Caroline Ellison, former CEO of Alameda Research and a central figure in the FTX scandal, is no longer incarcerated.

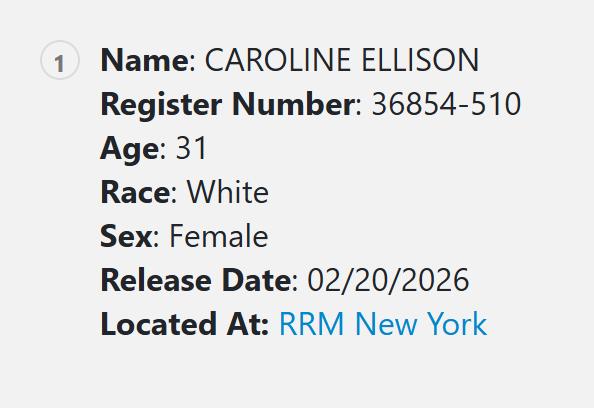

According to information from the U.S. Bureau of Prisons, Ellison has been transferred from a federal prison to the Reintegration Management Program (RRM) in New York. This marks a transition from incarceration to community-based supervision.

What does RRM status actually mean?

According to the Bureau of Prisons' records, Ellison remains under federal custody and is scheduled for release on February 20, 2026. However, she is no longer being held in prison.

RRM – short for Community Reintegration Management – is the final stage in a federal sentence. Individuals in this category may remain in a temporary shelter or be placed under house arrest instead of continuing to serve time in prison.

Prisoner placement is managed by the BOP. Source: Federal Bureau of Prisons

Prisoner placement is managed by the BOP. Source: Federal Bureau of PrisonsAlthough still under the supervision of the Bureau of Prisons, those in this category will face fewer physical restrictions, may be allowed to work, maintain limited social contact, and prepare to reintegrate into normal life.

Unlike prisons, RRM has no cells, no guards, and a much higher degree of freedom, but it is still strictly managed and supervised.

Ellison's transfer to this program suggests she is entering the final stages of her sentence – not yet being fully released.

Ellison's Vai in the collapse of FTX

In 2022, Ellison pleaded guilty to multiple federal fraud charges related to the misuse of FTX client funds .

As CEO of Alameda Research – a trading division closely associated with FTX – she admitted to participating in transactions and financial manipulations involving billions of dollars in client deposits.

However, prosecutors and the court clearly distinguished Ellison's Vai from that of Sam Bankman-Fried – the founder of FTX, who designed the system that allowed for the fraudulent activity. Ellison did not control the FTX exchange infrastructure, the client asset monitoring mechanisms, or governance.

Her cooperation was crucial. Ellison became a key government witness, providing testimony that helped successfully convict Sam Bankman-Fried. In 2024, a federal judge sentenced her to two years in prison for her active cooperation, early guilty plea, and minor Vai .

A stark contrast to Do Kwon

Ellison's release from prison coincided with the start of a 15-year federal prison sentence in the US by Terraform Labs co-founder Do Kwon for fraud related to the collapse of the stablecoin TerraUSD.

Prosecutors allege that Kwon intentionally misled retail investors about the stability of Terra 's price Peg algorithm, causing estimated losses of over $40 billion.

Unlike Ellison, Kwon was the founder , the public promoter, and the builder of the system that led to its collapse. This differing sentence reflects the court's clear distinction between the system's designer and its operator.

Too lenient, or in accordance with the law?

Ellison's move to community supervision is a fairly normal legal step, but it is also controversial. Some argue that it further raises doubts about the fairness of handling scandals in the cryptocurrency field.

For prosecutors, this reflects accepted principles: those who cooperate well, have a smaller Vai , and are willing to take responsibility will be XEM for lighter sentences.

Ellison remains under federal supervision. However, her release from prison – albeit temporarily – has led many to ask the familiar question again: who really pays the price when crypto empires collapse?