Metaplanet will begin trading in the US through US Depositary Receipts (ADRs), aiming to expand access for US investors without raising additional Capital.

Metaplanet will begin trading in the US through US Depositary Receipts (ADRs), aiming to expand access for US investors without raising additional Capital.

Metaplanet , a Japanese Bitcoin treasury company, is expected to begin trading in the United States through American Depositary Receipts (ADRs).

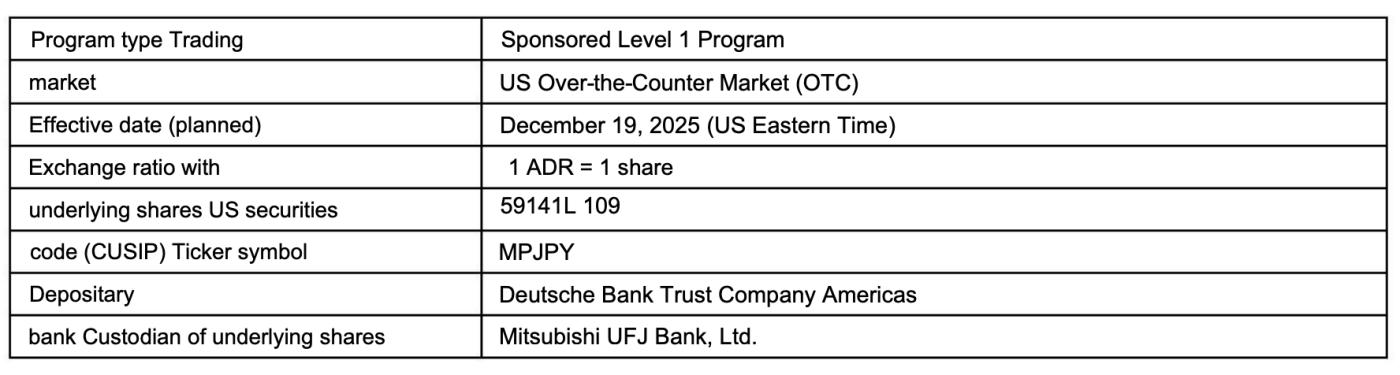

According to the announcement, trading of Metaplanet's ADR is expected to begin on Friday, with shares listed in USD on the over-the-counter (OTC) market under the ticker symbol MPJPY.

“This directly reflects feedback from individual and institutional investors in the U.S. who want easier access to our stock,” Metaplanet CEO Simon Gerovich Chia X, adding that the launch marks another step in the company’s strategy to expand its global reach.

This move comes months after Metaplanet established a subsidiary in Miami with an initial Capital of $15 million to expand its revenue streams from Bitcoin.

ADR is not intended for Capital purposes.

Metaplanet's ADR program is implemented through a sponsored trust agreement with Deutsche Bank Trust Company Americas Vai as the custodian bank in the US, and MUFG Bank as the custodian in Japan.

ADRs are financial instruments issued by US banks that represent shares of foreign companies, allowing US investors to buy and sell international stocks without directly trading on foreign exchanges.

"The ADR is not intended to raise Capital, but rather to fund the issuance of common and preferred shares by the company," Metaplanet stated.

This ADR program is different from Metaplanet's MTPLF product, which began trading on the OTCQX market of OTC Markets Group in December 2024. The company emphasizes that MTPLF is not a sponsored ADR program.

Metaplanet hasn't bought any more Bitcoin since September.

The launch of the ADR MPJPY program comes as Metaplanet temporarily halts Bitcoin purchases. After buying approximately 29,000 BTC in 2025, the company has stopped accumulating since September, with the most recent transaction on September 29th, according to data from Bitbo .

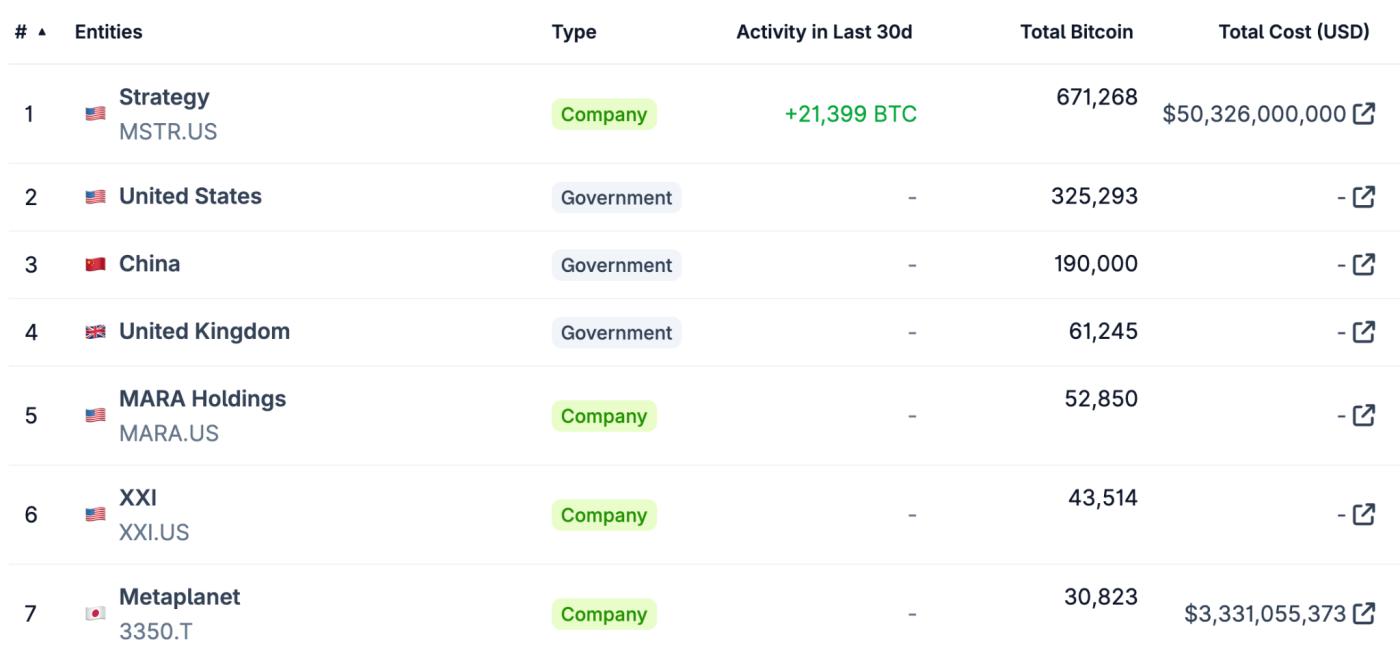

Since launching its Bitcoin accumulation strategy in April 2024, Metaplanet has held a total of 30,823 BTC, becoming one of the world's largest digital asset reserves, on Vai with Michael Saylor 's Strategy.

The pause in BTC purchases comes as Metaplanet's enterprise value fell below the value of its Bitcoin holdings in mid-October, raising concerns in the industry. Several other digital asset treasury companies also saw sharp declines in share prices after a surge in July 2025.

Metaplanet's market-to-Bitcoin NAV (mNAV) ratio – reflecting the company's value relative to its BTC holdings – has now recovered above 1, reaching approximately 1.12 at the time of publication, according to official data reported by the company.