Original title: Why fixed-rate lending never took off in crypto

Original author: Prince

Original translation by: Golem, Odaily Odaily

The failure of fixed-rate lending in the crypto space is not simply because DeFi users reject it. Another reason for its failure is that DeFi protocols designed their credit products using money market assumptions and then deployed them into a liquidity-driven ecosystem; the mismatch between user assumptions and actual capital behavior keeps fixed-rate lending a niche market.

Fixed-rate products are unpopular in the crypto space.

Today, almost all mainstream lending protocols are building fixed-rate products, largely driven by RWA (Rating and Waiver of Credit). This trend is understandable, as fixed terms and predictable payments become crucial as lending moves closer to the real world. In this context, fixed-rate lending seems inevitable.

Borrowers crave certainty: fixed payment methods, known terms, and no unexpected repricing. If DeFi is to function like real finance, then fixed-rate lending should play a central role.

However, the opposite is true in each cycle. The floating-rate money market is huge, while the fixed-rate market remains sluggish. Most "fixed" products end up performing like niche held-to-maturity bonds.

This is no coincidence; it reflects the composition of market participants and how these markets are designed.

TradFi has a credit market, while DeFi relies on the money market.

Fixed-rate loans have worked in the traditional financial system because the system is built around time. The yield curve is anchored to prices, and benchmark interest rates change relatively slowly. Some institutions have a clear mandate to hold duration, manage mismatches, and maintain solvency during periods of one-way capital flow.

Banks issue long-term loans (mortgage loans being the most obvious example) and fund them with liabilities that are not considered "profit-driven capital." When interest rates change, they do not need to immediately liquidate their assets. Duration management is achieved through balance sheet construction, hedging, securitization, and deep intermediaries specifically designed for risk sharing.

The key issue is not the existence of fixed-rate loans, but that someone will always absorb the mismatch when the terms of the borrower and lender are not perfectly matched.

DeFi has never built such a system.

DeFi is built more like an on-demand money market. Most fund providers have a simple expectation: to earn yield on idle funds while maintaining liquidity. This preference subtly determines which products can scale.

When lenders behave like they are managing cash, the market will liquidate around products that feel like cash rather than products that feel like credit.

How do DeFi lenders understand the meaning of "lending"?

The most important difference is not between fixed and floating interest rates, but between the cash withdrawal commitment.

In floating-rate liquidity pools like Aave, providers receive a token that is essentially a liquidity treasury. They can withdraw funds at any time, rotate their holdings when better investment opportunities arise, and typically use their positions as collateral for other investments. This option itself is a product.

Lenders accepted a slightly lower yield for this. But they weren't stupid; they were paying for liquidity, composability, and the ability to repric without additional costs.

Using a fixed interest rate reverses this relationship. To obtain a duration premium, lenders must relinquish flexibility and accept that their funds are locked up for a period of time. This deal is sometimes reasonable, but only if the compensation is also reasonable. In reality, most fixed-rate schemes do not provide sufficient compensation to offset the loss of option.

Why do highly liquid collaterals drive interest rates toward floating rates?

Today, most large-scale cryptocurrency lending is not credit in the traditional sense. They are essentially margin and repurchase agreements backed by highly liquid collateral, and these markets naturally employ floating interest rates.

In traditional finance, repurchase agreements and margin financing are constantly being repriced. Collateral is liquid, and risk is priced at market value. Both parties expect this relationship to adjust at any time, and the same applies to cryptocurrency lending.

This also explains a problem that lenders often overlook.

In order to obtain liquidity, lenders have effectively accepted economic benefits far below what is implied by nominal interest rates.

On the Aave platform, there is a significant interest rate differential between the amount borrowers pay and the returns lenders receive. Part of this is due to agreement fees, but a large portion is because account utilization must be kept below a certain level to ensure smooth withdrawals under pressure.

Aave 1-Year Supply and Demand Comparison

This interest rate spread manifests as a lower yield, which is the price lenders pay to ensure smooth cash withdrawals.

Therefore, when a fixed-rate product emerges and locks in funds at a moderate premium, it is not competing with a neutral benchmark product, but with a product that deliberately suppresses the yield but is highly liquid and safe.

To win, it's not as simple as just offering a slightly higher annual interest rate.

Why do borrowers still tolerate the floating rate market?

Borrowers typically prefer certainty, but most on-chain lending is not home mortgage lending. It involves leverage, basis trading, liquidation avoidance, collateral circulation, and tactical balance sheet management.

As @SilvioBusonero demonstrated in his analysis of Aave borrowers, most on-chain debt relies on revolving loans and basis strategies rather than long-term financing.

These borrowers don't want to pay a high premium for long-term loans because they don't intend to hold them for the long term. They want to lock in the interest rate when it's convenient and refinance when it's inconvenient. If the interest rate is favorable to them, they will continue to hold. If problems arise, they will quickly liquidate the position.

Therefore, a market eventually emerges where lenders need a premium to lock in funds, but borrowers are unwilling to pay that fee.

This is why the fixed-rate market has continuously evolved into a one-sided market.

The fixed-rate market is a one-sided market issue.

The failure of fixed-rate crypto offerings is often attributed to implementation issues. Comparisons include auction mechanisms versus AMMs (Automated Market Makers), round-based versus pooled pricing, better yield curves, and improved user experience.

People have tried many different mechanisms. Term Finance conducts auctions, Notional builds explicit term instruments, Yield tries a term-based automated margin building mechanism (AMM), and Aave even tries to simulate fixed-rate lending in a liquidity pool system.

The designs may differ, but the results are the same. The deeper issue lies in the underlying thought patterns.

The debate eventually turned to market structure. Some argued that most fixed-rate agreements attempt to make credit feel like a variant of the money market. They retain pooled funds, passive deposits, and liquidity commitments, only changing how interest rates are quoted. On the surface, this makes fixed rates more acceptable, but it also forces credit to inherit the constraints of the money market.

A fixed interest rate is not just a different interest rate; it is a different product.

At the same time, the notion that these products are designed for future user groups is only partially true. People expected institutions, long-term depositors, and native borrowers to flock to and become the backbone of these markets. But the actual influx of funds is more like active capital.

Institutional investors act as asset allocators, strategists, and traders. Long-term depositors have never reached a meaningful scale. Native credit borrowers do exist, but they are not the anchors of the lending market; lenders are.

Therefore, the limiting factors are never purely a matter of allocation, but rather the result of the interaction between capital behavior and flawed market structures.

For a fixed-rate mechanism to operate on a large scale, one of the following conditions must be met:

- The lender is willing to accept that the funds are locked up;

- There exists a deep secondary market where lenders can exit at a reasonable price;

- Some people hoard long-term funds, allowing lenders to pretend they have liquidity.

Most DeFi lenders reject the first condition, the secondary market for regular risk remains weak, and the third condition quietly reshapes balance sheets, which is exactly what most protocols are trying to avoid.

This is why the fixed-rate mechanism is always relegated to a corner, barely able to exist, but never able to become the default place for funds.

Maturity segmentation leads to fragmented liquidity, and the secondary market remains weak.

Fixed-rate products create a maturity segmentation, which leads to a dispersion of liquidity.

Each maturity date represents a different financial instrument, and the risks vary accordingly. A debt maturing next week is entirely different from a debt maturing in three months. If lenders want to exit early, they need someone to buy the debt at that specific point in time.

This means either:

- There are multiple independent fund pools (one for each maturity date).

- There is a real order book, with real market makers quoting prices across the entire yield curve.

DeFi has not yet provided a persistent second solution for the credit sector, at least not on a large scale yet.

What we are seeing is a familiar phenomenon: worsening liquidity and increased price shocks. "Early exit" has become "You can exit, but at a discount," and sometimes this discount can eat up most of the lender's expected returns.

Once a lender experiences this situation, the position ceases to resemble a deposit and becomes an asset that needs to be managed. Afterward, most of the funds will quietly flow out.

A specific comparison: Aave vs. Term Finance

Let's take a look at where the funds actually flow.

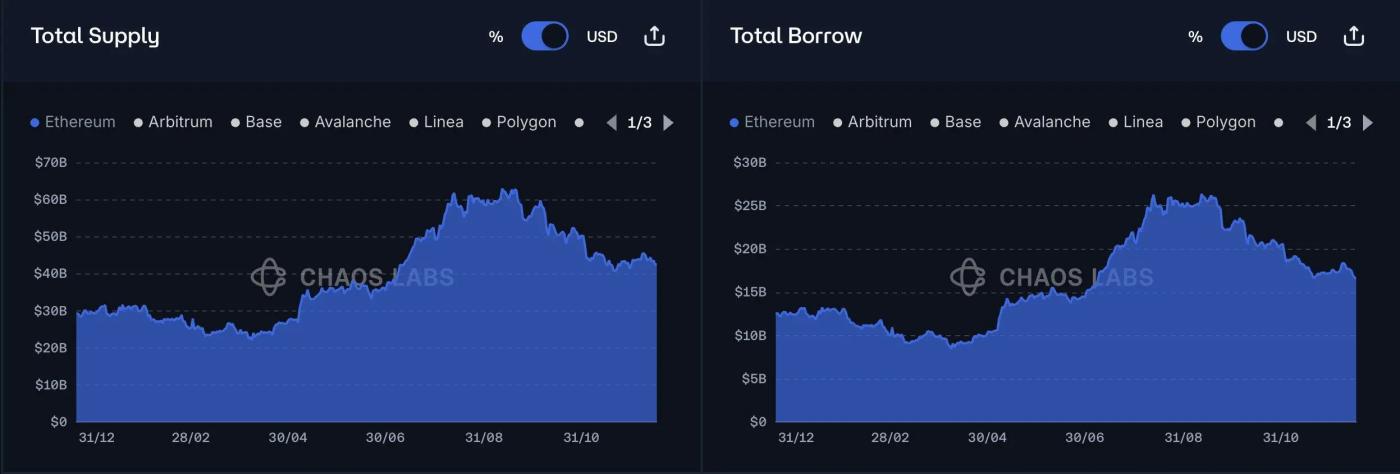

Aave operates on a massive scale, lending billions of dollars, while Term Finance, though well-designed and perfectly catering to fixed-rate advocates, remains small compared to the money market. This gap isn't due to brand recognition, but rather reflects actual borrower preferences.

On the Ethereum Aave v3 platform, USDC providers can earn an annualized yield of approximately 3% while maintaining instant liquidity and highly composable positions. Borrowers pay an interest rate of approximately 5% over the same period.

In contrast, Term Finance typically completes 4-week fixed-rate USDC auctions at mid-single-digit rates, sometimes even higher, depending on the collateral and conditions. On the surface, this seems better.

But the key lies in the lender's perspective.

If you are a borrower and are considering the following two options:

- The yield is approximately 3.5%, similar to cash (you can exit at any time, rotate your position at any time, and use the position for other purposes).

- The yield is approximately 5%, similar to bonds (held to maturity, with limited exit liquidity unless someone takes over).

Aave vs. Term Finance Annualized Yield (APY) Comparison

Many DeFi lenders choose the former, even though the latter is numerically higher. This is because the numbers don't represent the full return; the full return includes option gains.

The fixed-rate market requires DeFi lenders to become bond buyers, and in this ecosystem, most capital is trained to be profit-driven liquidity providers.

This preference explains why liquidity is concentrated in specific regions. Once liquidity becomes insufficient, borrowers immediately feel the effects of decreased efficiency and limited financing capabilities, and they will revert to floating interest rates.

Why fixed interest rates may never be the default option for cryptocurrencies

Fixed interest rates can exist, and they can even be healthy.

However, it will not become the default place for DeFi lenders to store funds, at least not until the lender base changes.

As long as most lenders expect par liquidity, value composability as much as yield, and prefer positions that can adapt automatically, fixed rates will remain structurally disadvantaged.

Floating-rate markets prevail because they align with the actual behavior of participants. They are money markets for liquid funds, not credit markets for long-term assets.

What needs to be changed for fixed-rate products?

For fixed interest rates to work, they must be treated as credit, not disguised as savings accounts.

Early exit must be priced in, not just promised; term risks must also be clearly defined; and when the flow of funds is inconsistent, someone must be willing to assume the responsibility of the other party.

The most feasible solution is a hybrid model. Floating interest rates serve as the base layer for capital deposits, while fixed interest rates act as an optional tool for those who explicitly wish to buy or sell duration-based products.

A more realistic approach is not to force fixed interest rates into the money market, but to maintain liquidity flexibility while providing an option for those seeking certainty to participate.

Recommended reading:

Why isn't Metaplanet, Asia's largest Bitcoin treasury company, buy the dips?