Tether's upward momentum slows as it fails to break 6.27% dominance.

Bitcoin and Ethereum are entering a short-term correction, falling from their all-time highs.

Increased volatility is expected ahead of BTC options expiration.

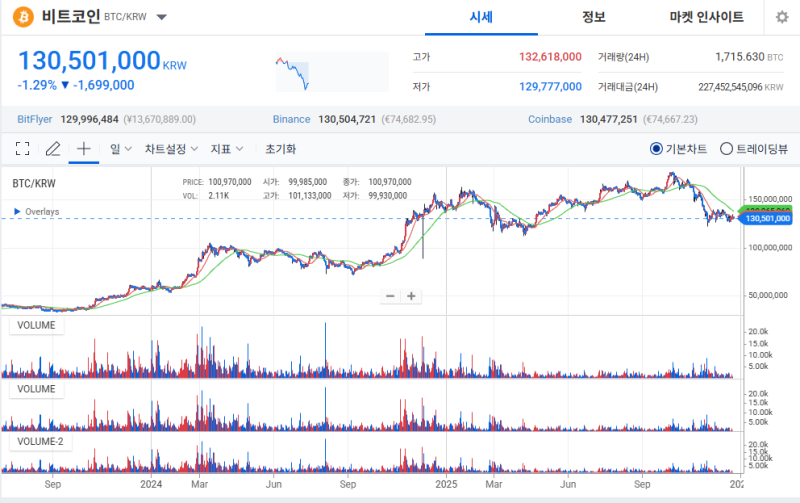

As the reduction in the proportion of stablecoins failed to continue and risk-averse sentiment weakened, Bitcoin fell approximately 3.44% from its previous high and is trading at around $87,500 (approximately 130,501,000 won) as of 4:00 PM today, continuing its short-term correction.

In particular, with the expiration of approximately $23.7 billion (approximately 31 trillion won) worth of Bitcoin options scheduled for this Friday and the low liquidity market trend, a sense of caution about increased volatility appears to be spreading across the market.

Bitcoin's market share remains high at 57.26% based on Sigbit, but despite the long position ratio reaching 68.05% in the futures market, prices are unable to break out of a downward trend, highlighting the burden of leveraged positions.

Ethereum (ETH) is trading at $2,965 (approximately 4,350,000 won) as of 4 p.m. today, down approximately 4% from its previous high. Short-term downward pressure persists as the price fails to recover the key support level of $3,000.

Other major altcoins also experienced adjustments due to the weakness of Bitcoin, but some coins attempted short-term technical rebounds, leading to a differentiated trend across coins.

◇ Bitcoin = As of 4:00 PM today, Bitcoin (BTC) was trading at 130,611,000 won on Upbit, with Bitcoin dominance at 57.31%. Based on Sigbit, the long-short ratio in the futures market was 68.05% long and 31.95% short, indicating a bullish bet, but the price remained in a downward trend.

◇ Rising Coins = As of 4:00 PM today, the coin with the largest price increase on Upbit was Groestlcoin (GRS), soaring 23.94% compared to the previous day. Groestlcoin is a project focused on electronic payments. It is the first coin to implement Segwit and Taproot, and supports the Lightning Network, enabling low fees and fast transactions.

◇ Fear and Greed Index = Alternative's Fear and Greed Index stood at 24 points, indicating "extreme fear." As the index remains at the fear level, investor sentiment remains conservative, and the potential for increased volatility remains.

◇ RSI = RSI 44.7, Stochastic 18.3, oversold signals are clear, so there is still room for a short-term technical rebound.

Lee Jeong-seop ljs842910@blockstreet.co.kr