summary

Recently, Lighter has become a focal point of discussion within the Perp DEX sector. Lighter boasts active trading, a stable points system, and has been included in Coinbase's listing roadmap; however, the token issuance time and specific details remain unclear, leading to premature market expectations and a lag in key information, sparking controversy. Unlike projects solely reliant on incentives, Lighter has attracted a large number of long-term users through its efficient matching mechanism and excellent trading experience, demonstrating strong product value. This has led the market to prematurely value it using the standards of mature assets, amplifying the divergence in opinions. The entire Perp DEX sector is at a critical juncture, transitioning from "incentive-driven" to "value-driven." Designing a token that effectively incentivizes users while reasonably embodying the platform's true value has become a common challenge in the industry. Previous projects' buyback and incentive strategies have varied in focus but generally demonstrated caution and balance. Lighter's current restraint regarding token release and functionality reflects, to some extent, a rethinking of token positioning within the sector. Whether a token is necessary and how to find a reasonable balance between incentives and value representation remain core issues that urgently need to be addressed. Observing Lighter's development path helps to understand the future token design logic and sustainable development direction of the entire Perp DEX ecosystem.

1. Where does the controversy surrounding Lighter come from? The mismatch between anticipated needs and delayed information.

Recently, discussions about Lighter have increased significantly. On the one hand, the project's progress continues to send positive signals: on December 13, Coinbase announced that it would add Lighter to its listing roadmap; at the same time, the platform's trading volume and points-related data have increased simultaneously, making it one of the most watched projects in the Perp DEX sector.

However, alongside the rising data and exposure, there is also uncertainty surrounding the TGE and airdrop schedule. The core controversy surrounding Lighter in the current market is not whether it will issue a token, but rather that market expectations have been significantly pushed forward, while key information determining its valuation remains unconfirmed. There has long been a expectation within the community that Lighter will conduct a TGE in December of this year, but the official team has consistently failed to provide clear details regarding the specific timing, rules, or token distribution method.

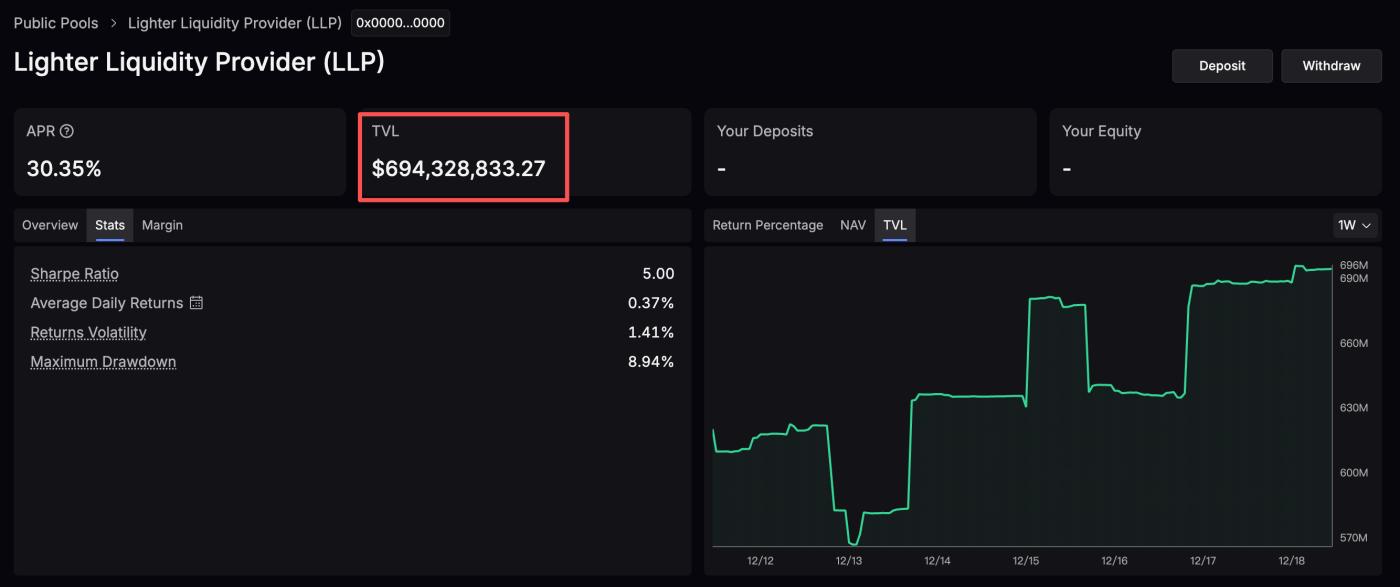

From a mechanism perspective, Lighter's points system has entered a stable operational phase. Users can earn points by depositing funds into the LLP (Lighter Liquidity Provider) public pool and participating in contract trading. Season 2 is currently underway, with the official team setting a relatively fixed points distribution schedule based on trading activity, while reserving the right to dynamically adjust the rules. However, as of now, the official team has not yet announced how points will be linked to future tokens or TGE, including exchange rates, distribution structures, or the complete Tokenomics design.

In practice, although the official answer has not been given, users have generally regarded points as an important reference indicator of potential future returns. This expectation has been further strengthened as participation has expanded. According to official website data, the current TVL (TVL) of the Lighter points pool has reached approximately $690 million, meaning that the system has already absorbed a considerable amount of real funds and transactions. Against this backdrop, uncertainties regarding the timing of token issuance and the rules can easily be amplified into uncertain judgments about potential returns, directly reflected in pricing disagreements in the prediction market and a significant divergence in participant sentiment.

Figure 1. Lighter points system. Source: https://app.lighter.xyz/public-pools/281474976710654

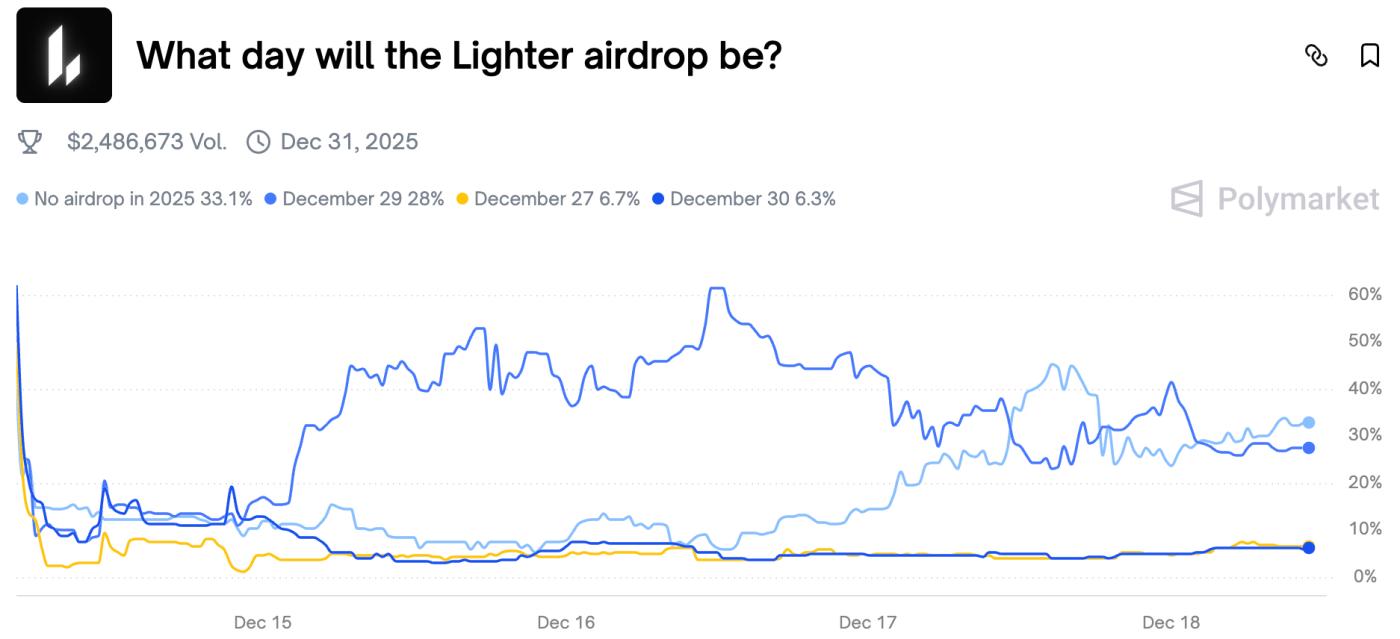

Data from the prediction market Polymarket shows that the market does not have a highly consistent opinion on the timing of the Lighter airdrop. For example, the probability of "Lighter airdropping on December 29th" is about 28%, while the probability of "no airdrop in 2025" is about 33%, with probabilities for other dates being relatively dispersed. This structure indicates that the market does not treat the airdrop as a certainty, but rather prices in multiple possible scenarios in parallel.

Figure 2. The prediction on Polymarket for when the Lighter airdrop will be. Source: https://polymarket.com/event/what-day-will-the-lighter-airdrop-be?tid=1766026269827

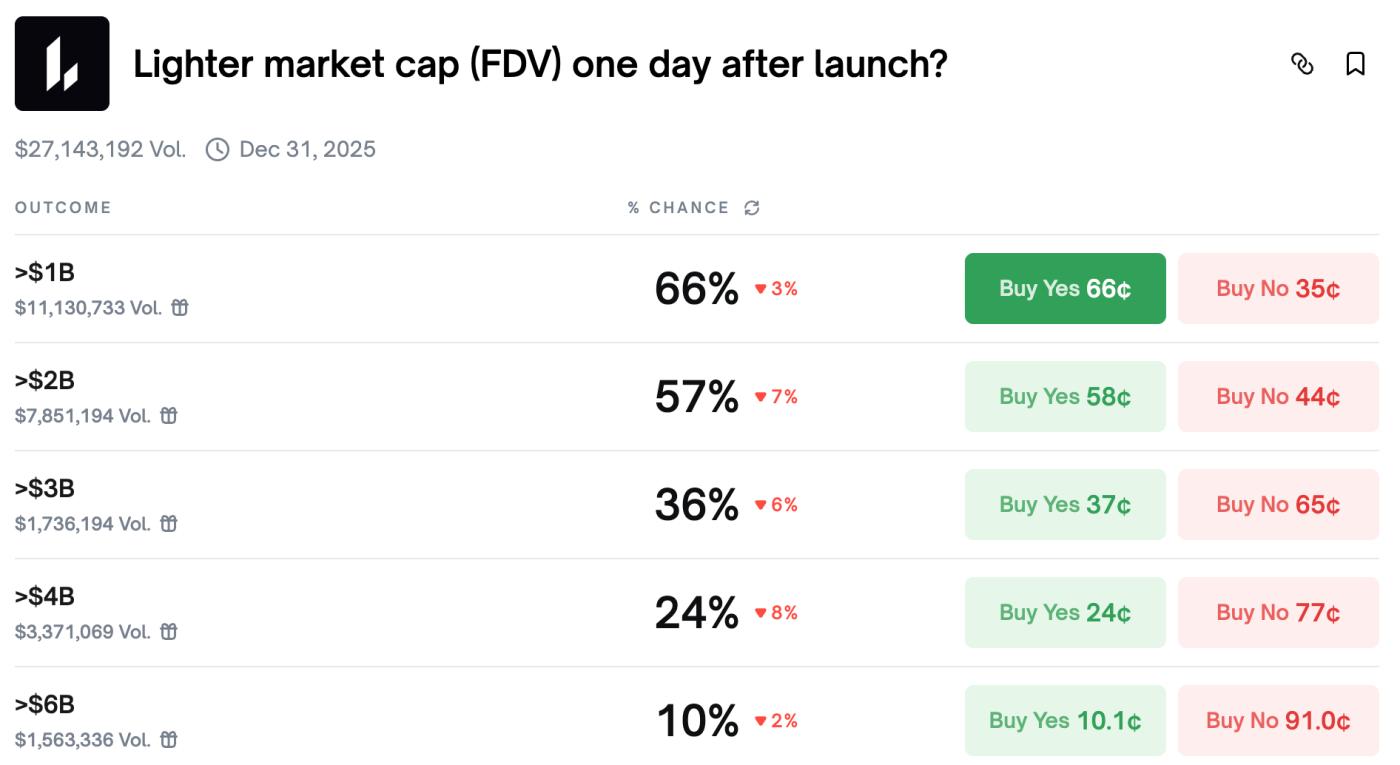

Regarding predictions about the token's valuation after listing, the market is generally optimistic about the "FDV exceeding $1 billion on the second day after listing," but the probability expectation for a higher valuation range has clearly narrowed. Overall, the market's attitude towards Lighter is not blindly optimistic, but rather a diversified pricing strategy undertaken in advance, given that uncertainties have not yet been eliminated.

Figure 3. The prediction on Polymarket for Lighter's market cap (FDV) one day after launch. Source: https://polymarket.com/event/lighter-market-cap-fdv-one-day-after-launch?tid=1766026452011

At a longer-term level, differing opinions are emerging within the community regarding Lighter's business model and token design. Some argue that Lighter currently focuses too much on the trading product itself, with limited development in staking, governance, or a richer ecosystem. They worry that if the token's functionality fails to create a clear value loop with the platform's trading activities, user activity will face significant downward pressure after the TGE and airdrop events. This discussion is not a denial of the project's progress, but rather reflects a growing market focus on long-term sustainability as the Perp DEX sector matures.

2. High Exposure Leads to Pre-Pricing: Why is Lighter Considered a "Quasi-Asset"?

Over the past year, there have been numerous on-chain Perp DEX projects, but only a few have maintained sustained market visibility. Unlike projects that rely on high-intensity incentive mechanisms to maintain data, Lighter was placed in a high-profile position from the outset. Coinbase's super app, Base, integrated Lighter's official website, allowing users to directly discover and use the product within the Coinbase ecosystem. This placed it under scrutiny within the context of potential mainstream trading scenarios, meaning the market's evaluation criteria quickly shifted from "whether its mechanism can function" to "whether it deserves long-term pricing."

During this process, Lighter did not initially present a complete token narrative, but its trading data and participation amplified simultaneously in a short period. This combination led the market to begin incorporating it into valuation and comparative discussions even before obtaining all the key information.

More importantly, Lighter's emergence coincided with a shift in the overall narrative of the Perp DEX sector. Industry focus was gradually shifting from early emphasis on mechanism and architectural innovation to a more practical question: whether sustainable, non-incentivized, genuine trading demand had emerged. In this context, as long as a project proves first that "people are actually using it," even if its business model and token value capture haven't yet completed their full narrative loop, it will often be viewed by the market as a "quasi-asset" in advance.

Therefore, the current controversy surrounding Lighter does not stem entirely from the project's own pace choices, but rather from a structural misalignment between market expectations and the project's current stage: when the market begins to evaluate a product still in the development phase as if it were a mature asset, the disagreement will naturally be amplified.

3. Without considering TGE, has Lighter truly realized its product value?

If we temporarily remove the expectations of TGE and airdrops, whether Lighter still has value for continued discussion is the key to determining whether this project is worth paying attention to.

Based on the disclosed data and actual trading behavior, Lighter exhibits at least several key signals that are not easily observed. First, in terms of perpetual contract trading, Lighter has undertaken a considerable scale of market trading activity. According to DefiLlama data, as of December 18th, Lighter 's perpetual contract trading volume over the past 30 days was approximately $256.27 billion, with a platform TVL of $1.457 billion, corresponding to a trading volume/TVL (TVL equivalent capital tied up) of approximately 175.88. In comparison, Hyperliquid and Aster's trading volume/TVL during the same period were approximately 49.16 ($203.84 billion/$4.146 billion) and 169.6 ($221 billion/$1.303 billion), respectively. Trading volume/TVL essentially reflects the turnover intensity of unit locked capital over a certain period. In the perpetual contract scenario, a higher metric generally indicates that funds are used more frequently, and trading behavior is more high-frequency and incentive-driven. From this metric, both Lighter and Aster currently exhibit a clear high turnover characteristic, showing strong trading activity, but this may include some trading demand amplified by incentive mechanisms; in contrast, Hyperliquid's trading structure is more inclined towards capital accumulation and relatively stable risk exposure.

During this timeframe, Lighter's perpetual contract trading volume is already at a high level within the Perp DEX sector, demonstrating its strong competitiveness in terms of transaction matching efficiency and system capacity. It should be noted that Lighter's current trading activity may still be influenced by incentive mechanisms and market expectations, rather than being entirely driven by natural demand. Even so, the ability to consistently handle such a volume of trading in a high-frequency, high-leverage trading environment constitutes a significant technical and product barrier, laying the foundation for further testing the sustainability of genuine trading demand.

Figure 4. Lighter data. Source: https://defillama.com/protocol/lighter?perpVolume=true&tvl=false

Secondly, from a product structure perspective, Lighter's order book hybrid matching model already supports continuous user engagement in terms of execution efficiency, slippage control, and transaction feedback. This means it's not just a one-off product, but rather something that some traders have incorporated into their long-term trading journey. Furthermore, the entry-level exposure gained from integrating with the base app's official page hasn't just remained at the stage of being seen. Based on currently observable trading and activity data, at least some traffic has already converted from "exposure" to "behavior." This is what sets Lighter apart from many Perp DEX projects that remain at the level of narrative and expectation.

It is precisely because Lighter has successfully navigated these crucial stages that the market is demanding higher standards from it. When a project has proven its real-world value, the question is no longer simply "whether there is a token," but rather whether the token can reasonably absorb and amplify this existing value.

4. Once Perp DEX is running successfully, how else can the token be designed?

Following projects like Hyperliquid and Aster, the Perp DEX sector is reaching a similar stage: once the trading product itself has been proven to be feasible, how should the token "justifiably exist"?

Past projects have demonstrated different approaches. Take Hyperliquid as an example: its token design didn't focus on governance or incentives, but rather on how to capture the protocol's real revenue. According to official disclosures and third-party statistics , the platform continuously uses the majority (over 90%) of its perpetual contract and other transaction fees to buy back HYPE tokens on the secondary market, supporting the token supply through burning or removing them from circulation. As trading volume and transaction fees increase, the buyback intensity also expands, thus transmitting the protocol's operating results to the token level, forming a relatively clear value loop. This path also places extremely direct demands on the fundamentals: the buyback mechanism can only continue to function effectively if the platform can generate a sufficiently large and stable amount of real trading revenue over the long term. Once trading activity declines, the token's value will also come under pressure.

In contrast, Aster rapidly expanded its user base and trading activity in its early stages through large-scale airdrops and multi-stage incentives. Official Tokenomics data shows that approximately 53.5% of ASTER's total supply was used for airdrops, trading incentives, and community rewards, helping to accumulate liquidity during the launch phase. In its long-term value design, Aster introduced a phased buyback and burn mechanism. About half of the publicly repurchased tokens were permanently burned, with the remainder locked for future incentives. Buyback funds primarily come from protocol fees and the project treasury, not entirely relying on protocol revenue. Unlike Hyperliquid, which consistently uses most of its fees for buybacks, Aster's buybacks are more for stabilizing expectations and adjusting supply and demand; their scale and pace do not automatically expand with fee revenue. This strategy helps increase attention and participation in the early stages, but in the medium to long term, if incentives weaken and trading demand becomes insufficient, the token may face selling pressure.

Under real-world constraints, the token designs of Perp DEX projects generally exhibit a kind of "conscious restraint": they are aware of the unsustainability of purely incentive-based tokens, while remaining wary of the structural complexity and compliance costs associated with revenue-sharing tokens. In the absence of a fully validated and scalable standard path, delaying commitments and maintaining flexibility becomes a more rational choice.

5. Returning to Lighter: Its "hesitation" may be part of the answer to the problem.

If we step outside of emotional discussions like "Will there be TGE?" and "When will it be airdropped?", and look at it from a relatively calm perspective, Lighter's current state is actually very clear: it is not a project that relies solely on TGE to boost its valuation, but at the same time, it has not yet provided a sufficiently convincing and market-priced narrative for the token's endgame.

From a product strategy perspective, Lighter did not use high-frequency, explicit subsidies to quickly accumulate short-term data. Instead, it leveraged a points system to link incentives to actual trading behavior. This incentive, with its delayed realization, serves more as a continuous guide to trading behavior than a one-time surge in volume. Lighter is using its already established trading volume, active users, and continuously growing data to buy time and patience from the market. In a market environment highly accustomed to using TGE (Trading Term) as a timeline, this restraint inevitably causes discomfort.

This is precisely why the disagreements surrounding Lighter have become increasingly apparent. For short-term participants, the lack of a clear token timeline and expected returns directly diminishes their motivation to participate, naturally increasing skepticism. For long-term traders, however, as long as the product depth, matching efficiency, and trading experience remain advantageous, the immediate issuance of a token will not affect their usage decisions. This misalignment in focus between the two groups leads to drastically different evaluations of the same project from different perspectives, further amplifying market disagreements.

From an industry perspective, the controversy surrounding Lighter goes beyond the question of "whether to issue a token" itself, touching upon the core issue of token design for decentralized perpetual trading platforms: given that Perp DEX has proven to have real users and trading demand, is a token truly necessary? Should its core functions focus on incentives and governance, or more importantly, value capture and long-term ecosystem building?

This reflects the entire sector's transition from "rapid growth + incentive-driven" to "sustainable value creation." As a project under intense market scrutiny, Lighteru's performance and token strategy will have a significant demonstrative effect on the token economic model of the entire Perp DEX ecosystem. Regardless of its final token design and issuance schedule, this discussion surrounding token positioning will continue to influence future project design ideas and market expectations. For investors and researchers, observing Lighter's path helps to understand how this sector is achieving a crucial leap from "incentive-driven user acquisition" to "intrinsic value creation."

refer to

1.Hyperliquid Diligence Report. Source: https://messari.io/research/deep-research-reports/hyperliquid-diligence-report-fdf9486f-d978-4a6f-980e-ccadc697b120

2.10 Projects Account for 92% of Token Buyback Spend in 2025: https://www.coingecko.com/research/publications/token-buybacks

3. Lighter points system: https://app.lighter.xyz/public-pools/281474976710654

4.The prediction on Polymarket for when the Lighter airdrop will be: https://polymarket.com/event/what-day-will-the-lighter-airdrop-be?tid=1766026269827

5.The prediction on Polymarket for Lighter's market cap (FDV) one day after launch: https://polymarket.com/event/lighter-market-cap-fdv-one-day-after-launch?tid=1766026452011

6.Lighter data on Deillama. Source: https://defillama.com/protocol/lighter?perpVolume=true&tvl=false

7.Aster DEX burns 80 million tokens and unveils 2026 roadmap: Key insights and analysis: https://investx.fr/en/crypto-news/aster-dex-burns-80-million-tokens-unveils-2026-roadmap-key-insights-analysis/

8.Aster PERP-DEX Investment Memo: https://insights.blockbase.co/aster-perp-dex-investment-memo

9.Aster Updates ASTER Token Buyback and Airdrop to Boost Token Value: https://www.mexc.co/en-IN/news/149436