1/ Perpetual exchanges have faced a trade-off:

Push execution onto a specialized L1 and lose composability with Ethereum’s $122B DeFi collateral, or accept generalized L1 constraints.

Breaking down @ZKsync's Atlas solution for composable perps, powering @grvt_io's Market layer.

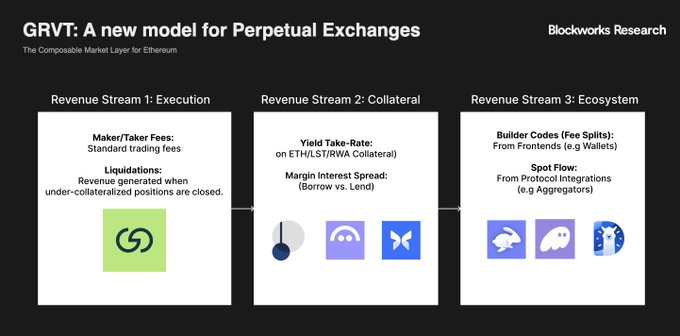

6/ The payoff is both monetization and expandability:

If collateral remains in ETH/LST form, the exchange can monetize beyond pure taker fees via yield on deposited collateral, margin interest spreads, and ecosystem-level fees alongside execution fees.

The same architecture also sets Grvt up for RWA expansion: tokenized equities can become eligible collateral, and market makers can post hedge inventory as margin directly, reducing buffer requirements versus siloed venues.

Grvt’s roadmap extends from RWA perps into unified margin using vault tokens as collateral, then a spot CLOB, and eventually options.

7/ ZKsync Atlas makes high-performance perps compatible with Ethereum composability, letting perp venues extend beyond execution into a broader market layer, as illustrated by Grvt.

Full report unlocked by ZKsync:

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content