This article is machine translated

Show original

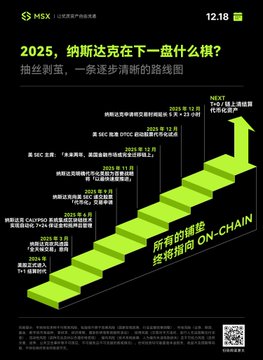

Time is money. The 23-hour trading system in the US stock market seems to be paving the way for #stocktokeization, on-chain clearing, and a 24/7 global asset network. Without overturning existing securities laws and the National Market System (NMS), the US stock market is attempting to unify its trading system, financial infrastructure, and participant behavior towards a continuous, "near-on-chain" operating rhythm. The true significance of this step is that stocks will ultimately possess the ability to circulate, settle, and price like tokens.

MSX Research Institute Original Article: US Stocks Sprint Towards "Never Closing": Why Did Nasdaq Launch a "5x23 Hour" Trading Experiment? mp.weixin.qq.com/s/N_mX5XilaLn...…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content