The holidays are upon us and generic gift cards won’t cut it.

If you’re shopping for someone who’s crypto-curious or already deep in the space, this list highlights five simple ways to gift crypto.

These gifts are easy to give, easy to understand, and designed to last across multiple cycles without reading a white paper.

Here’s my top five for the year:

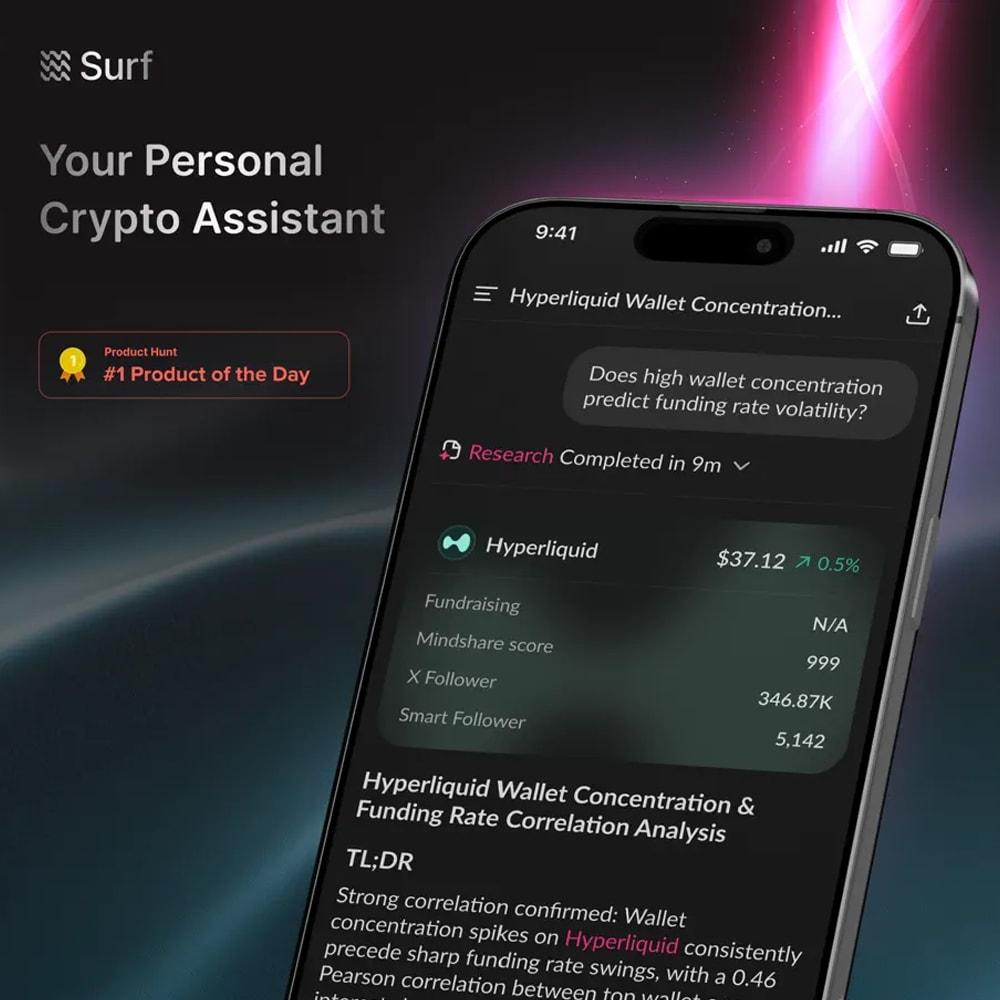

1. AskSurf.ai.

Price: Range of Pricing Plans

Not just a gift. This is an all-year edge. AskSurf.ai rapidly delivers AI crypto research, on-chain insights, sentiment, and unlimited Q&A. Traders, analysts, and creators love it, so this is a gift they’ll use while remembering you monthly.

2. Ledger Nano S Plus: Entry-Level Self-Custody Essential

Price: $59 USD

If someone owns crypto without a hardware wallet, this is the gift to give. Ledger Nano S Plus secures 5,500+ assets across major chains and is the simplest way to say, “I care about your security.”

3. Metal Seed Phrase Backup (Fireproof)

Price: Anywhere from $6.99 to $400 (with a 10K gold beauty for $8,000)

Not the most exciting gift—but essential. A metal seed phrase backup protects recovery phrases from fire, water, and disasters. Most crypto holders don’t have one. That’s why it lands. Gifting a very special person? Pair it with a hardware wallet.

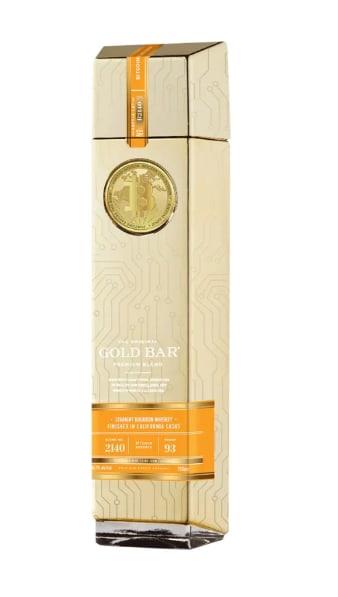

4. Gold Bar Bitcoin Reserve Bourbon Whiskey Limited Edition 750mL

Price: $109.99

This one’s for crypto party favorites. A straight-bourbon blend aged five to fourteen years, it’s limited to 21,000 bottles. A metal Bitcoin coin embedded inside nods to the 21M supply. 21+ friends only.

5. One Shot Miner PRO (2025 Edition): Bitcoin Mining Hobby Device

Price: $59.99

This compact, plug-and-play miner gives you a shot at Bitcoin rewards every ten minutes. It runs 24/7 at low power, making it a fun, hands-on way for hobbyists to join Bitcoin mining.

Like these recommendations? Subscribe to the newsletter.

As we kick off 2026, here are the critical developments I’m tracking that may shape the industry:

Business

Bitmine Accumulates 4.066M ETH and $13.2B in Crypto

This further strengthens Bitmine’s standing as one of the biggest ETH treasuries as it prepares to launch the MAVAN staking network.

Acting CFTC Chair Caroline Pham to Join MoonPay

Pham is leaving as her successor, Michael Selig, gets sworn into the position as CFTC Chair. Sworn in the acting position in January, Pham disclosed her plans to return to the private sector in May.

South Korean Card Giant Completes Stablecoin Payments Pilot for Foreigners

Payment processor BC Card has wrapped up their pilot program that will allow foreign users to pay local merchants via stablecoins.

Regulation

Michael Selig Sworn In as 16th CFTC Chairman

Sworn in on December 22, Selig brings in-depth public and private sector experience across multiple industries, including agriculture, energy, financial, and digital assets.

Arizona Advances Bill To Exempt Bitcoin, Crypto From Property Taxes

Besides exempting digital assets from property taxes, SB 1044 would limit state and local taxes on blockchain activities. This would require passage of a constitutional amendment held in the next election to become law.

Russia Moves to Legalize Domestic Crypto Deals for Retail Buyers

The country’s central bank formulated a regulatory framework that would allow qualified investors and retail investors to buy crypto. Non-qualified investors have the potential of buying up to 300,000 rubles annually of the most liquid cryptocurrencies.

Hong Kong Plans Crypto, Infrastructure Rules for Insurers

The Hong Kong Insurance Authority is recommending a capital framework for crypto and infrastructure that would redirect funds to government-prioritized sectors.

Ghana Legalizes Bitcoin and Crypto Trading Under New Legal Framework

After years of debate, Ghana’s parliament passed the 2025 Virtual Asset Service Providers Bill: a framework for licensing, supervising, and regulating crypto-related businesses.

New Products and Deals

JPMorgan Is Exploring Crypto Trading for Institutional Clients

In response to increased interest, JPMorgan, Chase & Co. is mulling over crypto trading services to institutional clients. The financial institution is currently assessing what services would be most feasible.

Coinbase Bets on Prediction Markets With Clearing Company Acquisition

Shortly after providing access to prediction markets in their current trading interface, Coinbase acquired The Clearing Company to accelerate their strategic plan in this area.

Fiserv to Implement QR Crypto Payments in Argentina

This Milwaukee-based company will leverage its Clover platform to allow customers to pay in crypto and, in exchange, merchants will receive Argentinian pesos.

This Week at Pantera

Pantera Capital Outlook: Consolidating Crypto Gains Under the Trump Administration

Although the shift in the crypto policy environment is real, multiple regulatory and legislative developments still merit close observation as we exit 2025 and enter 2026. Pantera identifies key areas.

The Year of Structural Progress

Pantera Chief Legal Officer Katrina Paglia delves further into structural developments in 2025, providing a comprehensive update on crypto regulation and policy.

Crypto for Advisors: Predictions for 2026

Pantera Capital’s Paul Veradittakit shares his 2026 crypto predictions: RWA tokenization, AI security advances, a big IPO wave, and the shift to institutional adoption.

Important Disclosures – This blog post is made for informational and educational purposes only. This blog post solely reflects the opinion of Paul Veradittakit, and does not reflect Pantera’s opinions. It does not contain all information pertinent to an investment decision. Nothing in this blog post constitutes an investment recommendation or an offer of investment advisory services. This blog post cannot be relied upon in making an investment decision. Nothing contained herein constitutes an offer to sell, or a solicitation to buy, any securities. This blog post contains information believed to be reliable, and has been obtained from sources believed to be reliable, but Pantera makes no representation or warranty (express or implied) of any nature, nor accepts any responsibility or liability of any kind, with respect to the fairness, accuracy, completeness, or reasonableness of the information or opinions contained herein. Forward-looking statements (including predictions) should not be relied upon. There is no guarantee that investments in any instrument or type of instrument described herein will be profitable – all investments carry the inherent risk of total loss. Analyses and opinions contained herein (including market commentary, statements or forecasts) reflect the author’s judgment as of the date this blog post was published, and may contain elements of subjectivity (including certain assumptions) or be based on incomplete information. There is no duty or obligation to update the contents of this blog post. This blog post is not intended to provide, and should not be relied on for accounting, legal, or tax advice, or investment recommendations. Pantera and its principals have made investments in some of the instruments discussed in this communication and may in the future make additional investments or trading decisions in connection with such instruments without further notice.