Amid growing market uncertainties, an analytical exposition has argued that selling XRP at this stage makes no sense in either a bullish or a bearish scenario.

XRP is down 8% over the past seven days. Interestingly, its current price of $1.88 indicates that the token has corrected by 48.6% from its high of $3.66 in July.

Notably, the downtrend has sparked mixed feelings among XRP proponents about the token’s near- and mid-term direction. Amid all this, market technician EGRAG Crypto believes it would be a very poor investment decision to sell XRP at this point.

Don’t Sell XRP Even If a Bear Market Has Begun

While EGRAG remains resolute that XRP has much more upside, he emphasized that selling now “makes no sense” even if the bear market has started. Backing his belief is the sentiment that the market doesn’t move in a straightforward manner.

According to him, XRP may have a final upward push if bears had actually taken over the current market. This means a relief pump could still occur, making selling here the worst possible time.

Fatal to Sell if the Trend is Barely Correctional

Notably, he calls this an emotional sell zone, suggesting that the current market sell-off is not the end of the bull market. Moreover, he highlighted that smart money sells when the market’s retail sentiment is bullish, rather than during periods of fear.

Additionally, the chart shows that the current downtrend is a reset rather than a collapse, as many argue. He even suggested that bears would get a better exit later, implying that these bears could still sell off their XRP bags at higher prices.

Moreover, he stressed that if the current dip were only a correction, it would be fatal to sell XRP now, as a recovery could be on the horizon. He then concluded that, in both bullish and bearish scenarios, the chart says, “Don’t Sell Here.”

XRP Reversal Would Be Massive

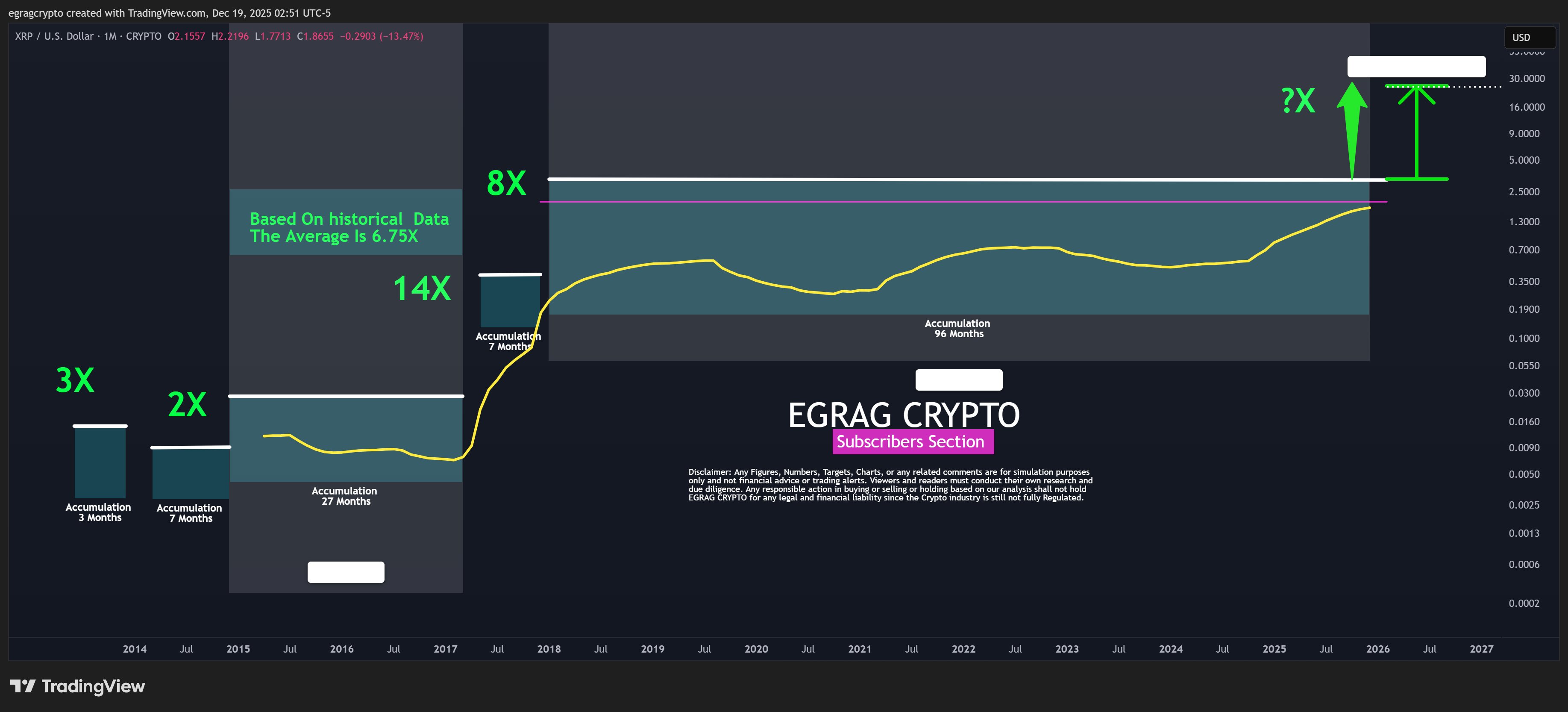

Meanwhile, an accompanying chart shows that XRP could see rapid bullish development when the consolidation phase ends. Specifically, it shows a 3x rally after a 3-month consolidation in early 2014.

XRP increased 2x again in late 2014 after consolidating for 7 months, then surged 14x after a 27-month accumulation from 2015 to late 2017. Interestingly, XRP has been in a 96-month accumulation phase since its all-time high of $3.84 in January 2018.

A breakout would set XRP up for unprecedented heights, with a chart highlighting an average surge of 6.75x, citing historical context. It also shows a possible rise to $27, EGRAG’s long-standing bullish XRP target.