The Chinese government's crackdown on large-scale mining operations has shut down approximately 400,000 mining machines.

Short-term selling pressure increases amid a sharp decline in Bitcoin's hash rate.

Ethereum maintains support at $2,940, highlighting its relative defensiveness.

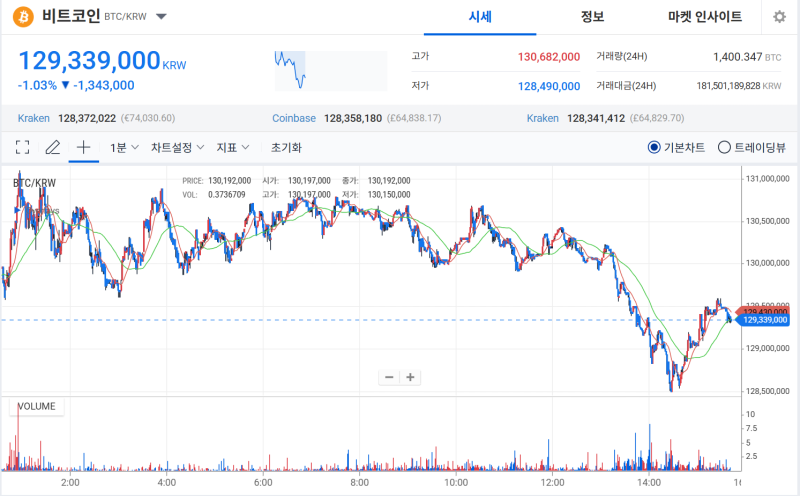

Bitcoin continued its bearish trend, trading at $86,837 (KRW 129,339,000), down approximately 1.1% from the previous day's close as of 3:30 PM today. The Sigbit Fear and Greed Index remained at 16 points, within the "extreme fear" zone, and the RSI was also in the neutral lower range, suggesting the possibility of increased short-term volatility.

Ethereum (ETH) showed limited adjustments compared to the previous day, but maintained a relatively stable trend, exceeding the key defensive level of $2,940 (KRW 4,343,000) suggested by this paper the previous day.

The altcoin market showed mixed performance overall, with limited bottom-line buying observed, particularly in real-world asset classes (RWA) and some small- and mid-cap stocks. The market believes the pace of hash rate recovery and news of additional regulations from China will be key variables in determining Bitcoin's short-term direction. If Bitcoin fails to quickly recover the $87,000 level, the likelihood of continued volatility is growing.

◇ Bitcoin = As of 4:00 PM today, Bitcoin (BTC) was trading at 129,339,000 won on Upbit, with Bitcoin dominance at 56.85%. Based on Sigbit, the long-short ratio in the futures market was 68.52% long and 31.48% short, indicating a bullish bet, but the price remained in a downward trend.

◇ Rising Coins = As of 4 PM today, the coin with the largest increase on Upbit was AlphaQuark (AQT), soaring 20.52% compared to the previous day. AlphaQuark (AQT) is a project that first launched in June 2021 as an NFT marketplace that allows users to directly create, sell, and purchase non-fungible tokens (NFTs).

◇ Fear and Greed Index = Alternative's Fear and Greed Index is at 16 points, reaching the "Extreme Fear" level. Amidst deepening investor sentiment, investor sentiment remains conservative, and the potential for increased volatility remains. ◇ With the RSIRSI at 39.5 and the Stochastic Index at 80.5, oversold signals are clear, suggesting potential for a short-term technical rebound.

Lee Jeong-seop ljs842910@blockstreet.co.kr