Really solid piece on feudal markets, which tells us how US policy protects asset prices over everything else.

But there's a missing piece on how does the US even pull this off without the economy collapsing?

Answer is dollar hegemony.

It's not just helping the system it IS the system. Here's how🧵

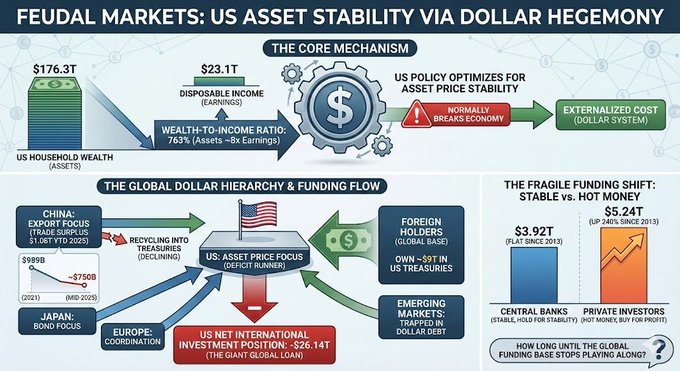

Right now, US household wealth is $176.3T while disposable income is $23.1T. That's a ratio of 763% meaning assets are worth nearly 8x what people actually earn. In any normal economy, that breaks. It doesn't here because the US exports the cost.

➢ The US runs deficits, foreigners fund it

➢ Foreign holders own ~$9T in US Treasuries

➢ The US Net international investment position is -$26.14T

That -$26T is basically a giant loan from the rest of the world to keep US asset prices up.

China ran a $1.08 trillion trade surplus in the first 11 months of 2025 but their Treasury holdings dropped to around ~$750 by mid 2025 (down from $989B in 2021 which is lowest levels in years).

They're making money selling to the world but stopped recycling it into US debt at the same rate. They're backing away.

US focuses on asset prices, Japan on bonds, China on exports, Europe on coordination but these aren't just different strategies, it's a hierarchy.

The US gets to focus on asset prices because the dollar forces everyone else into supporting roles...

1. China has to run surpluses to balance US deficits

2. Foreign holders have to buy Treasuries

3. Emerging markets get stuck in dollar debt

Remember who's buying US Treasuries has changed👇

‣ Central banks: $3.92T (flat since 2013)

‣ Private investors: $5.24T (up 240% since 2013)

Note that central banks buy for stability (they hold no matter what) while private investors buy for profit (they leave when returns don't make sense)

The system used to run on stable money. Now it runs on hot money. The money propping this up is getting less reliable.

The question I keep asking myself is how long before the global funding base stops playing along?

h/t to Nano Banana for infographics

twitter.com/YashasEdu/status/2...

There is no better way to articulate this than @arndxt_xo

Damn Nano is replacing designers ':V

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content