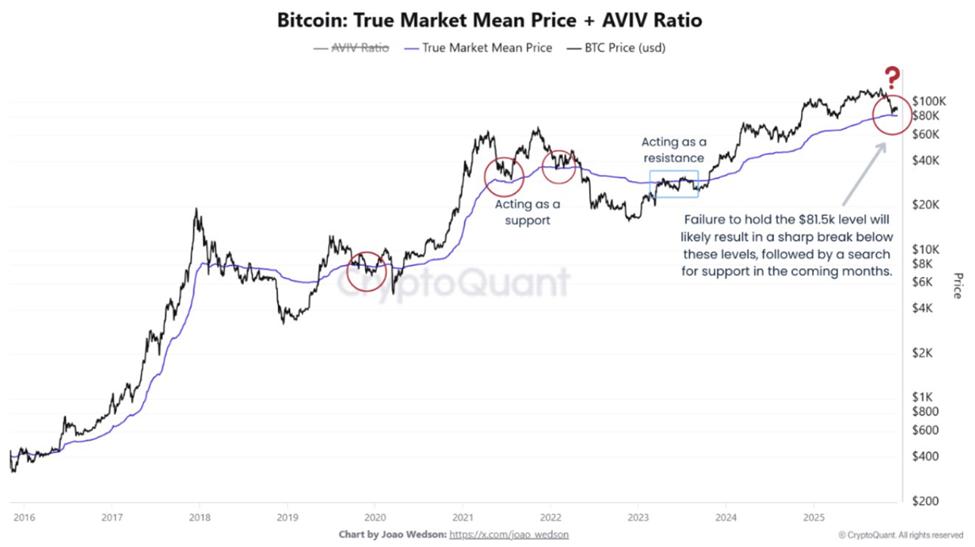

Bitcoin is currently trading near a much more significant price level than the number at the top of the news. Analysts are paying attention to the area representing the True Market Mean Price (TMMP) – the Medium price on the chain that non- Miners investors have bought into.

According to CryptoQuant, this TMMP level has become both a psychological and a structural boundary. It tests XEM market confidence is strong enough to absorb the supply or whether that confidence is beginning to waver.

Bitcoin is trading at a 'price of confidence' as $81,500 challenges market trust.

on-chain indicators signal mid-cycle pressure in the market, technical resistance continues to hold back upside , and analysts are now sharply Chia . The result is a delicate tug-of-war between:

- Long-term investors protect their Capital basis and

- Sellers are increasingly willing to exit positions when they break Capital.

In this context, TMMP emerges as Bitcoin's "lifeline." TMMP is not just a technical indicator, but also a collective psychological anchor, marking the Medium price at which investors initially bought into the market.

When Bitcoin trades around the TMMP (Total Market Price), investors face a choice: hold despite market uncertainty, or sell when they break Capital. This crucial point puts pressure on the market and often sets the stage for further significant price movements.

According to analyst Moreno from CryptoQuant, Bitcoin's TMMP is currently at $81,500 – a price at which the majority of real money has flowed into the market.

History shows that when Bitcoin trades above the TMMP (Total Market Value), investors often aggressively buy during price corrections. However, if this level is breached, that very area becomes resistance, as many previous buyers will rush to exit their positions when the price returns near the Medium purchase point. This scenario is repeating itself now.

“When BTC trades above the TMMP, investors often feel confident…But when the price drops, the TMMP becomes a resistance zone, as those who bought there take advantage of price rallies to sell,” Moreno explained .

Currently, the challenge around the $81,500 level is putting investors at a choice: hold through the period of uncertainty or sell once they break Capital.

Previous cycles have shown the significant impact of the TMMP range. During the 2020–2021 bull run, TMMP repeatedly Vai as a strong support zone. But in 2022, this area became resistance as market confidence declined. Its subsequent Vai will be crucial for Bitcoin's short-term trend.

Bitcoin's TMMP at $81,500 Vai as crucial support. Source: CryptoQuant

Bitcoin's TMMP at $81,500 Vai as crucial support. Source: CryptoQuantThe AVIV index shows the pressure of silent confidence.

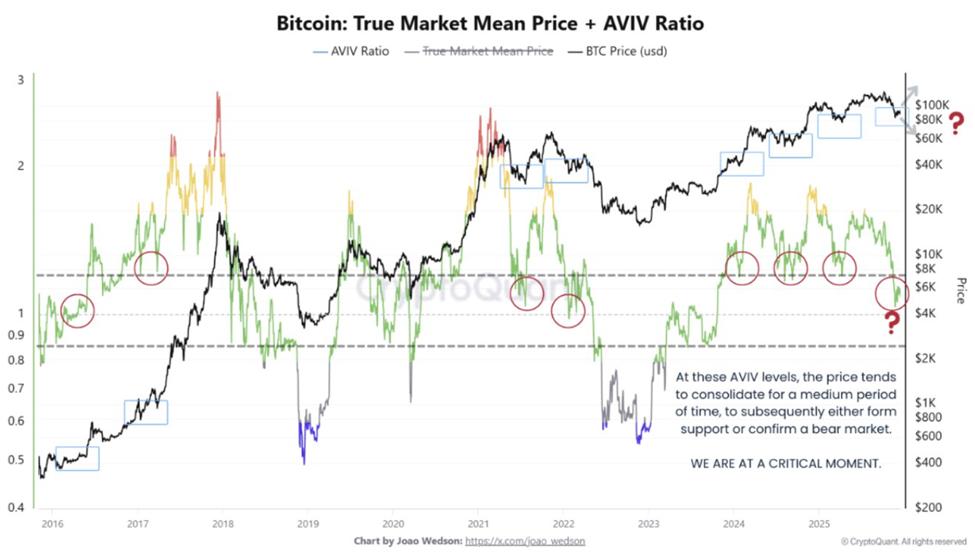

The AVIV Ratio – an on-chain indicator comparing the active market value and the realized value – also contributes to the analysis of investor behavior, particularly regarding actual returns. Unlike momentum indicators, AVIV reflects sentiment based on actual realized profits.

Currently, AVIV is consolidating in the 0.8–0.9 range – an area previously associated with mid-cycle transitions, where the market neither collapses nor shows a clear upward trend.

The AVIV indicator signals a mid-cycle compression phase. Source: CryptoQuant

The AVIV indicator signals a mid-cycle compression phase. Source: CryptoQuant“If Bitcoin holds above TMMP ($81,500) while AVIV remains stable ($0.8–0.9), this indicates that investors are absorbing supply and protecting the Capital basis. But if the price loses TMMP and AVIV continues to contract, it means profits are gradually eroding and confidence is weakening,” according to CryptoQuant expert.

Such periods typically don't cause sharp price drops, but instead put pressure on timid investors with prolonged sideways trading.

As unfulfilled profits thin out, confidence is quietly tested, paving the way for new accumulation buying or forcing the market to seek deeper demand.

Technical resistance is reinforcing the market freeze as macroeconomic concerns fuel debate.

The current Bitcoin price movement is not inspiring much hope . Bitcoin has consistently failed to surpass its opening price for the year, further increasing the hesitation of investors who follow trends and rely on technical analysis.

The failure to regain this level further reinforces the view that the upward trend may remain limited in the near future.

Bitcoin (BTC) price performance. Source: TradingView

Bitcoin (BTC) price performance. Source: TradingViewThis technical consolidation reflects a Chia of ideas in the market. Veteran investors, many of whom experienced the 2021 peak and the subsequent 70% drop, appear to be more sensitive to technical signals and cyclical patterns.

“Why isn’t Bitcoin going up in price? Because 50% are selling (OCs obsessed with after 2021, technical investors paying attention to the RSI, and those following 4-year cycles predicting a price drop 2 years after the halving) while the other 50% are buying (fundamental investors, traditional financial institutions, banks). A fierce battle… until the sellers run out of stock,” expert PlanB Chia .

Meanwhile, institutions and entities from the traditional financial sector seem unconcerned with short-term cycles. Their steady accumulation has helped absorb the supply of Bitcoin , but so far it hasn't been strong enough to push the market out of its current price range.

Besides the market's unpredictability, macro analyst Luke Gromen recently revealed that he sold most of his Bitcoin holdings near the $95,000 mark. Gromen stated that the reason was negative long-term technical factors and concerns about the stability of the financial system.

This decision, which he Chia on Swan Bitcoin's No Second Best podcast, has fueled pessimism, especially at a time when investor returns are under significant pressure.

Gromen also highlighted the weakening long-term momentum, Bitcoin's failure to reach new highs against gold , and concerns about overall market risks heading into 2026.

Despite counterarguments from Swan's hosts, his sale attracted significant attention in the investment community, especially as market confidence showed signs of wavering at key support levels.

The withdrawal of celebrities from the market often creates significant psychological pressure, especially during periods when Bitcoin prices are stagnant and on-chain signals indicate declining profitability.

Can the belief hold true?

Currently, Bitcoin is at a crossroads, with the challenge no longer lying in the hype but in the patience of investors. If the price holds above $81,500 and the AVIV index remains stable, this indicates that investors are still protecting their Capital basis. This would be a necessary condition for the uptrend to continue.

However, failure carries significant risks. If the price plummets below TMMP, coupled with continued suppression of AVIV, it would reflect a situation where mere confidence is no longer sufficient to support the market. At this point, Bitcoin would have to seek demand at lower price levels.