Author: David, TechFlow TechFlow

Original Title: 20x Return in 2 Days: A Quick Look at the Automated Market Making Mechanism of New large MC memecoinSnowball

The crypto market in December was as cold as the weather.

On-chain transactions have been dormant for a long time, and new narratives are struggling to emerge. Just look at the arguments and gossip that Chinese CT has been discussing these past few days, and you'll know that there's hardly anyone left in this market.

But something new has been being discussed in the English-speaking community these past few days.

A Meme coin called Snowball was launched on pump.fun on December 18th, and its market value soared to $10 million in just four days, and it is still hitting new highs; however, almost no one in the Chinese-speaking world is mentioning it.

In the current environment where there are few new narratives and memes are no longer popular, this is one of the few things that catches the eye and has a certain local wealth effect.

The name Snowball, which translates to "snowball effect," is itself the story it wants to tell:

A mechanism that allows tokens to "grow bigger and bigger on their own".

Turn transaction fees into buying orders, snowball market making

To understand what Snowball does, you first need to know how pump.fun tokens typically generate revenue.

On pump.fun, anyone can create a token in a few minutes. Token creators can set a "creator fee," which is essentially a percentage of each transaction that goes into their own wallet, usually between 0.5% and 1%.

This money could theoretically be used for community building and marketing, but in practice, most Devs choose to save up enough and then leave.

This is part of a typical lifecycle for tokens like "on-chain meme"(a type of token in the crypto world): launch, pump and dump, collect transaction fees, and then disappear. Investors aren't betting on the token itself, but on the developers' conscience.

Snowball's approach was to refuse the creator fee.

To be precise, 100% of the creator fees do not go into anyone's wallet, but are automatically transferred to an on-chain market-making bot.

This robot performs three tasks at regular intervals:

First, use accumulated funds to buy tokens in the market to create buying support;

Second, add the purchased tokens and corresponding SOL to the liquidity pool to improve trading depth;

Third, each operation destroys 0.1% of the tokens, creating deflation.

At the same time, the percentage of creator fees charged by this coin is not fixed and will fluctuate between 0.05% and 0.95% depending on the market value.

When the market capitalization is low, more funds are allocated to allow the robot to accumulate ammunition faster; when the market capitalization is high, the allocation is reduced to decrease transaction friction.

To summarize the logic of this mechanism in one sentence: every time you make a transaction, a sum of money automatically becomes buy orders and liquidity, instead of going into the developers' pockets.

Therefore, you can easily understand this snowball effect:

Transactions generate fees → fees become buying orders → buying orders push up prices → prices attract more transactions → more fees... Theoretically, this can run on its own.

On-chain data status

Now that we've explained the mechanism, let's look at the on-chain data.

Snowball launched on December 18th, and in just four days, its market capitalization has surged from zero to $10 million, with a 24-hour trading volume exceeding $11 million.

For a on-chain meme on pump.fun, this achievement is already considered quite good for surviving in the current environment.

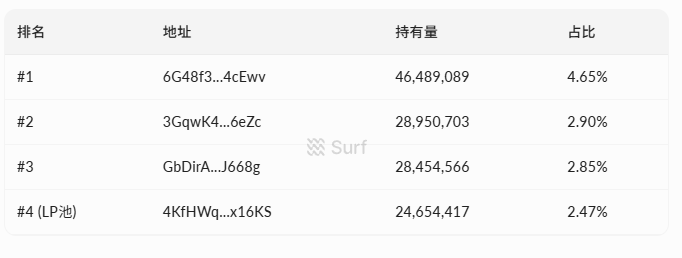

In terms of token distribution, there are currently 7,270 addresses holding tokens. The top ten holders together account for about 20% of the total supply, while the largest single holder accounts for 4.65%.

Data source: surf.ai

There was no single address holding two or three-tenths of the chips; the distribution was relatively dispersed.

In terms of trading data, there have been over 58,000 transactions since launch, including 33,000 buy orders and 24,000 sell orders. The total buy amount was $4.4 million, and the sell amount was $4.3 million, resulting in a net inflow of approximately $100,000. Buying and selling are basically balanced, with no one-sided selling pressure.

There's approximately $380,000 in the liquidity pool, half in tokens and half in SOL. For a market capitalization like this, the liquidity isn't very deep, and large orders entering or leaving the pool will still cause noticeable slippage.

Another noteworthy point is that Bybit Alpha announced the listing of the token less than 96 hours after its launch, which to some extent confirms the short-term hype.

Perpetual motion machines hit a cold market

After browsing around, it's clear that discussions about Snowball in the English-speaking community mainly focus on the mechanics themselves. Supporters' logic is quite straightforward:

This is the first Meme coin to lock 100% of creator fees into the protocol, preventing developers from running away with the money. It is at least structurally safer than other on-chain meme.

The developers are also aligning with this narrative. Developer wallets, market-making robot wallets, and transaction logs are all publicly available, emphasizing "on-chain verifiability."

@bschizojew labels himself as "on-chain schizophrenia, 4chan special forces, and a first-generation Meme coin veteran," a self-deprecating degen flavor that appeals to the crypto native community.

But the security of the mechanism and whether it can make money are two different things.

The snowball effect works only if there's a sufficient volume of transactions continuously generating fees to feed the bot into executing buybacks. The more transactions, the more ammunition the bot has, the stronger the buying pressure, the higher the price, attracting even more traders…

This is also the ideal state for any meme's so-called buyback flywheel to start spinning in a bull market.

The problem is that the flywheel needs external power to start.

What is the current environment of the crypto market? On-chain activity is sluggish, the overall popularity of Meme coin is declining, and there is already little capital willing to invest on-chain meme. In this context, if new buying doesn't keep up, trading volume shrinks, the fees that bots can collect will decrease, buyback efforts will weaken, price support will diminish, and trading willingness will further decline.

The flywheel can rotate in either the forward or reverse direction.

A more realistic problem is that while the mechanism addresses the risk of "developers running away with the money," Meme Coin faces far more risks than that.

If market manipulators dump shares, liquidity is insufficient, or the narrative is outdated, any one of these factors will have very limited effect on a 100% transaction fee buyback program.

Everyone's been burned before, and a veteran in the Chinese-speaking community summed it up quite well:

Have fun, but don't get carried away.

More than one snowball is rolling.

Snowball isn't the only project telling this automated market-making story.

Similarly, within the pump.fun ecosystem, a token called FIREBALL is doing something similar: automatic buybacks and burns, packaging it into a protocol that other tokens can integrate with. However, its market capitalization is much smaller than Snowball's.

This indicates that the market is currently reacting to the direction of "mechanism-based Meme coins".

Traditional methods like shill, price manipulation, and community hype are becoming increasingly difficult to attract funds. Using mechanism design to tell a story of "structural security" may be one of Meme Coin's recent strategies.

However, artificially creating a mechanism is not a new concept.

The case of OlympusDAO's (3,3) in 2021 is the most typical example. It used game theory to package the staking mechanism and told the story that "everyone can make money together if no one sells." At its peak, its market value soared to several billion US dollars. As we all know, it spiraled downward and lost more than 90%.

Even earlier, there was Safemoon's "tax on each transaction distributed to the holder" model, which was also an innovative narrative, but it was eventually sued by the SEC and its founders were accused of fraud.

Mechanisms can be great narrative hooks that can quickly gather funding and attention, but mechanisms themselves do not create value.

When external funds stop flowing in, even the most ingenious flywheel will stop turning.

Finally, let's clarify what this little golden dog is doing:

The Meme coin creator fee is transformed into an "automated market maker." The mechanism itself is not complicated, and the problem it solves is clear: it prevents developers from simply taking the money and running away.

Just because developers can't run away doesn't mean you can make money.

If you find this mechanism interesting after reading it and want to participate, remember this: it is first and foremost a Meme coin, and only secondly an experiment in a new mechanism.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush