Original title: Aave Will Win: 2026 Master Plan

Original author: @StaniKulechov

Original translation by Peggy, BlockBeats

Editor's Note: As DeFi gradually moves beyond its early "narrative-driven" phase and towards scaling and institutionalization, Aave is at a critical juncture. This lengthy article, personally written by founder Stani Kulechov, is not merely a retrospective, but also a comprehensive overview of Aave's future over the next decade and beyond, as regulatory uncertainties gradually dissipate.

With the U.S. Securities and Exchange Commission (SEC) concluding its four-year investigation into the Aave protocol, Aave has passed through its most costly and uncertain phase in terms of compliance. Against this backdrop, Aave's definition of its role has become increasingly clear: no longer merely positioning itself as a leading DeFi lending protocol, but rather aiming to become a global on-chain credit layer.

The following is the original text:

I spent almost a full decade building Aave, long before the concept of DeFi even existed. Along the way, we've witnessed countless hype cycles, but our mission has never changed.

When Aave was founded, the entire DeFi sector was worth less than $1 billion; today, Aave alone is more than 50 times larger than it was back then.

Over the years, many teams have come and gone. Aave Labs has been continuously developing for over 7 years, and very few teams truly match our long-term experience. We've personally driven and delivered:

-Aave Protocol V1, V2, V3, and the currently developing V4

-Aave's native stablecoin GHO

- Engaged in a four-year compliance and regulatory battle with the SEC, defending Aave

- Continued maintenance of Aave.com, and the upcoming release of Aave Pro

Cross-chain extensions of GHO

- First deployment of a non-EVM system

-Aave App

-Aave documentation system and developer toolkit

And many more tasks not yet listed

Today, Aave Protocol has become the largest, most trusted, and most liquid lending protocol of all time, operating in a completely independent field with virtually no comparable competitors.

Even so, in my view, we are still in "day zero" compared to the landscape we truly want to expand into in the future. This article will outline our long-term vision spanning decades: to bring the next trillion-dollar asset to Aave and drive millions of new users to truly go on-chain.

Aave in 2025

2025 will be Aave's most successful year ever.

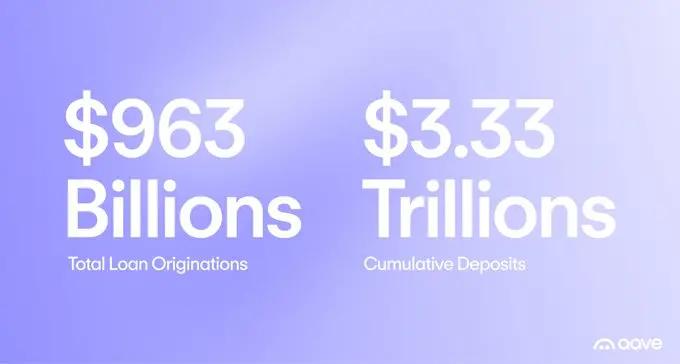

Our net deposits once reached $75 billion; even more impressively, since its launch five years ago, Aave has processed a total of $3.33 trillion in historical deposits and issued nearly $1 trillion in loans.

Over the past one to two years, we have fully embraced the cross-chain world within the Aave ecosystem. Continuing Aave's consistent approach, it has now become the only protocol with a TVL exceeding $1 billion on four different networks.

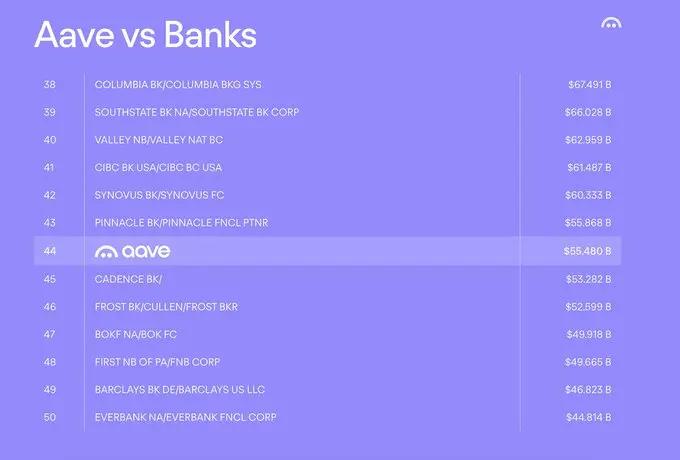

More importantly, in terms of size, the Aave Protocol is now comparable to the top 50 banks in the United States—and the United States is the core hub of the global financial system.

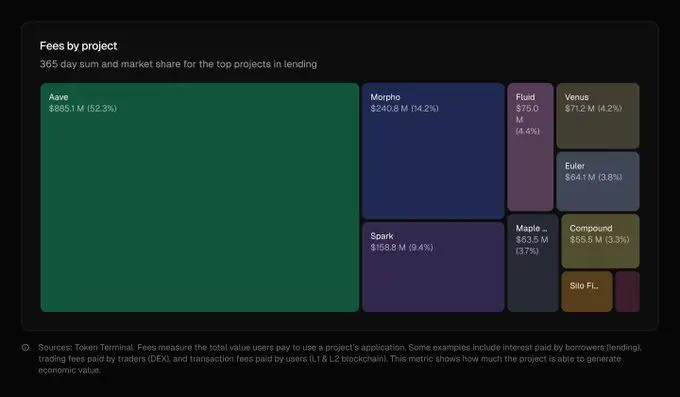

These growth achievements have enabled Aave to capture 59% of the DeFi lending market and account for 61% of all active DeFi loans.

This year alone, the agreement generated $885 million in fee revenue, accounting for 52% of the total fees from all lending agreements, exceeding the combined total of its five largest competitors. This ongoing revenue stream has further fueled AAVE's substantial buyback program.

A DeFi protocol operating at this scale is unprecedented in the entire history of the industry.

The market has made its choice based on the results: Aave is no longer a temporary product, but a long-term infrastructure.

Next, I'd like to talk about Aave Labs' assessment and plans for next year.

Looking ahead to 2026

Currently, our overall strategy for the next phase will revolve around three core pillars: Aave V4, Horizon, and the Aave App.

Aave V4

Aave V4 will be a key step for Aave towards becoming a "global financial foundation." This is a complete overhaul of the Aave protocol.

Its core innovation lies in achieving unified liquidity through the Hub & Spoke model. The V4 architecture will replace the current fragmented capital pool structure, establishing a capital hub on each network; on top of this, highly customized "Spokes" can be built to provide dedicated lending markets for different types of assets.

This design will enable Aave to handle trillions of dollars in assets, making it the preferred platform for institutions, fintech companies, and various enterprises to access deep and reliable liquidity.

At the same time, we will be launching V4 next year along with a brand-new developer experience. Over the past few months, Aave Labs has been building a new toolset with the goal of enabling developers to publish and scale products on Aave with unprecedented ease.

Entering 2026, Aave will witness a series of new markets, new assets, and new integrations never before seen in the DeFi space. We will also continue to collaborate with fintech companies and work closely with DAOs and ecosystem partners to steadily advance deployments and gradually expand TVL.

Horizon

Horizon is a bridge to the next trillion dollars.

Launched earlier this year, Horizon is Aave's dedicated marketplace for institutional-grade real-world assets (RWA). Through Horizon, eligible institutions can borrow stablecoins using tokenized U.S. Treasury securities and other credit-based assets as collateral.

This is a solution developed by Aave Labs specifically for large global financial institutions, meeting their real-world needs in compliance, risk control, and operations. By providing a secure and efficient on-chain entry point for institutional-grade funds, Horizon becomes the core platform for bringing the massive capital scale of traditional finance onto the blockchain.

Horizon will bring numerous top financial institutions into the Aave ecosystem in ways that were previously impossible, and drive Aave's expansion toward an asset base of over $500 trillion.

In a very short period of time, Horizon has grown into the largest and fastest-growing RWA mortgage lending platform. We do not believe this growth momentum will slow down in the short term.

Currently, Horizon has approximately $550 million in net deposits. Our goal is to rapidly expand this figure to $1 billion or more by 2026. To achieve this, we will deepen our partnerships with leading institutions such as Circle, Ripple, Franklin Templeton, and VanEck, bringing more global asset classes to Aave.

If Aave wants to play a truly central role in the entire financial system, it must first integrate stocks, ETFs, funds, real estate and mortgages, commodities, accounts receivable, and bonds and fixed-income assets into its on-chain lending system. Horizon is the key component in achieving this goal.

Aave App

The Aave App is a "Trojan horse" to the next million users. It is the flagship mobile application of the Aave protocol, aiming to truly bring DeFi to everyone.

The protocol itself is a highly complex financial system, and the mission of the Aave App is to shield these complexities and provide an intuitive and easy-to-use product experience to address the real needs that exist in the current economic environment.

Aave App is deeply integrated with Push – our global, zero-fee stablecoin deposit and withdrawal channel, covering over 70% of the world's capital markets. This will make Aave App the product with the best direct cash-to-DeFi experience on the market.

Many people don't realize that mobile financial technology itself is an industry worth over $2 trillion. Apps like CashApp and Venmo have tens of millions of users, but they have almost no real product capabilities when it comes to "savings"; while Aave App has the potential to fundamentally change the way people save.

Early next year, we will officially launch the Aave App and begin our journey towards reaching our first million users. This will directly inject growth momentum into the Aave protocol through a new market that has never been fully reached before. Without large-scale adoption at the product level, Aave could not have scaled to the trillion-dollar level.

Adhering to a clear stance, continuous innovation, and the freedom to design products are the most beneficial paths for Aave.

At Aave Labs, we consistently focus on three things: bringing the next trillion-dollar asset onto the blockchain; getting millions of new users into DeFi; and enabling $AAVE to win.

This vision requires us to build not a "replacement" of the traditional financial system, but a structurally superior financial infrastructure.

More importantly, Aave Labs aligns perfectly with the long-term success of the Aave protocol. This alignment isn't just talk; it's demonstrated through action.

Aave Labs and its employees are the largest holders of AAVE.

Everything we create is designed to strengthen the protocol's core fee capture mechanism, with all profits going to the DAO.

Aave Labs delivers more products to Aave than any other team.

For the past eight years, I have dedicated countless hours to continuously driving Aave's growth—whether it's product innovation, global business development, or organizing numerous community events.

By the way, I bought another $10 million worth of AAVE on-chain yesterday.

I've also seen various discussions on the DAO forum. I want to be very clear: no one cares about Aave more than I do. Open discussion is a characteristic of DeFi governance, not a sign of "misalignment."

Aave, as a global credit layer

Our long-term goal, spanning decades, is to build the foundational credit layer for the on-chain economy. Aave Labs envisions that in the future, any form of value can be tokenized, used as productive collateral, or lent out without intermediaries.

In this future, Aave is the foundation of everything, the basic liquidity layer upon which next-generation financial products and services are built.

Everything we've done over the past few years has been laying the foundation for this goal that is still ahead.

We sincerely thank Aave DAO, the numerous service providers, and the countless developers who have contributed to Aave. This was a true collective effort, and we are grateful for the ecosystem that has grown around the protocol. Aave Labs is ready to face the challenges of the next phase, and we will always prioritize the long-term interests of Aave.

Building in the public environment is no easy feat; governance and DeFi itself are inherently challenging. Aave is one of the few DeFi protocols that has stood the test of time, and that's what makes it unique. Innovation must always be prioritized—this is why the Aave ecosystem continues to succeed.

But now is not the time to celebrate... we're just getting started.

Aave will win.

Recommended reading:

Why isn't Metaplanet, Asia's largest Bitcoin treasury company, buy the dips?