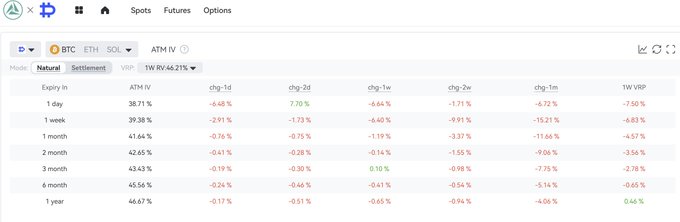

This week is the Christmas holiday, and US stock markets will be closed on Christmas Eve and Christmas Day. Institutional and individual investors in Europe and the US will likely stay away from the market, a situation that usually lasts until after New Year's Day. This Friday, the 26th, is the year-end settlement date, and currently, over 50% of total open interest in options is awaiting expiration. Most institutions are choosing to roll over their positions early. Since last week, implied volatility (IV) across major maturities has shown a significant decline, and the proportion of large-scale transactions has also increased. With the decrease in volatility, the Christmas holiday season, and the year-end settlement rollover, the combined effect of these three factors has resulted in a more than 5% decrease in implied volatility across major Bitcoin maturities over the past month, with short-to-medium term IV decreasing by over 10%, and ETH's IV decreasing even more. All of this data indicates relatively subdued market expectations, with market anticipation for low volatility in the remaining two weeks. As we predicted last month based on the above data, December is expected to be a low-volatility month, and we believe the next two weeks will also be low-volatility, with a high probability of a gradual decline.

This article is machine translated

Show original

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content