Bitcoin (BTC) is showing signs of slowing down as market sentiment becomes more cautious and the crypto sector lacks clear drivers to lead the trend. With prices trading sideways for an extended period and liquidation gradually thinning, a segment of the market is beginning to view the current phase as a prolonged accumulation.

However, while some investors are temporarily withdrawing from mainstream assets, others are shifting their focus to infrastructure layers that could help Bitcoin expand its functionality in the long term. One project attracting attention in this direction is Bitcoin Hyper (HYPER) .

Bitcoin Hyper aims to add an execution layer to Bitcoin, allowing applications to operate more efficiently than the current capabilities of the original network, while maintaining connectivity with Bitcoin to ensure final settlement. The goal of this model is to make BTC more flexible in transactions, true to its original Vai as a medium of exchange.

Is Bitcoin taking a break or entering a revaluation phase?

Bitcoin's short-term outlook remains highly debated, as the price has yet to make a significant breakthrough and market sentiment is still quite fragile. The fact that BTC has been fluctuating below its recent peaks has Chia analysts into various camps.

From a technical perspective, veteran trader Peter Brandt warns that Bitcoin may have broken out of its previous parabolic uptrend. According to him, in previous cycles, similar breakouts often led to prolonged sideways phases or deep corrections, and rarely resulted in only short-term dips.

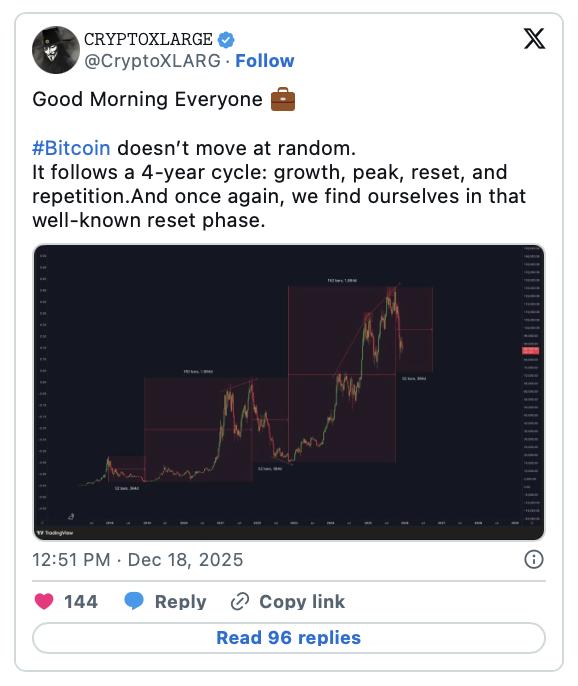

Conversely, some analysts argue that this is simply a familiar "cooling-down" phase of the cycle. Analyst CRYPTOXLARGE points to Bitcoin's familiar four-year pattern – growth, peaking, then correction – and suggests that the current phase may reflect a cyclical correction rather than a structural shift.

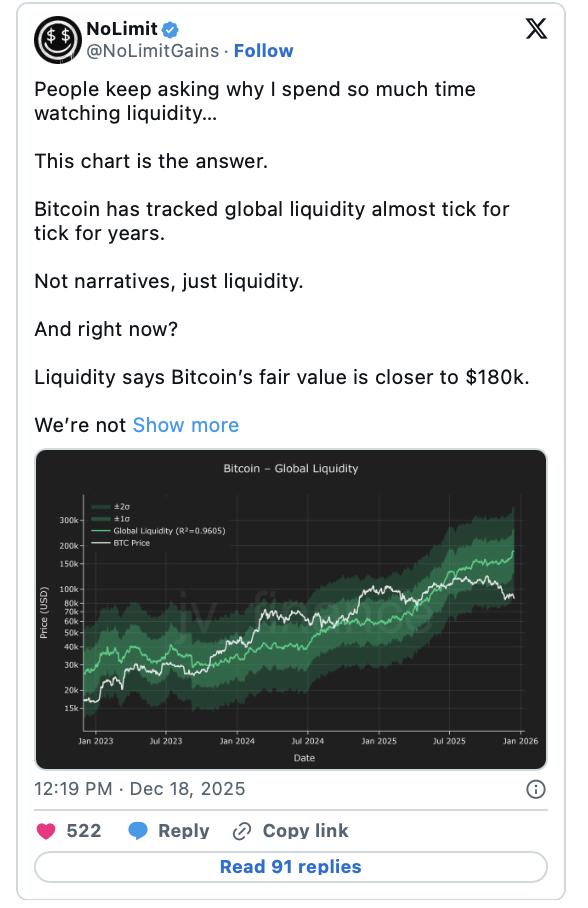

Another perspective focuses on global liquidation . Analyst NoLimit emphasizes the long-term correlation between Bitcoin and liquidation, arguing that in the past, BTC has often been valued positively after periods of trading below the general liquidation trend.

The differences in these viewpoints partly explain why dips still attract buying interest, despite the generally cautious sentiment. Liquidation based models don't offer specific timeframes, but suggest that Bitcoin's long-term trajectory may be more influenced by macroeconomic monetary conditions than by short-term narratives.

In summary, the market is currently caught between short-term technical risks and long-term structural dynamics. Against this backdrop, some investors are beginning to pay more attention to infrastructure developments – factors that could impact future demand for Bitcoin platforms, including projects like Bitcoin Hyper.

The implementation layer focuses on speed while still ensuring verifiability.

Bitcoin Hyper aims to build an infrastructure that allows BTC to be circulated more frequently, supporting transactions and applications, thereby creating more sustainable demand over time.

The project introduces a high-speed execution layer on top of the original Bitcoin network, while final settlement still takes place on the Bitcoin blockchain as it does today. Processing takes place Off-Chain, but BTC remains the asset used in transactions, increasing the frequency of its circulation within the system.

To operate at scale, Bitcoin Hyper builds its execution layer on the Solana Virtual Machine (SVM) – a platform designed for parallel processing. A notable point in recent updates to the project is the emphasis on determinism in execution , ensuring that each transaction produces a consistent and verifiable result, regardless of where it is processed.

This approach aims to avoid "blind trust" in the system. Instead of prioritizing speed, Bitcoin Hyper focuses on ensuring that transaction results can be checked and verified, rather than simply accepted.

In practical terms, this allows BTC to be used in applications without losing the core characteristics that have made it valuable. The goal is not just to be faster, but more readily available, while maintaining the principle of transparent verification.

Value streams can form during periods when Bitcoin's trend is unclear.

With the direction of Bitcoin's price still unclear, some investors are shifting their attention away from predicting breakout timing and towards XEM where value and activity might accumulate during periods of market stagnation.

With Bitcoin Hyper, the difference lies in the system design. BTC is positioned as the asset for circulating and settling value, while execution, fees, and coordination take place within the network itself. If usage increases as expected, the accumulated value will reside in this layer, through the HYPER token – the system's operating Token .

Instead of directly reflecting Bitcoin's price fluctuations , HYPER is designed to reflect the activity level of the entire ecosystem. As applications are deployed and usage increases, the demand for transaction processing will become tied to this Token . For some investors, this is XEM as an approach that is more aligned with actual usage levels, rather than short-term price volatility.

During periods of sideways market movement, infrastructure can still be built and operations can still be established. From that perspective, HYPER represents an approach to the Bitcoin story from an application-oriented point of view, rather than focusing solely on subsequent price fluctuations.

According to published information, Bitcoin Hyper is currently in the presale phase before the network officially goes live. The HYPER Token is used to operate the system and process transactions within this network.

Note: This is a promotional article from our partner, featured in the Press Releases section of Bitcoin News, and is not investment advice. Please do your own research before taking any action; we are not responsible for your investment decisions.