Market Update aims to provide readers with the latest market reports and key digital asset data.

Article author: 0xArthur

Article source: ME News

Most sectors in the crypto market rose, with the NFT sector up 8.92% in the last 24 hours. Within the sector, Audiera (BEAT) surged 63.88%, while Pudgy Penguins (PENGU) and APENFT (NFT) rose 0.63% and 2.56% respectively. Additionally, Bitcoin (BTC) rose 1.05%, surpassing $89,000; Ethereum (ETH) rose 2.30%, surpassing $3,000.

Other sectors that performed well include: RWA (Rise of 3.53% in 24 hours, Sky (SKY) up 7.97%); Layer 1 (Up 1.26%, Kaspa (KAS) up 5.90%); DeFi (Up 1.25%, MYX Finance (MYX) up 13.06%); Meme (Up 1.00%, MemeCore (M) up 11.16%); CeFi (Up 0.56%, Binance Coin (BNB) up 1.20%); and PayFi (Up 0.05%, Velo (VELO) up 7.64%).

In addition, the AI sector fell 0.29%, with Fartcoin (FARTCOIN) rising 2.92% within the sector; the Layer 2 sector fell 0.89%, but SOON (SOON) rose 8.17%.

The crypto sector indices, which reflect the historical performance of the sector, show that the ssiRWA, ssiLayer1, and ssiCeFi indices rose by 3.42%, 2.11%, and 1.10%, respectively.

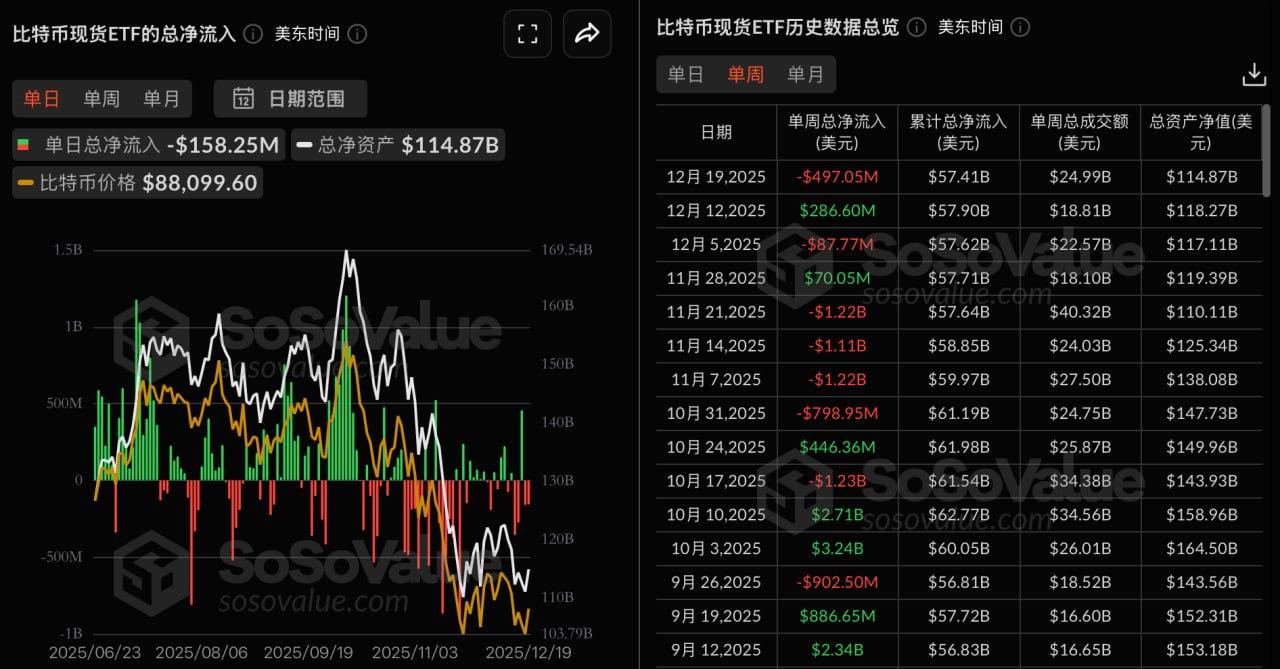

ETF Directional Data

According to SoSoValue data, Bitcoin spot ETFs saw a net outflow of $497 million last week (December 15 to December 19, Eastern Time).

The Bitcoin spot ETF with the largest net inflow last week was the Fidelity ETF FBTC, with a weekly net inflow of $33.15 million. The total historical net inflow of FBTC has now reached $12.21 billion.

The Bitcoin spot ETF with the largest net outflow last week was BlackRock ETF IBIT, with a weekly net outflow of $240 million. IBIT's historical total net inflow has reached $62.49 billion. The second largest was Bitwise ETF BITB, with a weekly net outflow of $115 million. BITB's historical total net inflow has reached $2.17 billion.

As of press time, the total net asset value of Bitcoin spot ETFs was $114.87 billion, with an ETF net asset ratio (market capitalization as a percentage of Bitcoin's total market capitalization) of 6.53%, and a cumulative net inflow of $57.41 billion.

According to SoSoValue data, Ethereum spot ETFs saw a net outflow of $644 million last week (December 15 to December 19, Eastern Time), with none of the nine ETFs experiencing net inflows.

The Ethereum spot ETF with the largest net outflow last week was BlackRock ETF ETHA, with a weekly net outflow of $558 million. ETHA's historical total net inflow has reached $12.67 billion. The second largest was Grayscale Ethereum Trust ETF ETHE, with a weekly net outflow of $32.36 million. ETHE's historical total net outflow has reached $5.05 billion.

As of press time, the Ethereum spot ETF has a total net asset value of $18.21 billion, with an ETF net asset ratio (market capitalization as a percentage of Ethereum's total market capitalization) of 5.04%, and a cumulative net inflow of $12.44 billion.

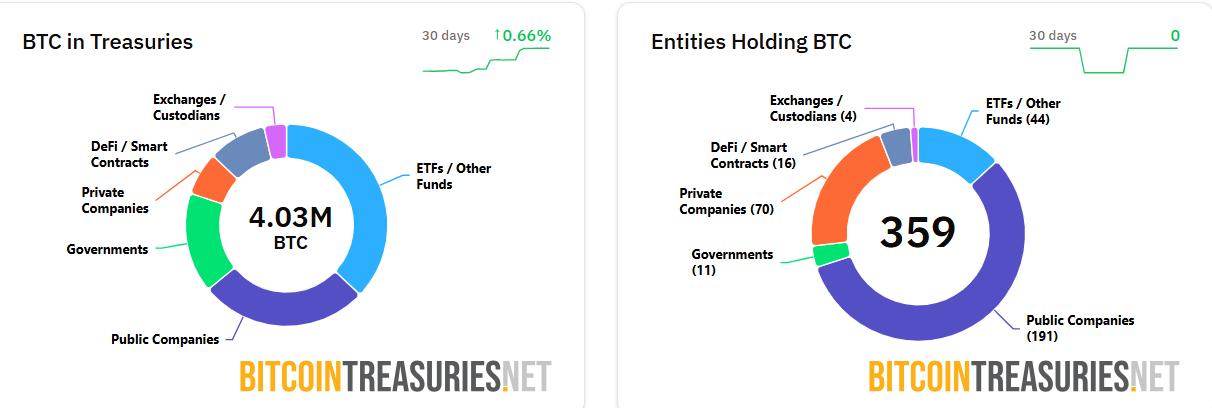

BTC direction

According to data from BitcoinTreasuries, 191 listed companies currently hold a total of 1,087,759 Bitcoins, accounting for 5.17% of the total Bitcoin supply. Among them, Strategy holds the largest amount, with 671,268 Bitcoins, accounting for 61.71% of the holdings of listed companies.

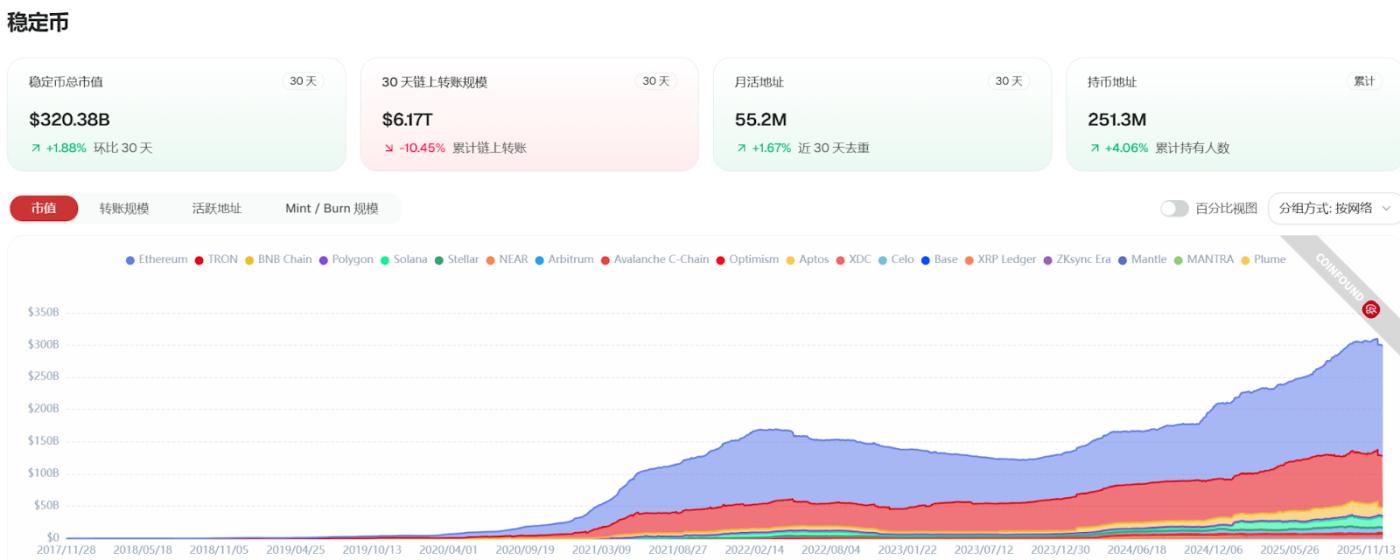

Stablecoin direction

According to CoinFound data:

- USDT market capitalization: $198.87 billion

- USDC market capitalization: $76.77 billion

- USDS market capitalization: $11.2 billion

- USDeS market capitalization: $6.49 billion

- PYUSD market capitalization: $3.92 billion

- USD1 market capitalization: $2.77 billion

Market Dynamics

US lawmakers propose a tax haven for small stablecoin payments and staking: regulated USD-pegged stablecoin payments under $200 would be exempt from capital gains tax; staking rewards could be deferred for taxation up to 5 years.

Coinbase launches Custom Stablecoins, allowing businesses to issue their own stablecoins.

FinTech Weekly points out that stablecoins support real-time micropayments and AI-assisted transactions, thus solving the problem of high fees in traditional payments; the GENIUS Act provides regulatory backing, and the Google AP2 protocol supports the expansion of stablecoins, which is expected to help the proxy business reach a scale of $1 trillion by 2030.

Summarize:

- The stablecoin market is stable, with favorable regulations and enterprise adoption. There have been no large-scale minting/burning or decoupling events. Supported by the moderate rise in the crypto market, on-chain transfer activity is stable.

RWA direction

According to CoinFound data:

- Commodity market capitalization: $3.76 billion (7D +1.31%)

- Government bond market value: $1.2 billion (7D +0.33%)

- Institutional fund market capitalization: $2.92 billion (7D +5.07%)

- Private lending market capitalization: $28.3 billion (7D -18.01%)

- Market value of US Treasury bonds: $8.84 billion (7D -1.5%)

- Corporate bond market value: $260 million (7D -0.34%)

X-Stock Market Cap: $620 million (7D -3.08%)

Market Dynamics:

US lawmakers have proposed tax breaks for small stablecoin payments and staking rewards, including a proposed exemption from capital gains tax on stablecoin transactions under $200.

Ethereum has become the settlement layer for global dollar liquidity, processing approximately $90 billion to $10 billion in stablecoin transfers daily.

Summarize:

- Institutional participation has increased significantly, with large financial institutions such as DTCC, JPMorgan, and Standard Chartered launching tokenized government bonds and money market funds, marking the accelerated migration of traditional finance to blockchain.