A joke sparked a frenzy worth billions

In early October 2025, a seemingly casual blessing unexpectedly ignited passion in the Chinese crypto. "May you hold BNB, drive a Binance car, live in a Binance community, and enjoy a Binance life"—this Chinese reply from Binance co-founder He Yi on social media instantly struck a chord with the community. Almost immediately, a meme token called "Binance Life" appeared on the BNB Chain.

The community's reaction was astonishingly swift: people saw not just a funny meme, but a clear roadmap for token listing . Within days, the token, which originated as a joke, soared from a few cents to nearly $0.50, with its market capitalization briefly exceeding $500 million. Social media was flooded with stories of overnight riches—screenshots of turning a mere thousand dollars into millions went viral. According to Lookonchain, an on-chain analytics platform, someone turned an early investment of 5 BNB into an astonishing return of $1.6 million. For countless Chinese investors, the phrase "Binance Life" transformed from a joke into a wealth code within days, sparking a nationwide frenzy.

However, beneath the surface of the euphoria often lurks a turbulent undercurrent. During the meteoric rise of "Binance Life," community investors experienced a rollercoaster of emotions: some woke up in the early hours to find two extra zeros in their account balances, achieving financial freedom overnight; others bought in at the peak, only to plummet from their dream into a nightmare. This speculative storm, ignited by an internet meme, vividly demonstrated the public's thirst for quick riches and laid bare the fragility and fervor of the crypto market's sentiment.

Meme Diffusion: How Chinese Memes Conquered the Crypto

The viral success of "Binance Life" was no accident; it stemmed from a unique mechanism for memes to spread within the Chinese community. This case demonstrates how social media and community work together to create viral spread . First, a relatable blessing resonated with investors' psychological needs—who wouldn't want to "drive a Binance car and live in a Binance neighborhood" and enjoy a life of financial freedom? This meme precisely tapped into the long-standing wealth anxiety within the Chinese crypto community, generating a strong sense of shared experience.

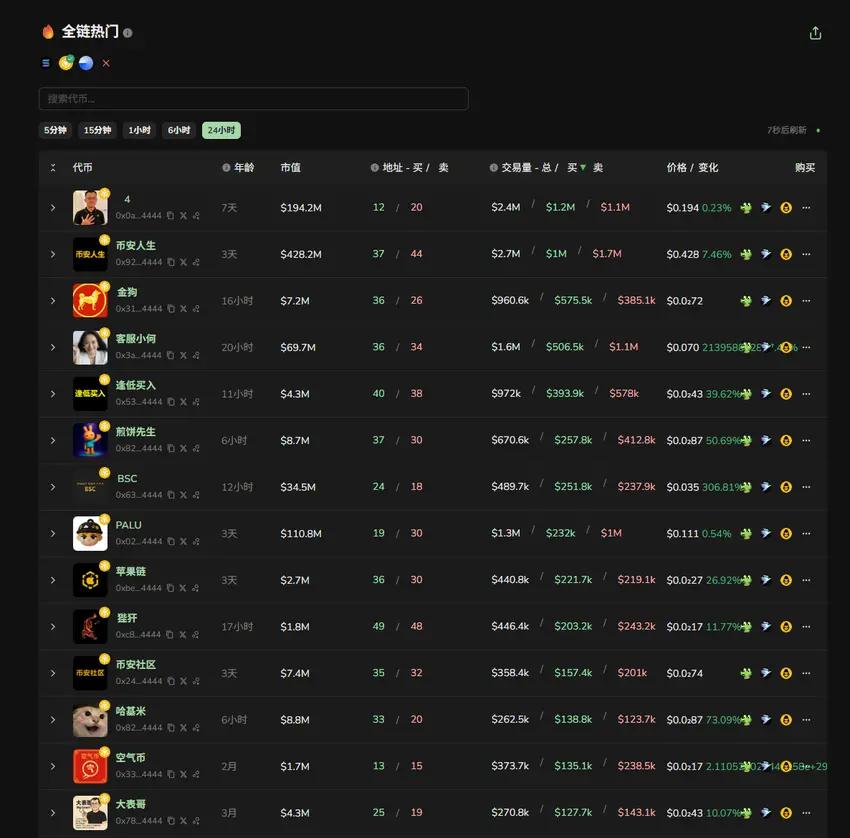

Next, trending posts on Weibo, Telegram group chats, and tweets from the X platform all began to generate secondary creations around this meme: adapted jokes, funny short videos, and emojis sprang up like mushrooms after rain, quickly propelling "Binance Life" to the top of the media frenzy. The project team and early participants also fueled the fire, creating an impression of "official endorsement" through the Binance Alpha platform and Binance Wallet, while simultaneously mobilizing major Chinese communities and KOLs to share and amplify the hype. This cycle of spontaneous meme creation, dissemination, and re-creation within the community allowed a token with no technical support to achieve a level of reach far exceeding that of typical projects in a very short time.

It's worth noting that the reactions of Chinese and Western investors during this wave of Chinese meme popularity presented an interesting contrast. Western investors, often accustomed to American internet memes, struggled to grasp the meanings of Chinese slang. When cryptocurrencies with Chinese names like "Binance Life" saw their market capitalization surpass 20 million, 60 million, or even over 100 million US dollars, European trading groups erupted in excitement. Many, though unaware of the underlying reasons, couldn't suppress their FOMO (fear of missing out) and rushed to the BSC chain in an attempt to ride the wave.

On October 8th, the daily trading volume of the BNB blockchain decentralized exchange surged to $6.05 billion , with over 100,000 new traders joining in a single day. According to BubbleMaps data, nearly 70% of early participants profited, creating a positive feedback loop that convinced more people that "this time is different." Western players, ironically, reacted slowly, with many only starting to learn the meanings of Chinese internet slang after the price spike, experiencing for the first time the informational disadvantage caused by cultural differences.

"Previously, meme investing in Europe and America followed American humor, mostly self-deprecating or rebellious; the sudden emergence of Chinese memes left many Westerners momentarily disoriented." In contrast, the Chinese community appears more adept at organizing and participating in this type of market trend—telling stories and evoking empathy in WeChat groups, casting a wide net to capture popular IPs, and then concentrating firepower to chase rising strong coins; a smooth "emotional mobilization - capital following" approach.

A seasoned investor participated in 65 different Chinese meme-based cryptocurrencies on the BNB blockchain within a single week. He started with small, trial investments of around a hundred dollars to test the waters, then increased his investment in high-performing projects, ultimately netting approximately $87,000 in seven days. This high-frequency and emotionally driven speculative style demonstrates the remarkable self-organizing and mobilizing capabilities of Chinese retail investors in the face of new trends. It can be said that in the highly flattened information world of blockchain, memes have become a powerful tool for the Chinese community to quickly build consensus and guide capital flows.

Cryptocurrency Price and Consensus: When Memes Become Market Drivers

As it turns out, in a decentralized market environment, emotion can precede logic, and consensus can triumph over technology . A community can rewrite the logic of traditional project evaluation simply by using a joke to build consensus and by generating market capitalization through viral dissemination. As observers have noted, the explosive popularity of "Binance Life" was not due to technological innovation, but rather to the precise capture of market sentiment. When jokes can become investment reasons, language itself becomes the starting point for consensus.

The sense of community identity brought by memes should not be underestimated. Crypto analyst Murad once proposed the concept of a "meme coin supercycle," arguing that excellent meme coins often offer more functionality than ordinary Altcoin : they bring fun, alleviate loneliness, shape identity, and provide the resonance, emotional connection, and sense of mission that DAOs originally sought to achieve.

A truly exceptional meme coin can even cultivate a community faith that lasts for years, allowing it to survive multiple crashes. Throughout crypto history, there are numerous examples: Dogecoin, initially a mockery of Bitcoin, rose to a market capitalization of nearly $90 billion after eight years thanks to endorsements from celebrities like Elon Musk and sustained community enthusiasm; Pepe, born from the 4chan culture, didn't let its statement of "no intrinsic value, just for fun" prevent it from surpassing a billion-dollar market capitalization in 2023.

These legendary stories demonstrate that a sufficiently compelling meme can build community values that transcend speculation. In contrast, the Chinese crypto has historically lacked similar cultural symbols that resonate with the entire population—from DOGE to PEPE, the English-speaking world dominated most meme narratives, leaving the Chinese community largely as spectators. "Binance Life" fills this void, signifying the rise of crypto culture within the Chinese context .

When "Chinese puns" and "Chinese symbols" begin to attract global attention and even be imitated, this release of cultural confidence is perhaps more symbolic than the rise and fall of token prices. It shows that the narrative of the crypto world is becoming more diverse, and local culture can certainly serve as a new bond of consensus.

Chain reaction: When Solana and Base take turns creating Chinese memes

The buzz surrounding "Binance Life" quickly spread beyond the Binance ecosystem, radiating throughout the entire crypto community. Other public blockchain projects followed suit, leveraging Chinese memes to create buzz. The most representative example was the "official naming + meme coin" drama staged by the Solana community in late October.

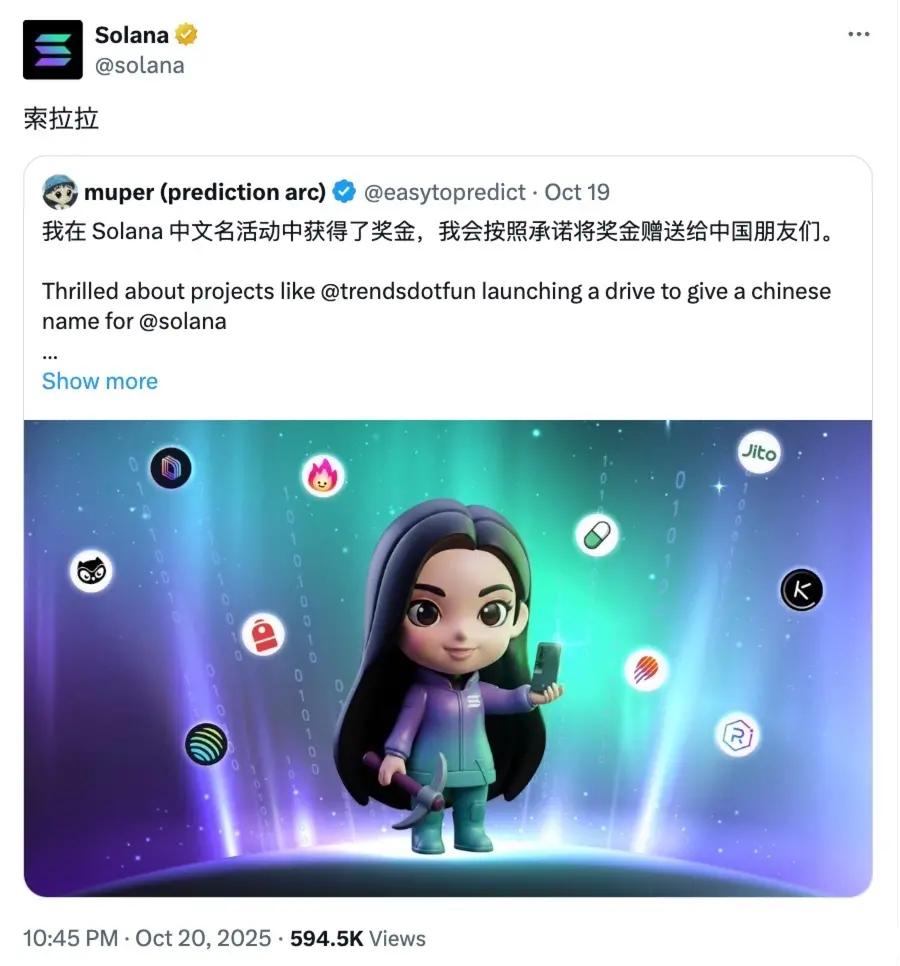

The story began with a Chinese name contest for Solana: In mid-October, the content platform Trends.fun launched a "Give Solana a Chinese Name" campaign, attracting a large number of Chinese-speaking users to contribute their ideas. Within just a few days, the name "索拉拉" (Suo La La) stood out, not only because it was easy to pronounce, but also because its creator imbued it with an interesting image—a long-haired female builder, symbolizing every builder who strives on Solana.

On the evening of October 20th, the official Solana account reposted a community post about "Solara" and directly wrote "Solara" in the caption, effectively officially adopting this Chinese name. This moment signifies Solana's embrace of Chinese meme culture : Solana, which had previously been transliterated as "Solara," now has a new name with a more community-oriented feel. Almost simultaneously with the official endorsement, the eponymous Meme token "Solara" was also created on the Solana blockchain and skyrocketed overnight, with its market value reaching tens of millions of US dollars .

Even more interestingly, because Trends.fun itself supports content tokenization, the creator of the "Solara" meme coin earned a considerable share of transaction fees through the protocol—over $20,000 in transaction fees within just half a day of its release, and nearly $100,000 in less than 24 hours. This is a milestone event, marking the first time a meme creator has directly earned income through an on-chain protocol , and it also shows the new possibilities of the "meme economy" in the Web3 era: memes created by the community can not only bring attention and consensus, but also directly monetize and benefit the creators.

At the same time, the wave of meme coins on Binance Smart Chain is also extending to external chains, triggering cross-chain interactions and a "public opinion war".

Following the popularity of Binance's meme-based cryptocurrencies, a similar trend of Chinese meme-based cryptocurrencies emerged within the Tron ecosystem. Even the CEO of the OKX exchange participated in the discussion, indirectly suggesting that his platform was also paying attention to this trend. More dramatically, in mid-October, the founder of Limitless, a prediction market project invested in by Coinbase, suddenly revealed on the X platform that some exchanges (alluding to Binance) required projects to meet stringent conditions for listing, including staking large amounts of tokens and paying exorbitant fees. This statement brought the conflict between Binance and its competitors into the public eye.

Against this backdrop, Base's head, Jesse, quipped, " Starting Binance life mode on Base ." In a technical demonstration, he showcased the flow of $BNL tokens through Base's cross-chain bridging, sparking heated discussion within the community. People realized that this was also a gesture of goodwill from Base towards the Chinese community—demonstrating through action that they welcome and support the use of Chinese memes . Thus, a cross-chain dispute sparked by meme-based tokens ironically fostered interesting interactions between chains: Solana gained an official Chinese meme, Base embraced meme culture, and the previously somewhat fragmented multilingual crypto community found new points of connection through "memes."

It could even be said that Chinese memes are becoming one of the new mainstreams of on-chain narratives .

From Binance to Solana to Base, this wave of memes has achieved a cross-ecosystem relay, allowing global players to witness the magic of Chinese memes.

The Culture and Risks Behind the Meme Craze

From "Binance Life" to "Solala," the Chinese crypto in 2025 seemed to be illuminated by a high-voltage current. In just one month, a token launched jokingly for $35 traversed the path that Dogecoin took five years to complete in five days. Emotions swirled between social media and trading depth, KOL trends and listing schedules dictated prices, and community discourse wove a tradable web of jokes and identity narratives. Hype brought popularity, quickly reviving sluggish markets; bubbles inflated accordingly. The dividing line always lay in the ability to "understand": to distinguish between fleeting success and long-term sustainability, and to identify which teams could focus their attention on product, cash flow, and reusable mechanisms. Jokes could boost market capitalization, but those who remained were often those who respected the rules, revered risk, and were willing to do their homework.

Incidentally, CEEX is making its participation path more sustainable. The platform centers on "brokers," with CMC mining exclusively for them. The new app streamlines the registration-to-participation journey into a clear channel, with centralized entry points, data visibility, and automated upgrades, providing a more convenient one-stop mining experience. Its positioning and strategy are equally clear: a multi-currency aggregator exchange offering mainstream services such as spot and futures trading; expansion into the African market has begun, extending invitations to diverse talents and institutions for collaboration; and an application for a VASP license has been submitted to Dubai's VARA, initiating compliance and growth strategies in the Middle East. The goal is simple—to transform short-term hype and traffic into transparent rules and long-term participation, giving rational investors more leverage.