A quick overview of institutional and trader opinions on the market outlook.

Written by: 1912212.eth, Foresight News

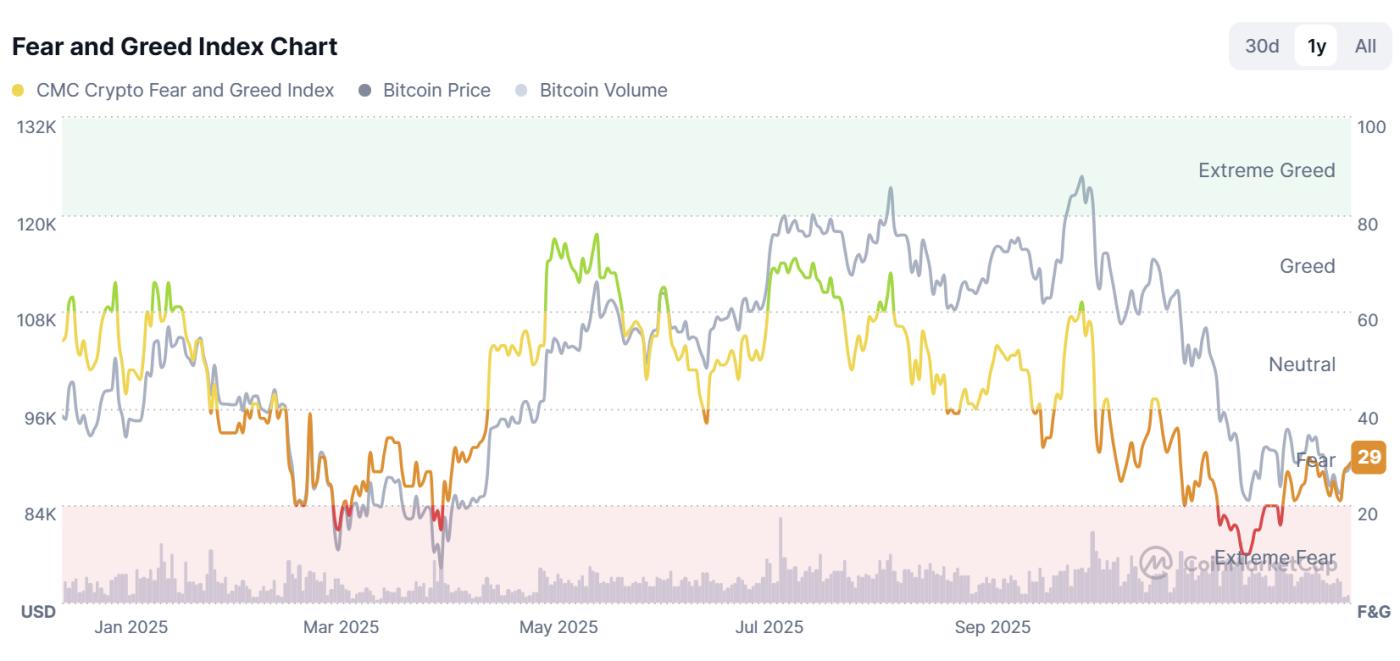

Since the Federal Reserve's interest rate cut and the Bank of Japan's interest rate hike, the cryptocurrency market has remained in a range-bound trading pattern, with the fear index struggling to climb but still below 30. After the ups and downs following this year's black swan events, how do market traders and institutions view the future market trend?

Wintermute trading strategist: Bitcoin may fluctuate between $86,000 and $92,000.

In an interview with CoinDesk, Wintermute trading strategist Jasper De Maere believes Bitcoin may be trading within a range of $86,000 to $92,000. Jasper cautioned against overinterpreting technical indicators at this time and anticipates more profit-taking in the next two weeks due to year-end portfolio adjustments and tax considerations. "People are closing positions to take a breather… short-term rallies will soon be sold off."

He anticipates that Bitcoin will continue to consolidate sideways until a new catalyst emerges, one of which could be the expiration of large-scale options in late December. While Jasper hasn't definitively stated that the market has bottomed out, he indicates that signs of a bottom are beginning to appear. "I feel we're at our biggest pain point. In the short term, I certainly think the market is oversold."

IOSG Founding Partner: Bullish on the market in the first half of 2026

Jocy, founding partner of IOSG, posted on social media, "2025 was the darkest year for the crypto market, but also the dawn of the institutional era. This was a fundamental shift in market structure, yet most people were still viewing the new era through the lens of old cycles. A review of the 2025 crypto market reveals a paradigm shift from retail speculation to institutional allocation. Core data shows institutional holdings at 24%, while retail investors exited at 66%, marking a complete turnover in the crypto market. Market dominance has shifted from retail to institutional investors. Institutions are continuously building positions at high levels because they are not looking at price, but rather at the cycle. Retail investors are selling, while institutions are buying. The current period is not the peak of a bull market, but rather an institutional accumulation phase."

The midterm elections will be held in November 2026. Historically, policies tend to precede decisions in election years. Therefore, the investment logic should be: the first half of 2026 will be a policy honeymoon period, with institutional allocations favoring the market; the second half of 2026 will see increased political uncertainty and volatility. However, risks remain, including Federal Reserve policy, a strong dollar, potential delays in market structure legislation, continued selling of LTH bonds, and uncertainty surrounding the midterm election results. But on the other hand, risks present opportunities; when everyone is bearish, it is often the best time to position oneself.

- Short term (3-6 months): Trading range of $87,000-$95,000, with institutions continuing to build positions.

- Mid-term (First Half of 2026): Driven by both policy and institutional factors, with a target of $120,000-$150,000.

- Long term (second half of 2026): Increased volatility, depending on election results and policy continuity.

This is not the top of a cycle, but the beginning of a new one. 2025 marks an acceleration in the institutionalization of the crypto market. Despite a negative annual return for BTC, ETF investors demonstrated strong HODL resilience. While 2025 appears to be the worst year for crypto, it actually saw the largest supply turnover, the strongest institutional allocation intentions, the clearest policy support, and the most extensive infrastructure improvements. Despite a 5% price drop, ETFs saw $25 billion in inflows, indicating optimism for the first half of 2026. Key developments in 2026 include: progress on market structure legislation, the possibility of expanding the strategic Bitcoin reserve, and policy continuity after the midterm elections. In the long term, the improved ETF infrastructure and regulatory clarity lay the foundation for the next upward trend. When the market structure fundamentally changes, old valuation logic becomes invalid, and new pricing power is rebuilt.

Galaxy Digital Research Director: BTC Could Still Reach New Highs in 2026

Alex Thorn, Head of Research at Galaxy Digital, wrote that "Bitcoin will reach $250,000 by the end of 2027. The trajectory of 2026 is too volatile to predict, but it's still possible for Bitcoin to reach a new all-time high in 2026. Currently, options market pricing shows that by the end of June 2026, the probability of Bitcoin falling to $70,000 or rising to $130,000 is almost equal; and by the end of 2026, the probability of falling to $50,000 or rising to $250,000 is equally close. This wide price range reflects the high degree of uncertainty in the market regarding the short- to medium-term outlook."

Data analyst Murphy: On-chain data sentiment is recovering.

Data analyst Murphy stated that on-chain data observed signs of sentiment recovery. The number of addresses that switched from "holding BTC" to "completely liquidating" within 30 days surged between November 13th and 25th, coinciding with the fastest and largest drop in BTC price during that period. The large number of liquidation addresses reflects the panic and pessimism in market sentiment.

However, from December 1st to 18th, BTC repeatedly tested the bottom, and the number of liquidation addresses began to decrease, which perfectly matched the bullish behavior and sentiment changes shown in the futures market.

Santiment founder: Bitcoin could still fall to around $75,000.

Maksim Balashevich, founder of crypto market analysis firm Santiment, stated that there hasn't been enough panic on social media to confirm a market bottom, and Bitcoin could still fall to around $75,000, implying a potential drop of approximately 14.77% from current levels. Balashevich explained that many users remain optimistic that the downtrend will reverse in the short term, but this typically doesn't happen when a true market bottom is formed.