Solana price is currently calm after weeks of significant volatility. SOL has fallen by approximately 10% in the last 30 days, but has remained virtually unchanged in the last 24 hours, even as the overall market weakened. This period of calm is noteworthy.

Currently, Solana is quietly seeking opportunities to reach institutional investors in Brazil through Valour's Solana ETP (Exchange-Traded Product), which is expected to be listed on the B3 stock exchange. This move further strengthens a legitimate demand channel for the SOL coin at a time when technical charts suggest a potential breakout. The question then becomes: Will current conditions help Solana overcome this challenging technical phase, or are the sellers still in control of the trend?

ETP appeal faces a breakout trend.

Valour's Solana ETP offers investors and institutions in Brazil a legitimate and transparent way to access SOL . While this isn't a factor that causes immediate price surges, the product plays a stabilizing Vai , especially when the market is under selling pressure. This becomes even more significant whenever the chart forms important patterns. In a market where every asset needs a compelling narrative, such psychological boosts are invaluable.

Technically, Solana is trading within a descending Vai and Vai pattern, though not a textbook pattern. With the neckline of the downtrend still in place, breakouts require more confirmation as sellers consistently hold the price at lower levels over time.

Weak breakout pattern: TradingView

Weak breakout pattern: TradingViewWant more Token analysis like this? Sign up for editor Harsh Notariya's daily crypto newsletter here .

However, positive signals have begun to emerge from the buying side, which could help reduce selling pressure and support Solana price towards a clear breakout above the neckline.

Silent accumulation occurs beneath the surface.

Although prices haven't surged yet, on-chain data suggests initial accumulation signals have emerged.

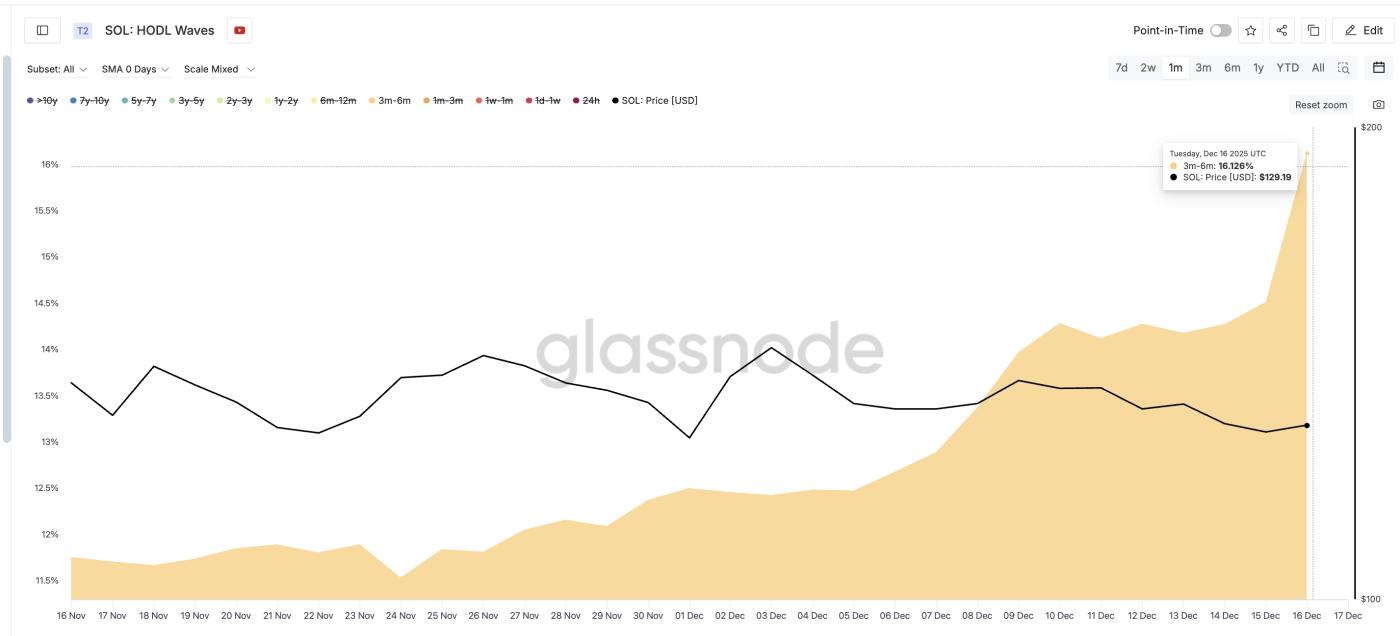

The amount of SOL held by this group for 3 to 6 months has increased significantly. They held 11.756% of the total supply on November 16th, and this figure had risen to 16.126% by December 16th. This is a fairly rapid increase in just one month, indicating that medium-term investors are taking advantage of the weak market to buy in.

Solana investor appears: Glassnode

Solana investor appears: GlassnodeSimultaneously, the Chaikin Money Flow (CMF) indicator also signals positively. From November 3rd to December 15th, Solana price formed a lower Dip , but the CMF formed a higher Dip . This difference suggests that underlying buying pressure is increasing, even though the price remains weak.

Signs of large money flow: TradingView

Signs of large money flow: TradingViewHowever, the CMF remains below zero, indicating that large capital flows are still cautious. There are buyers, but they haven't entered the market aggressively yet. Overall, these signals only show position preparation, not confirmation of a reversal.

Solana price levels will determine the next trend.

Currently, Solana 's story depends entirely on price movements. The $141 mark is the first level to watch. If it breaks above $141, it would indicate that the price has broken through the sloping neckline, but it's not enough to confirm a trend reversal. Remember, the neckline is sloping downwards, so clearer confirmation is needed.

The $153 level is therefore truly important. If the daily candle closes above $153, this would confirm that the buyers have taken control and could help the price move towards higher resistance levels.

Solana price analysis: TradingView

Solana price analysis: TradingViewConversely, the $121 level is extremely important support. If it breaks below $121, the assumptions about accumulation and the possibility of a breakout will be shattered, and market sentiment could revert to a deeper bearish scenario.