According to Sina Finance on December 18, Standard Chartered Hong Kong and Ant International announced a collaboration to launch a multi-currency tokenized deposit service based on blockchain technology, supporting corporate clients to conduct 24/7 real-time fund transfers in Hong Kong dollars, RMB, and USD. This service is being implemented under the framework of the Hong Kong Monetary Authority's Distributed Ledger Technology Regulatory Incubator and the Ensemble project.

Both parties utilized Ant International's Whale platform to tokenize accounts, enabling 24/7 multi-currency settlement and real-time liquidity management. Mahesh Kini, Global Head of Cash Management at Standard Chartered Hong Kong, stated that this move marks a significant step towards the commercial application of blockchain technology in cash management, effectively improving corporate financial efficiency.

This is not a simple technological upgrade. It occurs at a delicate moment: the global banking industry has shifted from cautious observation to proactive embrace of blockchain, and Hong Kong is vying for its position as a global digital asset hub. Is this a perfect example of compliance, or a Trojan horse that could reshape the very foundations of banking?

When a century-old international bank joins forces with a fintech giant to "move" corporate deposits onto the blockchain, what the outside world sees is an efficiency revolution, but behind it lies a strategic alliance between traditional finance and digital native forces in the new era.

I. Hong Kong's Bet: Why Here, and Now?

In December 2025, Standard Chartered Hong Kong's announcement of its collaboration with Ant International quickly became a hot topic in the Asian fintech world. According to the joint statement, the service will be conducted under the framework of the Hong Kong Monetary Authority's Distributed Ledger Technology Regulatory Incubator and the Ensemble project, utilizing Ant International's Whale platform to achieve account tokenization.

The timing is far from accidental. In June 2025, Hong Kong just released the "Hong Kong Digital Asset Development Policy Declaration 2.0," which systematically proposed the four policy axes of "LEAP." The collaboration between Standard Chartered and Ant Group can be seen as a direct implementation of the axes of "legal and regulatory optimization" and "expansion of tokenized products."

The Hong Kong Monetary Authority (HKMA) reduced policy uncertainty for this innovation by establishing a clear regulatory sandbox. What Hong Kong is currently undertaking is a sophisticated institutional experiment: it attempts to demonstrate that cutting-edge technological applications can still emerge while strictly safeguarding financial security.

On a deeper level, this collaboration answers a core question for Hong Kong in the competition for digital finance: what are Hong Kong's differentiated advantages compared to Singapore and New York? The answer seems to be: leveraging its unique position under "one country, two systems" to act as a "conversion interface" connecting the traditional financial system and the digital financial world.

Ankur Kanwar, Head of Transaction Banking for Singapore and ASEAN at Standard Chartered Bank, offered a representative commentary, stating that tokenized deposits have the potential to improve settlement efficiency, enable new financial use cases, and deliver tangible benefits to customers. He believes this collaboration is an important step in supporting Singapore (and Hong Kong) to grow into leading digital financial centers.

II. The fundamental debate: Is tokenized deposits an evolution of banks or a replacement for stablecoins?

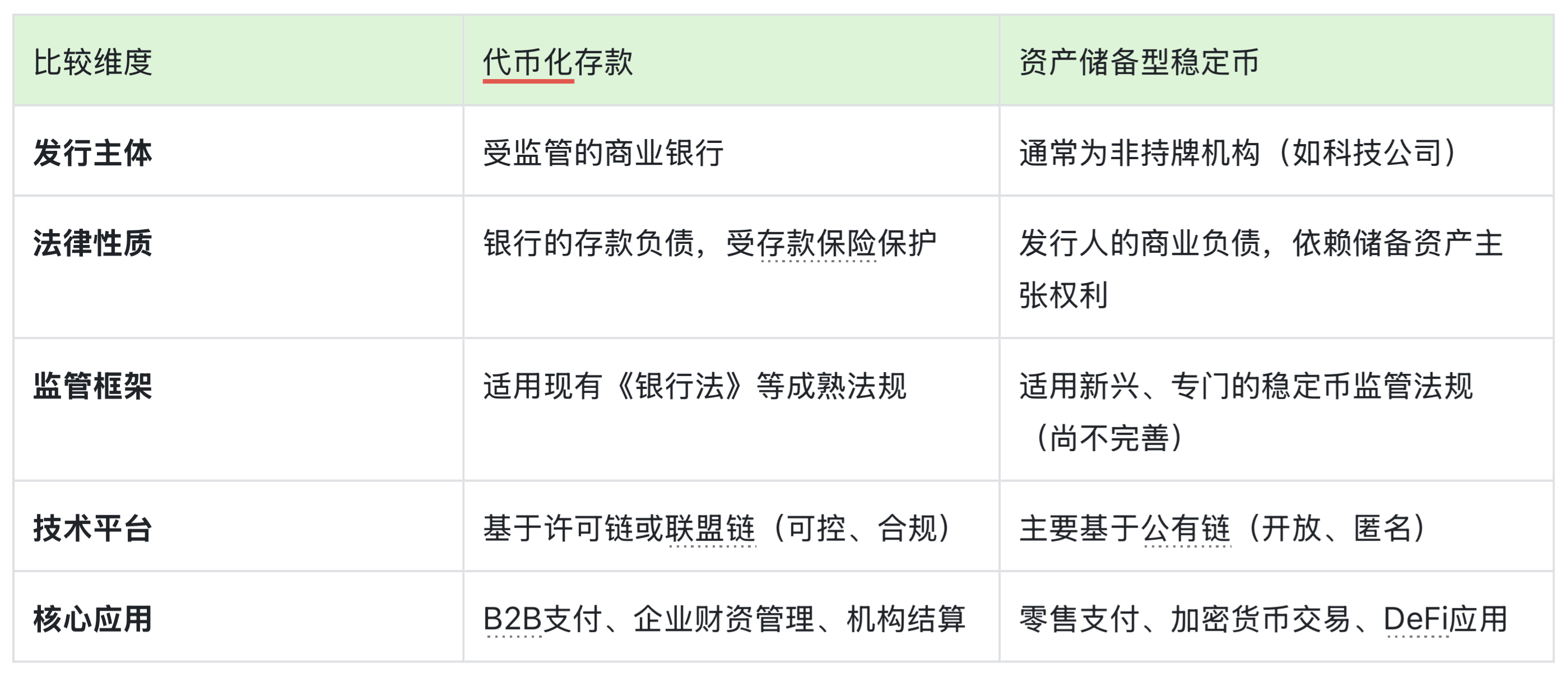

To understand the value of this collaboration, we must clarify a fundamental question: What exactly is tokenized deposit? How does it differ from existing stablecoins in the market? This is not only a technical issue, but also a watershed moment in terms of regulatory attitude and business logic.

The legal core of tokenized deposits has never changed—they remain liabilities of commercial banks to depositors, protected by the existing Banking Law system, and their value is anchored to the central bank's fiat currency system. Most stablecoins, on the other hand, are commercial liabilities issued by technology companies, and their value depends on the reserve assets held by the issuer.

This difference in legal nature determines their drastically different development paths and regulatory treatment. Tokenized deposits follow a compliance path of "regulation first," while stablecoins have experienced rapid, unregulated growth on public blockchains. A significant advancement in Hong Kong's "Policy Declaration 2.0" is the clear distinction between "virtual assets" and "digital assets," directing policy focus towards the on-chaining of assets to serve the real economy.

Standard Chartered and Ant Financial's choices have technically enabled "on-chain representation" of bank deposits, but in terms of legal and regulatory frameworks, they remain firmly rooted in the traditional financial system. This may suggest a mainstream direction for the future development of digital finance: innovation does not necessarily require disrupting the system; it can also be a digital enhancement of the existing system.

To clearly demonstrate the differences in their legal and technical characteristics, the following is a core comparison between tokenized deposits and asset-reserve stablecoins:

III. Business Game: Who is Dominating This Cooperation?

On the surface, this appears to be a win-win collaboration between banks and technology companies. However, a deeper analysis of their motivations reveals a subtle power struggle and their respective far-reaching strategic considerations.

For multinational banks like Standard Chartered, this is primarily a defensive counterattack. Digital banks and fintech companies are eroding their core payment and cash management businesses. Through tokenized deposits, Standard Chartered can offer 24/7 real-time service that traditional systems cannot provide, creating a technological moat to solidify its corporate client relationships.

Mahesh Kini, Global Head of Cash Management at Standard Chartered, reveals a core demand from banks: meeting the growing need for "timely" liquidity from businesses. Banks are transforming from simple custodians of funds into real-time dispatch centers for businesses' global cash flows.

Ant International's role is more complex. It is both a customer and a technology solution provider. Through the Whale platform, Ant is "productizing" its capabilities in blockchain and payments and offering them to traditional financial institutions. This marks a significant strategic shift: from building its own financial ecosystem to becoming an infrastructure service provider for the financial industry.

Kelvin Li, General Manager of Ant International Platform Technology, reflected this positioning in his statement: "Combining Standard Chartered's deep banking service capabilities with Ant's expertise in tokenization and global payments, the new solution can provide its global business with a smoother and more secure access to working capital."

In this collaboration, banks provided compliance credit and customer networks, while technology companies contributed technological capabilities and an innovative culture. Both sides are testing each other's boundaries and learning each other's language. Ultimately, this may give rise to a new type of hybrid financial services that is neither a traditional bank nor a technology company.

IV. Global Race: The Banking Industry's Collective "On-Chain" Migration

The collaboration between Standard Chartered and Ant Group is not an isolated case, but rather a striking example in the global wave of digital transformation in the banking industry. By 2025, mainstream financial institutions had collectively shifted their attitude towards blockchain technology from passive defense to proactive exploration.

Back in May 2025, HSBC launched the first tokenized deposit service offered by a local bank in Hong Kong and completed its first interbank transfer. Across the Atlantic, Bank of New York Mellon incorporated tokenized deposit testing into its core payment system modernization plan. JPMorgan Chase went even further, announcing it would offer dollar deposit tokens to institutional clients via a public blockchain.

Even in the relatively conservative UK, a pilot program for tokenized sterling deposits, initiated by the Financial Institute, has been launched and is planned to continue until mid-2026.

The driving forces behind this global wave are clear and urgent. According to industry analysis, the market size of blockchain financial products reached approximately $189 billion in the third quarter of 2025, showing significant year-on-year growth. More importantly, pilot data shows that tokenization technology can reduce cross-border payment processing time from days to minutes, while significantly reducing operational costs and the risk of funds being in transit.

In this global race, Hong Kong has secured a significant position in the Asian market through the partnership between Standard Chartered and Ant Group. However, the competition is far from over, with similar projects underway in Singapore, the UAE, and other locations. The real prize in this race may be the right to set standards for future global digital financial infrastructure.

V. Risks and Limitations: Overlooked Challenges

Amidst widespread optimism, the challenges and limitations of tokenized deposits are often underestimated. These challenges stem not only from technological aspects but also from structural adjustments to the financial system.

First, there is the impact on the existing cross-border payment system. Tokenized deposits bypass some traditional clearing intermediaries, potentially affecting the revenue model and regulatory transparency of the existing international payment system. Balancing efficiency improvements with system stability is a challenge that regulators must address.

Secondly, there are issues of technological barriers and fair competition. Developing and maintaining a blockchain system requires huge investments, which may further exacerbate the "Matthew effect" in the banking industry, causing resources to concentrate in the hands of leading banks, while small and medium-sized banks face the risk of being marginalized.

Thirdly, there's the issue of cross-chain interoperability and liquidity fragmentation. Different banks and regions may adopt different technical standards, creating new "on-chain silos." How to improve efficiency while avoiding the fragmentation of liquidity across multiple chains is a technical and governance challenge that needs to be addressed.

Finally, there's the issue of cross-border legal and regulatory coordination. Tokenized deposits inherently possess cross-border characteristics, but countries have vastly different regulatory attitudes towards digital currencies. A tokenized deposit product that is compliant in Hong Kong may face completely different legal interpretations in Singapore, the European Union, or the United States.

These challenges remind us that technological breakthroughs are just the beginning; institutional adaptation and social acceptance are a much longer process.

VI. Future Vision: Redefining Programmable Finance and Banking

This "ice-breaking" between Standard Chartered and Ant Group may foreshadow the evolution of the financial industry over the next decade. Its impact will extend far beyond improving corporate cash management efficiency; it could trigger a rethinking of the very nature of banking.

Corporate financial management is shifting from static record-keeping to dynamic programming. In the future, CFOs may no longer need to manually allocate funds, but instead, they can use smart contracts to preset rules, allowing funds to operate automatically like a program. Complex operations such as accounts receivable management, supply chain financing, and dynamic discounting may all achieve full automation.

The interaction between banks and customers may undergo a fundamental change. Traditional online banking interfaces may be replaced by a combination of "wallets + smart contracts." Banks' core competitiveness will shift from branch network distribution and customer manager relationships to their ability to optimize fund flows through algorithms and build cross-chain settlement networks.

This transformation will redefine the competitive landscape of the banking industry. The winners of the future may be those "dual-brain" institutions that can both maintain the stability of the financial system and flexibly embrace technological change—half prudent bankers, half agile technology experts.

Hong Kong plays a unique role in this transformation. It is neither entirely technology-driven like Silicon Valley, nor as conservative as traditional financial centers. Hong Kong's experiment may explore a middle ground: allowing technological innovation to be smoothly integrated into the existing system while ensuring financial security.

As the largest and oldest financial asset—bank deposits—begins to steadily migrate to the blockchain, the seeds of change have been sown. For businesses, this means unprecedented capital efficiency; for banks, it's a self-renewal process where stagnation means regression; and for Hong Kong, it's a crucial battle to solidify its position as an international financial center.

This experiment, which began in the Hong Kong Monetary Authority's sandbox, could ultimately change the way global capital flows. Those companies and financial institutions that first understand and adapt to this change will gain a competitive advantage in the era of programmable finance.

Some of the information comes from the following sources:

Standard Chartered and Ant Financial's "Whale" platform test tokenized deposits.

Standard Chartered tokenizes Ant International's Hong Kong dollar, RMB, and USD accounts through "Whale" platform.

• Tokenized Deposits: Compliant Innovation in Blockchain Technology

Author: Liang Yu; Editor: Zhao Yidan