Ownership coins are expected to revolutionize decentralized governance by 2026, with experts predicting at least one project will reach a market Capital exceeding $1 billion.

Unlike current governance Token , ownership coins combine three elements—economic rights, legal rights, and governance rights—into a single asset. This is a step forward that could help solve many of the problems that Decentralized Autonomous Organizations have faced for years.

The difference between ownership coins and traditional governance Token .

Current traditional DAO governance Token typically only provide voting rights, lacking real economic power or clear legal accountability within decentralized organizations. This increases risk for small investors while failing to achieve the goal of true decentralized governance.

Ownership coins offer a completely new approach. According to a research report by Galaxy Digital , this type of Token integrates economic, legal, and governance rights into a single digital asset with real legal value. This model aims to thoroughly address the liability issues that DAOs have faced since their inception.

Galaxy Digital calls this model "digital companies," where all governance decisions made on the blockchain will have legal effect, not just relying on social consensus as before.

Token holders will therefore have substantial and legal control over digital organizations with real assets. This step paves the way for the formation of autonomous, legally recognized entities right on the blockchain.

MetaDAO was one of the first projects to experiment with this model by applying futarchy, a governance system based on a prediction market instead of traditional direct voting.

The project began operating on Solana in November 2023, with all key decisions guided by trading on prediction markets, rather than through traditional voting.

The Messari report identifies AVICI as a top-performing project.

The Messari Theses report considers ownership coins a prominent investment opportunity in 2026. AVICI emerged as a leading name last year, demonstrating the growth potential of this sector.

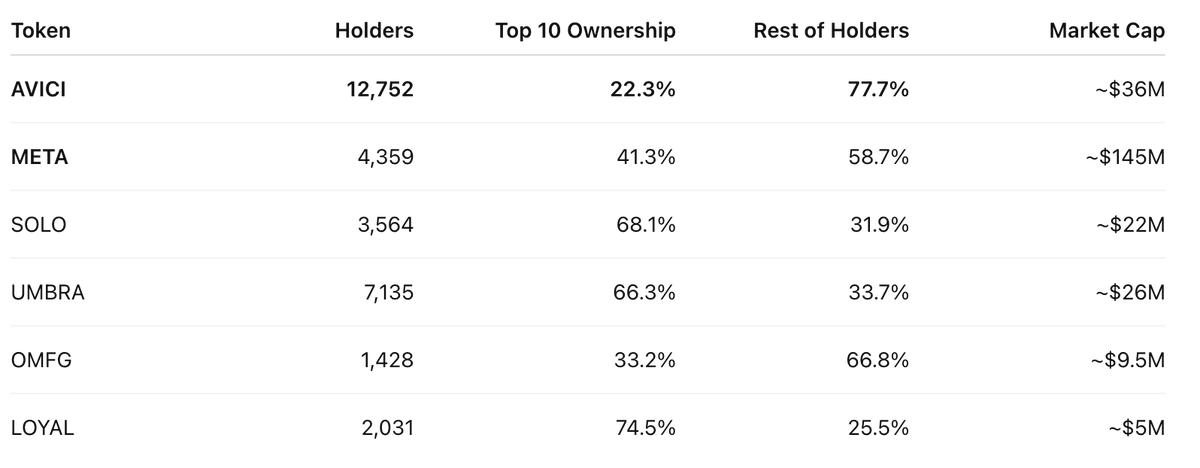

AVICI is highly regarded for its ability to retain Token holders and its wide Token distribution, even during periods of significant price volatility. By mid-December 2025, AVICI had a total of 12,752 Token holders, with a very low concentration of "whales" (large investors).

Crypto_iso analysts Chia that AVICI started with 4,000 holder and reached 13,300 holder in just 45 days.

Despite experiencing a sharp 65% price drop, AVICI only lost 600 holder, representing a loss of only 21% compared to its previous growth. On Medium , AVICI gained 200 holder per day during the growth phase and only lost about 43 holder per day during the market downturn. This demonstrates that the community maintained its confidence despite price fluctuations.

AVICI is leading in terms of the number and distribution of holder compared to other ownership coins (crypto_iso).

AVICI is leading in terms of the number and distribution of holder compared to other ownership coins (crypto_iso).The industry is still in its early stages, offering significant growth potential.

The ownership coin market is XEM a very new field with huge growth potential, as no project has yet reached a fully diluted market Capital of over $1 billion. Many small investors see this as an unprecedented opportunity to seek exceptional returns.

“My biggest bet for 2026 is ownership coin. This is still in a very early stage; no coin has reached a market Capital of $1 billion yet. The opportunity is clearly right in front of you,” analyst Anglio Chia .

Many discussions on social media have mentioned 2026 as the "year of ownership coin." The combination of genuine innovation and early entry opportunities is attracting interest from both retail and institutional investors.

Ownership coins can address the barriers hindering the development of DAOs and making it difficult to attract investment. With a legally guaranteed on-chain governance system, pure blockchain organizations will operate like real businesses.

This step promises to bring about changes in attracting Capital, protecting investors, and developing decentralized governance.

However, this field is still very young. The majority of ownership coin projects are still under development, and the legal framework for this hybrid model is not yet unified across regions. Whether ownership coins will truly turn the dream of autonomous organizations on the blockchain into reality will depend on the crucial test in 2026.