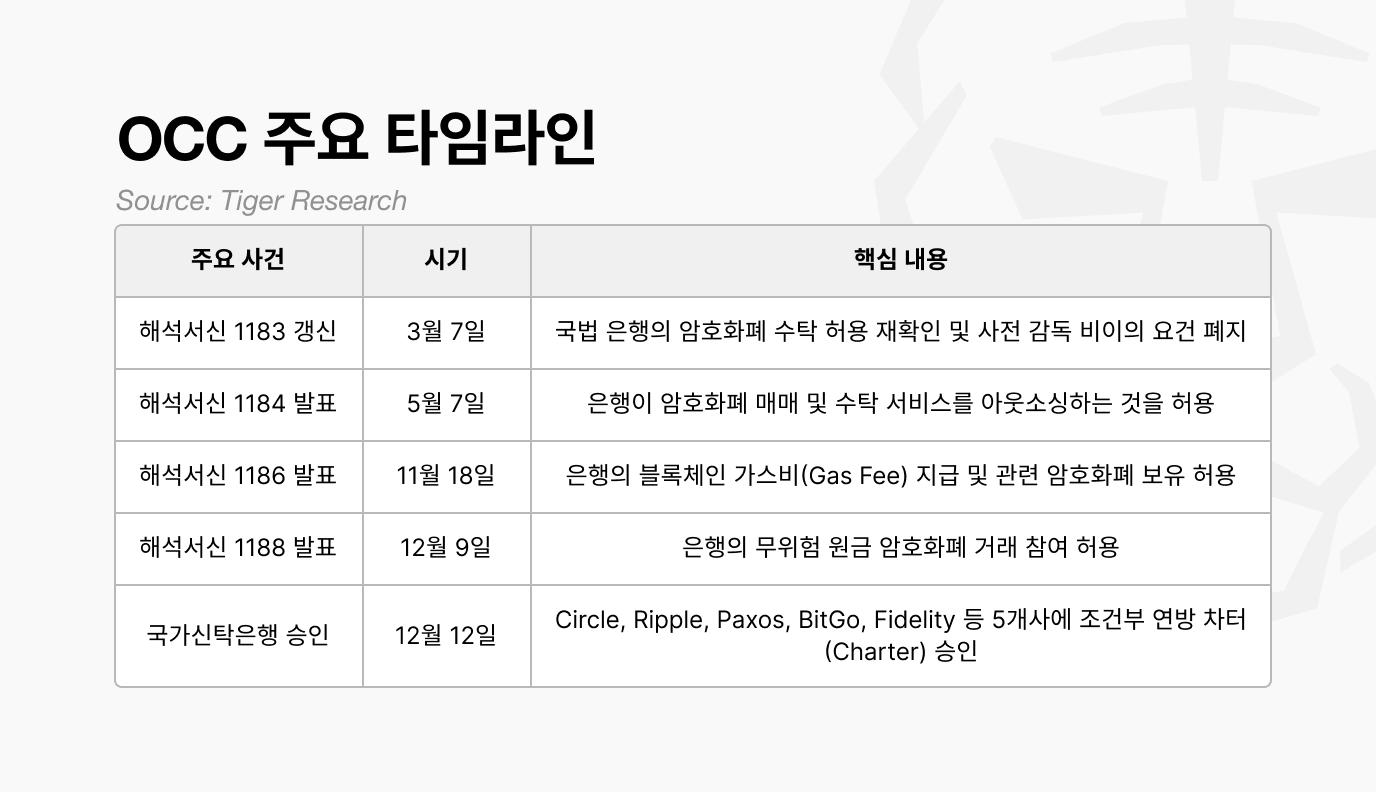

In the past, the OCC distanced itself from the cryptocurrency industry. Cryptocurrency companies had to obtain separate licenses in each state and faced difficulties accessing federal banking supervision. Business expansion was limited, and connections to the traditional financial system were structurally blocked. Under these circumstances, cryptocurrency companies were forced to remain outside the regulatory framework.

However, rather than keeping cryptocurrency companies outside the financial system, the OCC has chosen to bring them into the banking regulatory framework. The OCC has issued a series of interpretation letters (official documents from regulators stating whether specific financial activities are permissible). The scope of bank permission has gradually expanded to include cryptocurrency custody, trading, and even gas payment. This trend reached its peak in December, when the OCC conditionally granted national trust bank status to major companies such as Circle and Ripple.

This approval significantly positions cryptocurrency companies on par with traditional financial institutions. Federal oversight allows them to operate nationwide. Remittances that previously required a separate bank can now be processed directly, just like regular banks.

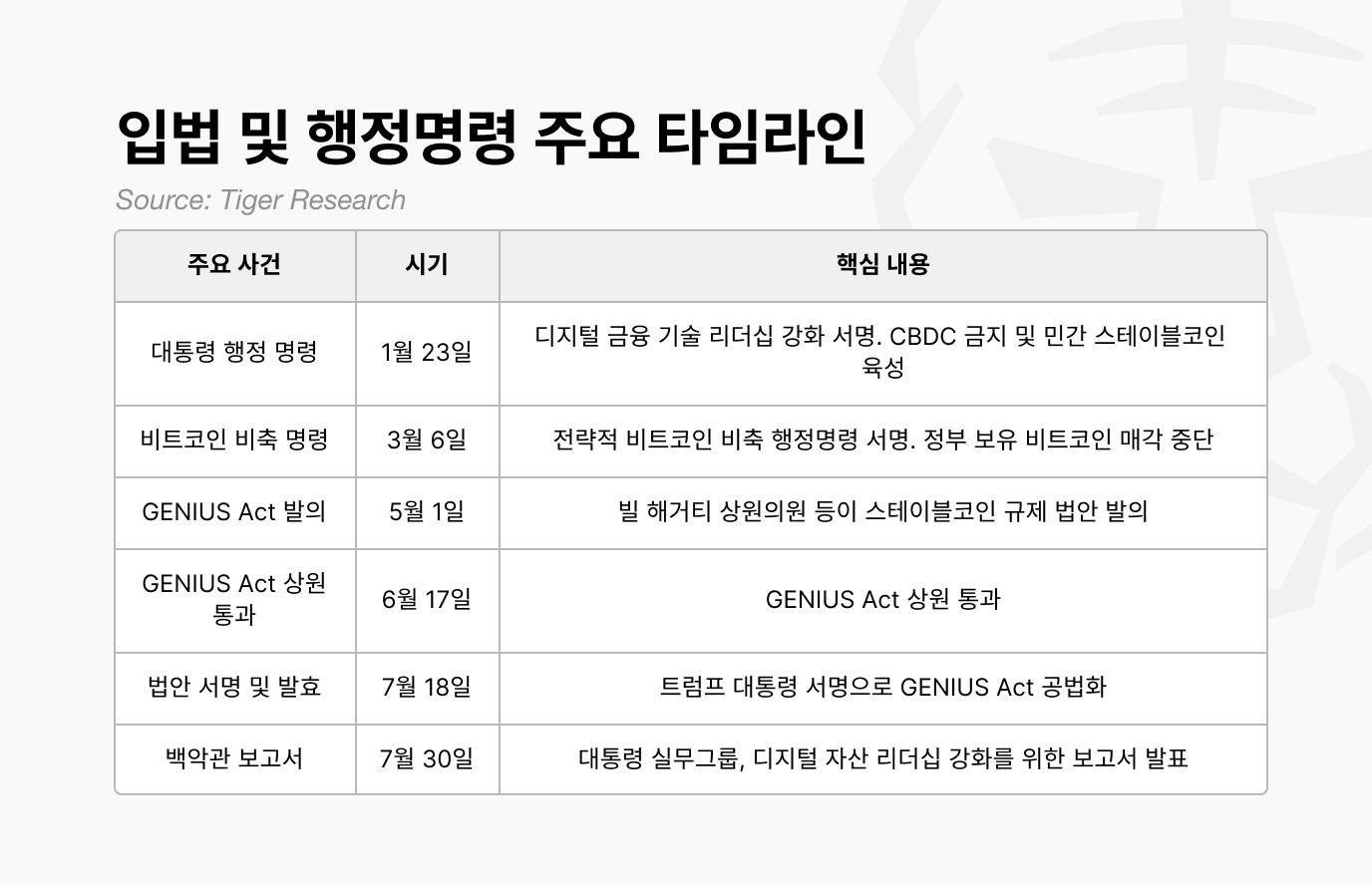

The United States previously prepared a stablecoin bill starting in 2022. However, the bill's continued delays created a regulatory vacuum in the market. There were no clear standards for how reserves should be structured, who would oversee them, or what the issuance requirements were. Investors had no way to verify whether issuers actually held reserves. As a result, some issuers faced reserve transparency issues.

Therefore, the GENIUS Act clearly defined the requirements for stablecoin issuance and the composition of reserves. It mandated that reserves equal 100% of the amount issued be held, and prohibited re-collateralization, the practice of using assets held in custody as collateral for other purposes. Supervision was also centralized under the federal financial authorities.

As a result, stablecoins have established themselves as digital dollars with legally guaranteed solvency .

In summing up the past year, the direction of US cryptocurrency policy appears to be moving in one direction: bringing the cryptocurrency industry into the formal financial system. However, this process hasn't progressed smoothly.

Differences of opinion remain within the United States. A prime example is the differing views surrounding Tornado Cash, a privacy-mixing service. The administration is aggressively enforcing the law, citing it as a means to stem illicit financial flows. Meanwhile, the SEC chairman publicly cautioned against an approach that overly restricts privacy. This suggests that even within the United States, views on cryptocurrencies are not entirely unified.

However, these differences do not signal a policy slump. Rather, they are characteristic of the American decision-making process. Agencies with different powers interpret issues from their own perspectives, sometimes openly expressing differing opinions and challenging and persuading each other. The tension between prioritizing law enforcement and protecting innovation may appear as friction in the short term, but in the long run, it has served to make regulatory standards more specific and sophisticated.

The key point is that these tensions persist. Amidst debate and conflict, the United States simultaneously pushes forward the major trends of SEC rulemaking, CFTC infrastructure integration, OCC institutional integration, and standard-setting through congressional legislation. It doesn't wait for a complete agreement. It simultaneously engages in competition and coordination, driving the system forward.

Ultimately, the United States neither unconditionally embraced nor strongly suppressed cryptocurrencies. Instead, it simultaneously redesigned regulations, personnel, and market infrastructure. Instead, it leveraged internal disputes and tensions as momentum, adopting a strategy of bringing the center of the global cryptocurrency industry to its own shores.

The past year has been significant in that the direction has gone beyond declarations and into actual systems and implementation.

이번 리서치와 관련된 더 많은 자료를 읽어보세요.

Disclaimer

This report has been prepared based on reliable sources. However, we make no express or implied warranties as to the accuracy, completeness, or suitability of the information. We are not responsible for any losses resulting from the use of this report or its contents. The conclusions, recommendations, projections, estimates, forecasts, objectives, opinions, and views contained in this report are based on information current at the time of preparation and are subject to change without notice. They may also differ from or be inconsistent with the opinions of other individuals or organizations. This report has been prepared for informational purposes only and should not be construed as legal, business, investment, or tax advice. Furthermore, any reference to securities or digital assets is for illustrative purposes only and does not constitute investment advice or an offer to provide investment advisory services. This material is not intended for investors or potential investors.

Tiger Search Report Usage Guide

Tigersearch supports fair use in its reports. This principle allows for the broad use of content for public interest purposes, provided it does not affect commercial value. Under fair use rules, reports may be used without prior permission. However, when citing Tigersearch reports, 1) "Tigersearch" must be clearly cited as the source, and 2) the Tigersearch logo must be included. Reproducing and publishing materials requires separate agreement. Unauthorized use may result in legal action.