According to ME News, on December 17th (UTC+8), the global macro environment remains in a rate-cutting cycle. Although the hawkish dot plot raised concerns, the actual results were slightly better than expected, and the market has priced in 1-2 more rate cuts next year. The Federal Reserve has largely ruled out another rate hike, and its policy direction remains accommodative. The labor market continues to cool, and if employment and inflation data weaken further, an unexpected rate cut cannot be ruled out. This week, attention will be focused on non-farm payrolls, CPI, PPI, and the ECB and BOJ meetings. The BOJ rate hike has been fully priced in, and its overall impact is limited. Year-end options trading is large, putting short-term volatility under pressure, but amplified risks should be noted when key levels are broken. Funds are beginning to rotate from crowded sectors like AI to cyclical sectors, utilities, and healthcare.

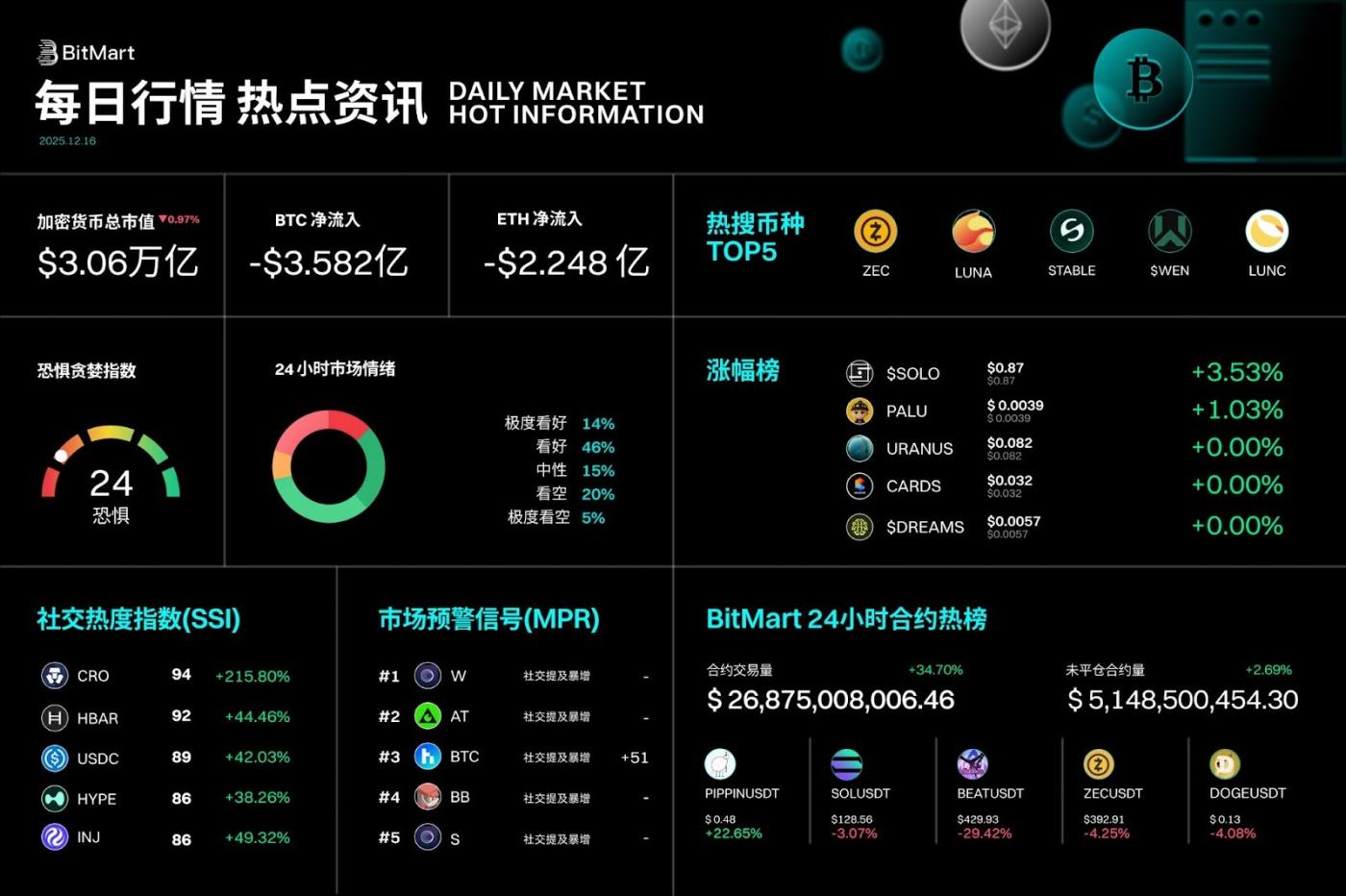

In the crypto market, BTC maintained high-level fluctuations, repeatedly encountering resistance and falling back within the $92,000–$95,000 range, with its price movement still dominated by macroeconomic sentiment. Major cryptocurrencies were relatively stable, while Altcoin were generally weak, with structural divergence intensifying. BTC and ETH are approaching important cost levels. ETFs maintained net inflows, but at a slower pace, while MicroStrategy continued to increase its holdings, indicating that the long-term institutional allocation logic remains unchanged. The overall pattern is more like a weak rebound structure with repeated back-and-forth movements. Caution is still needed at the end of the year and the beginning of next year, awaiting further clarification from macroeconomic and policy signals.

Regarding regulation and projects, the CLARITY Act has entered a crucial phase, and its implementation is expected to boost sentiment towards compliant assets. New projects are offering only a limited number of trading opportunities, and on-chain activity remains insufficient. The transformation of mining companies into AI data centers and the strengthening of precious metals continue to reflect market concerns about growth divergence and stagflation risks. (Source: ME)