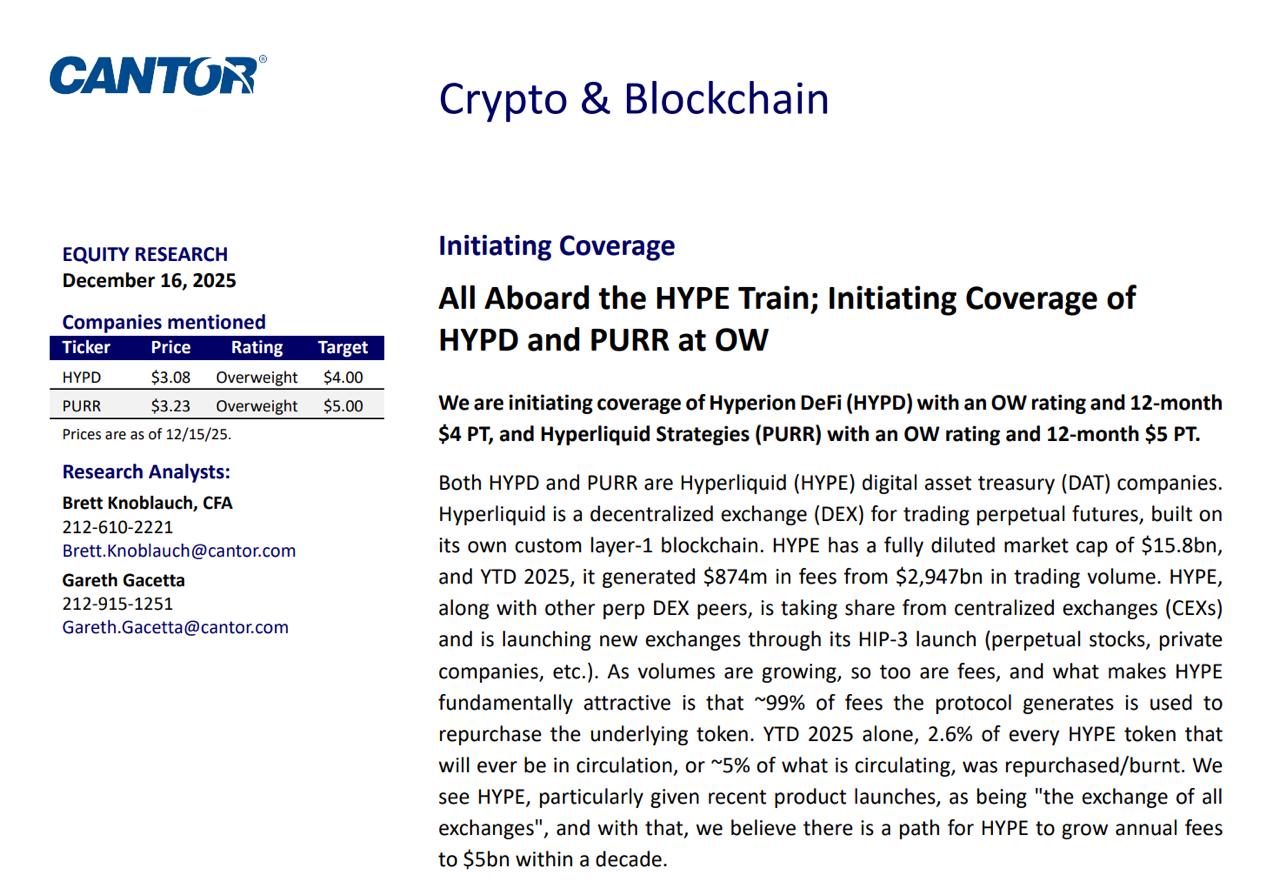

All Aboard the HYPE Train; Initiating Coverage of HYPD and PURR at OW Core thesis - Hyperliquid is the leading perp DEX with strong performance and growing volumes/fees; in YTD 2025 it generated about $874m in fees - Assistance Fund uses ~99% of protocol fees to repurchase HYPE, more volume → more fees → more buybacks and potentially lower circulating supply - They also argue competitive fears are overblown: competitor volume can be inflated by points/airdrop incentive behavior What each company does - HYPD: owns HYPE and monetizes via validator, staking and HIP-3 (trades around 1.14x “fully adjusted” mNAV) - PURR: bought 12.6m HYPE using proceeds from a $1.65bn PIPE; “institutional” way to access HYPE Key risks - Both are leveraged bets on HYPE - HYPD execution risk: thesis depends on the ability to raise capital to buy more HYPE; if it can’t (or mNAV falls), the strategy breaks - Centralization / governance risk on Hyperliquid: the March 2025 JELLY incident ended with validators voting to delist and force settlement at a pre-manipulation price—good outcome for users, but highlights “decentralization” tradeoffs sso.bluematrix.com/idp/authn?c...

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content