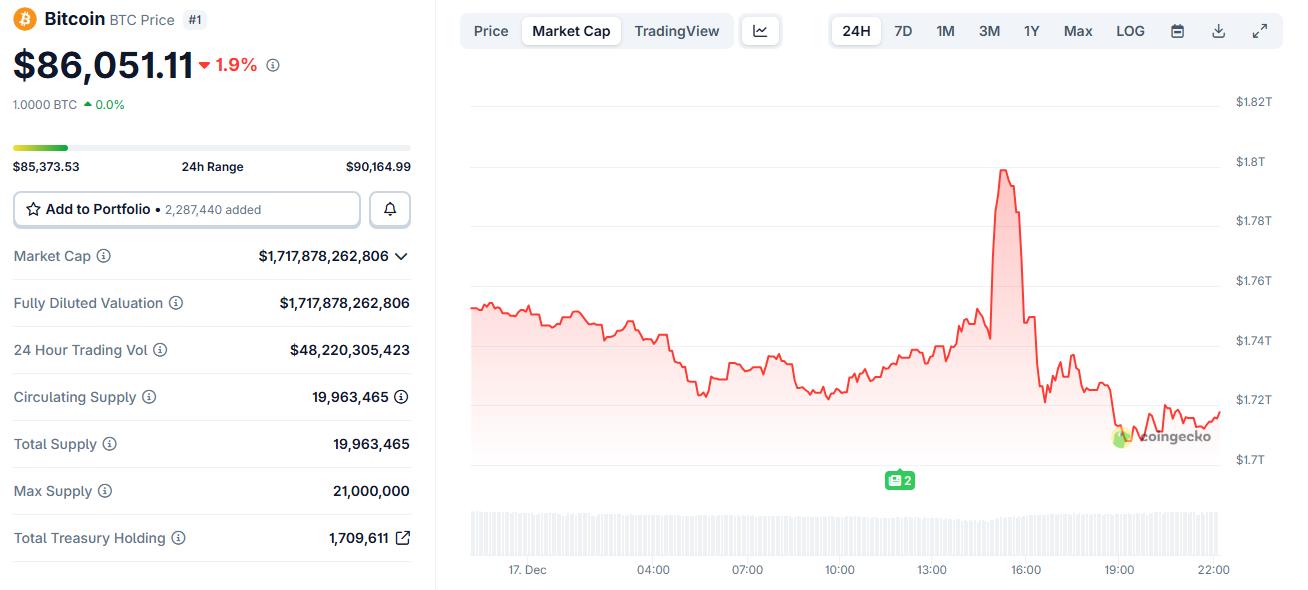

Bitcoin experienced extreme volatility on December 17, 2023, when its price surged by over $3,000 in less than an hour before reversing sharply to nearly $86,000.

This period of volatility did not stem from any major news. Instead, market data suggests the primary cause is the use of leverage, weak trading positions, and low liquidation , making the market vulnerable.

Short squeeze pushed the price of Bitcoin higher.

This sharp increase began when Bitcoin approached the $90,000 mark – a crucial psychological and technical resistance area .

Bitcoin price fluctuations on December 17, 2023. Source: CoinGecko

Bitcoin price fluctuations on December 17, 2023. Source: CoinGeckoLiquidation data shows that there were many leveraged short positions above that price level. When the price rose above that level, these short sellers were forced to close their positions. This closing meant they had to buy Bitcoin , causing the price to rise even faster.

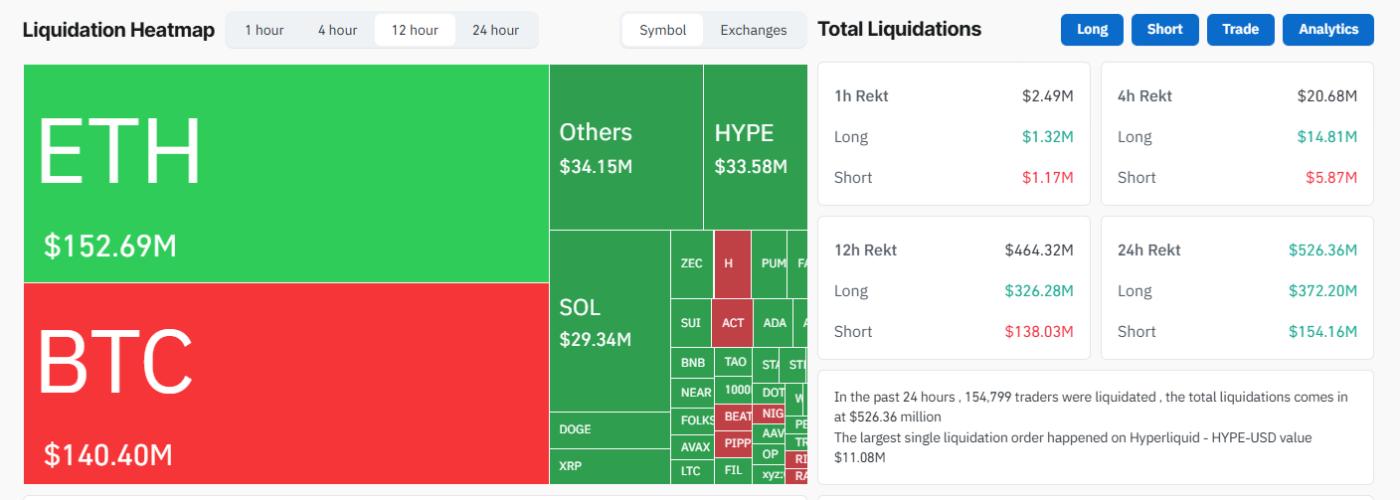

An estimated $120 million worth of short positions were liquidated during this rally. This is a classic example of a Short squeeze, where forced buying pushes prices above the normal levels that spot demand could generate.

Liquidation on the crypto market on December 17, 2023. Source: Coinglass

Liquidation on the crypto market on December 17, 2023. Source: CoinglassAt this stage, the market may appear strong, but its internal structure is actually quite weak.

The price surge has turned into a wave of liquidation of Longing positions.

When Bitcoin briefly touched the $90,000 mark again , many new traders jumped in to seek profits from the strong trend.

Most of these people opened Longing positions using leverage, hoping the price would continue to rise. However, this rally did not receive enough buying pressure from the spot market and quickly stalled.

When prices reversed and started falling, these Longing positions became dangerous. Once key support levels were broken, the exchange automatically liquidated these positions. As a result, over $200 million worth of Longing positions were liquidated, causing the market to plummet.

The second wave of liquidation explains why the decline was faster and deeper than the previous upward phase.

In just a few hours, Bitcoin dropped to nearly $86,000, wiping out much of its earlier gains.

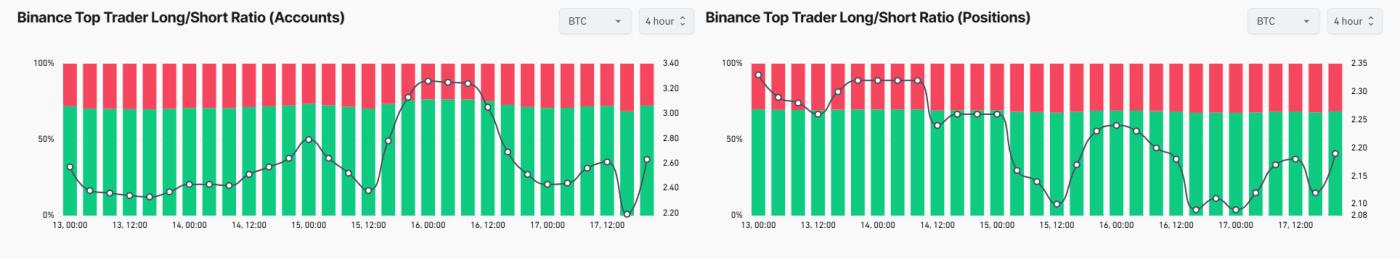

Position data suggests the market is in a fragile state.

Data on trader positions from Binance and OKX helps explain why volatility is so extreme.

At Binance, the number of top trader accounts leaning towards Longing increased sharply before price fluctuations. However, data on position volume suggests they were hesitant to "bet big," meaning many were Longing but with small amounts of money.

Bitcoin Longing/ Short ratio on Binance Futures. Source: Coinglass

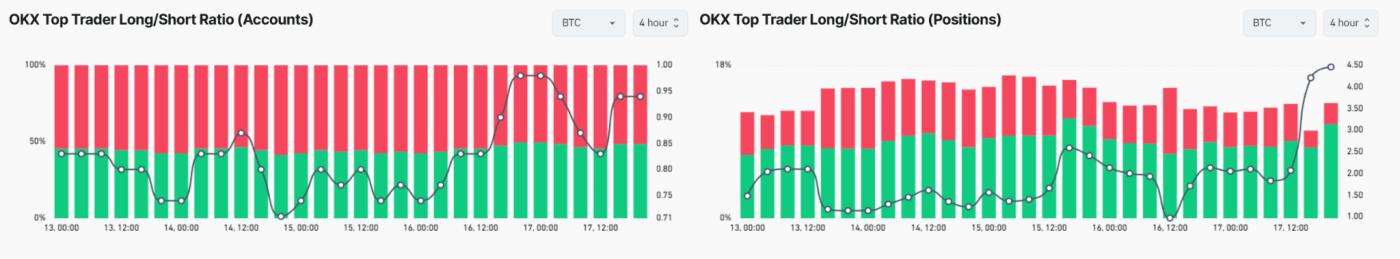

Bitcoin Longing/ Short ratio on Binance Futures. Source: CoinglassOn OKX, position indicators change sharply immediately after price fluctuations. This suggests that large traders quickly adjusted their positions, possibly taking advantage of price dips or hedging against risk as orders were liquidated.

When there are too many crowd positions, market sentiment is inconsistent, and leverage is high, the market is very susceptible to strong fluctuations in both directions without warning.

Bitcoin Longing/ Short ratio on OKX. Source: Coinglass

Bitcoin Longing/ Short ratio on OKX. Source: CoinglassCould market makers or whales be manipulating these price fluctuations?

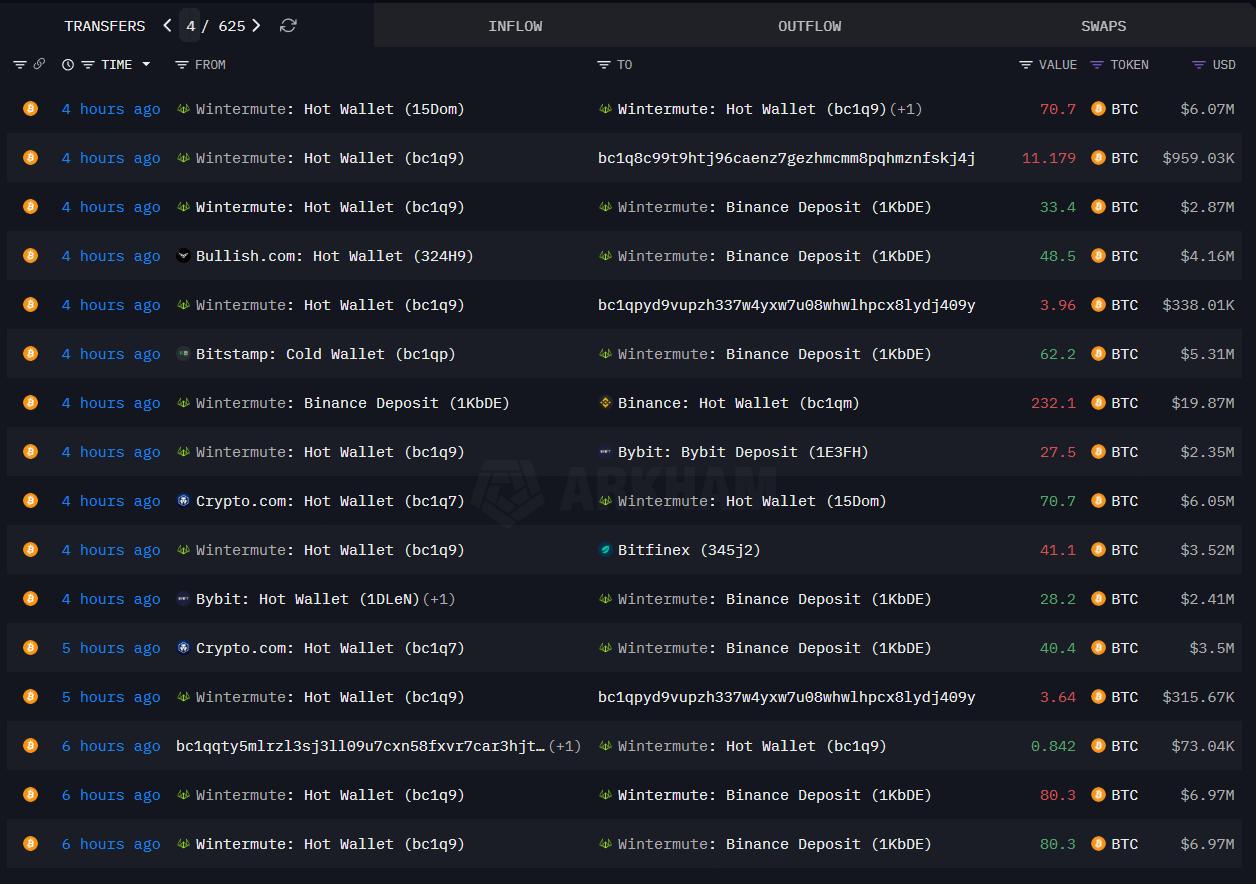

on-chain data shows that market makers like Wintermute moved Bitcoin between exchanges during periods of volatility. These transfers coincided with periods of sharp price swings but do not prove market manipulation.

For market makers, rebalancing assets during periods of market stress is common. They may deposit Bitcoin on exchanges for hedging, margin management, or liquidation support, not necessarily to dump it and Dump down the price.

More importantly, this entire development can be explained by known market principles: liquidated positions, high leverage, and thin Order Book . There is currently no evidence to suggest widespread manipulation.

Wintermute is conducting large-scale Bitcoin transactions on centralized exchanges. Source: Arkham

Wintermute is conducting large-scale Bitcoin transactions on centralized exchanges. Source: ArkhamWhat does this mean for Bitcoin in the near future?

This article highlights a major risk in the current Bitcoin market .

Currently, leverage levels remain high. Market liquidation can dry up quickly during periods of high volatility. As prices approach key support or resistance levels, forced liquidation of positions can completely dominate price movements.

The fundamentals of Bitcoin have remained unchanged over the past few hours. This large fluctuation indicates a very fragile market, rather than a change in Bitcoin's long-term value.

Until the market "resets" leverage and investors adjust their positions, similar sharp fluctuations can continue to occur. This time, Bitcoin did not rise or fall due to news.

Simply put, leverage has caused prices to "turn against themselves."