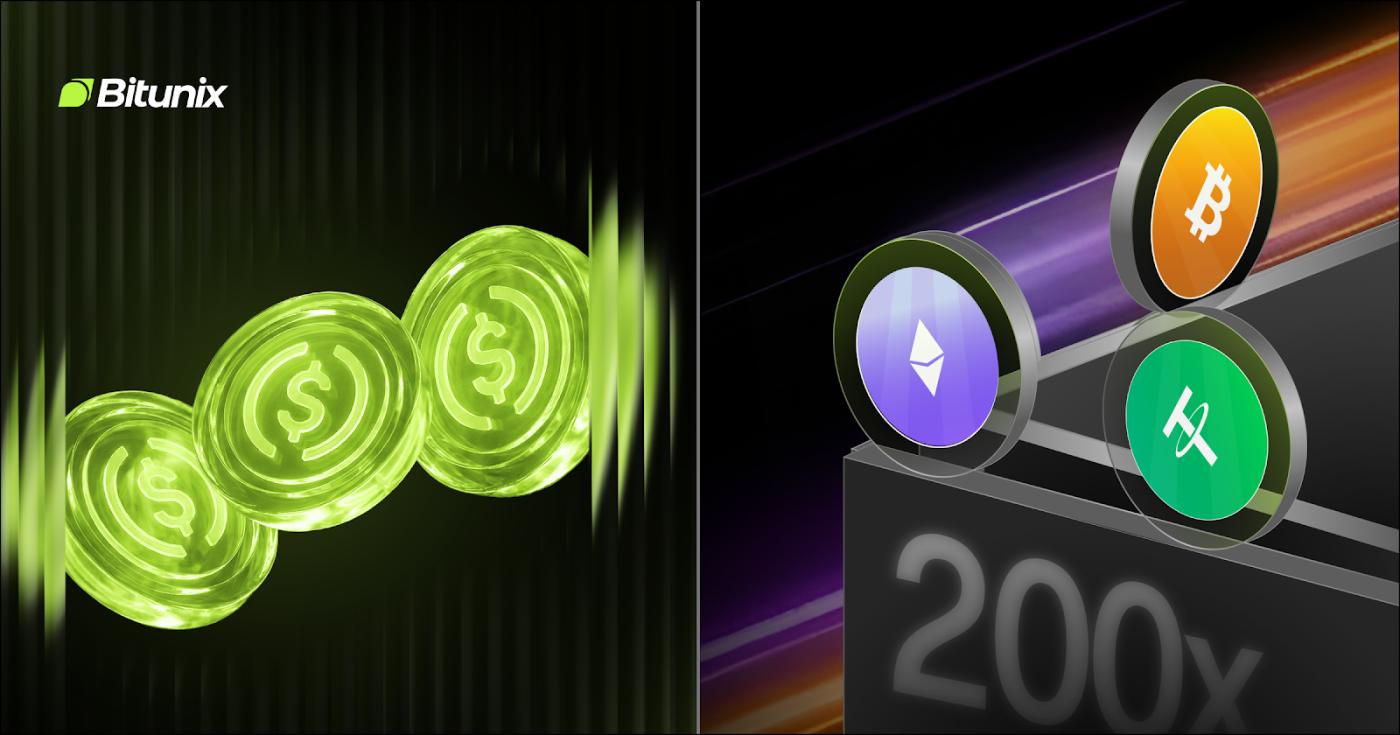

Bitunix, the world’s fastest-growing crypto exchange, is continuing to expand its derivatives offerings with a series of core upgrades aimed at improving how traders use futures markets. As part of this systematic expansion, the exchange has introduced USDC-M Futures and raised leverage on BTC/USDT and ETH/USDT perpetual contracts to 200x. Together, these updates show Bitunix’s focus on building a stronger and more flexible futures platform, offering traders more choice in margin options and more control over how they manage positions.

"We are doing this to make derivatives trading more attractive on Bitunix. This is part of our long-term plan as an exchange to improve trading conditions and offer a more complete and, why not, more unique platform," said Steven Gu, Chief Strategy Officer at Bitunix exchange.

“By expanding product depth and strengthening its infrastructure, Bitunix is building a derivatives platform designed to support both professional and institutional trading demands,” he added.

Driving the Move Toward USDC-M Derivatives

Crypto derivatives continue to grow rapidly. According to CME Group, with an average daily open interest of around $31 billion, global crypto futures and options trading topped $900 billion in Q3 2025, reflecting sustained demand from both retail and institutional participants.

At the same time, stablecoins such as USDC are playing an increasingly important role in crypto trading, driven by price stability and growing adoption as a settlement asset across exchanges. Data from Coinglass shows that the total stablecoin market cap stands at $270 billion with USDC alone holding roughly $61 billion of that supply, underscoring how widely these assets are used across the crypto ecosystem.

Hence, Bitunix has launched USDC-M Futures, which is yet another step in the process of expanding the derivatives offerings by the exchange and staying aligned with evolving market preferences.

With USDC-M futures, traders can open and manage positions directly using USDC, without needing to convert funds or pay extra fees, making profit and loss easier to track. Bitunix also offers zero-fee spot trading on the USDC/USDT pair, allowing users to move between the two at no cost.

USDC trading on Bitunix is supported by a broad spot market, with 20 trading pairs available, including BTC, ETH, SOL, XRP, BNB, DOGE, ADA, LINK, AVAX, LTC, UNI, AAVE, ARB, BCH, FIL, NEAR, HBAR, ENA, SUI, and SHIB. In addition, the multi-asset margin feature allows USDC, USDT, and other supported assets to be used together as margin, helping traders use their funds more efficiently.

Furthermore, USDC-M Futures are fully integrated with Bitunix’s suite of advanced features, such as the Ultra K-Line candlestick system and multi window feature reflecting the exchange’s broader strategy of building a comprehensive, scalable derivatives platform that fits both experienced traders and newcomers alike.

Bitunix Raises the Bar With 200x Leverage

The exchange has raised the maximum leverage for BTC/USDT and ETH/USDT Perpetual Futures to 200x, up from 125x. This change isn’t just a higher number, it also reflects deeper liquidity and improved platform infrastructure, giving traders more confidence and flexibility when managing positions in fast-moving markets.

The boost in leverage comes alongside the launch of USDC-M futures and other recent updates. Together, these improvements show Bitunix’s focus on strengthening its core derivatives offering and providing a platform that works well for both experienced traders and those just starting out.

With these recent updates and feature additions, Bitunix is laying the groundwork for a crypto derivatives platform that can support different trading styles and experience levels. These updates reflect a steady, long-term effort to build a derivatives environment that is clear, practical, and ready to grow with its users.

About Bitunix

Bitunix is a global cryptocurrency derivatives exchange trusted by more than 3 million users in over 100 countries. The company is committed to providing a transparent, compliant, and secure trading environment for all users. Bitunix offers a fast registration process and a user-friendly verification system supported by mandatory KYC to ensure safety and regulatory compliance.

With global protection standards such as Proof of Reserves (PoR) and the Bitunix Care Fund, the exchange places strong emphasis on user trust and fund security. Its K-Line Ultra chart system delivers a seamless trading experience for both beginners and advanced traders, while leverage of up to 200x and deep liquidity make Bitunix one of the most dynamic platforms in the market.