Approximately $184.11 million worth of leveraged positions were liquidated in the cryptocurrency market over the past 24 hours.

According to currently compiled data, long positions accounted for 41.1% of the total liquidated positions, at $75.59 million, while short positions accounted for 58.9%, at $108.52 million.

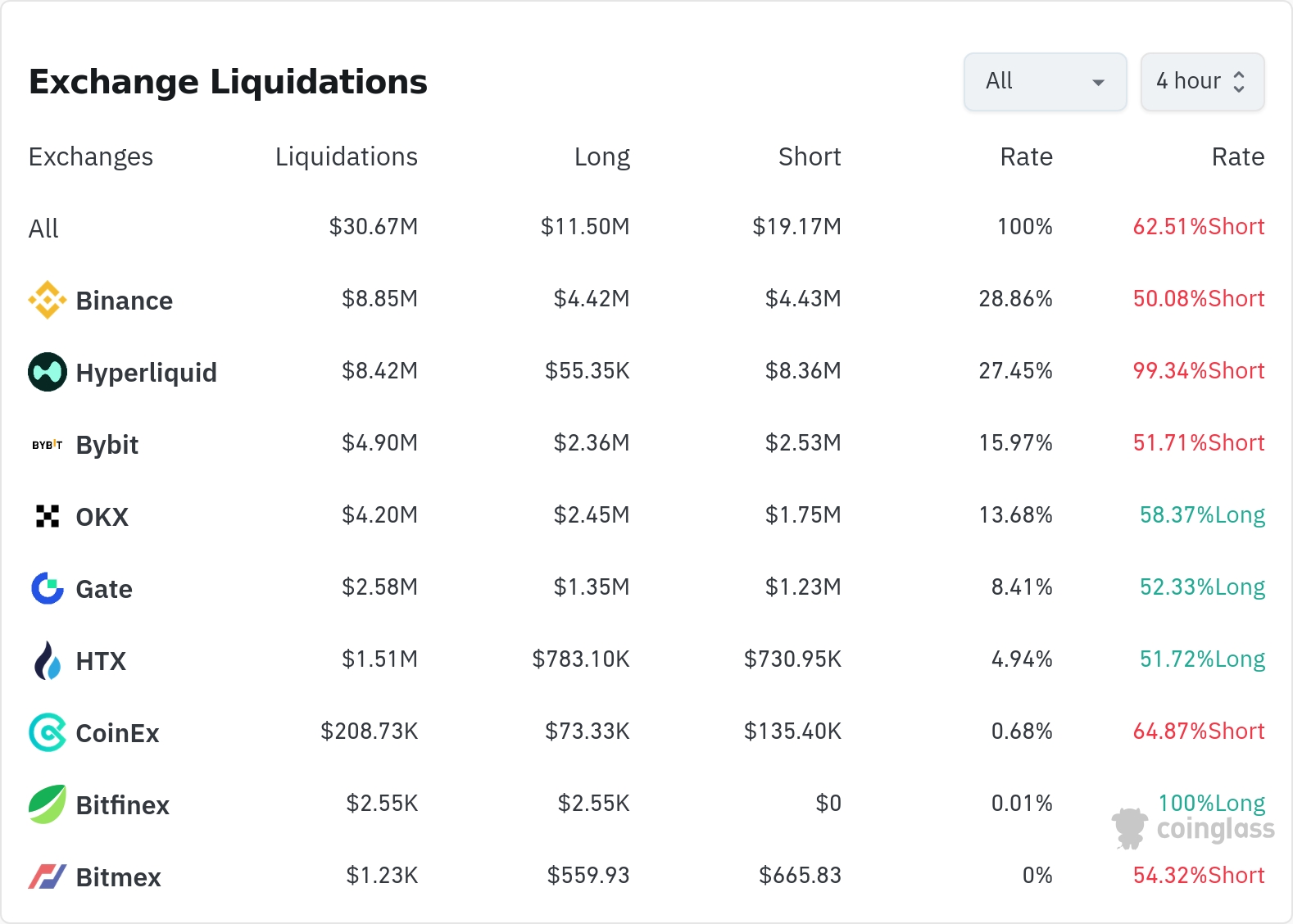

Binance saw the most liquidations over the past four hours, with a total of $8.85 million (28.86% of the total). Short positions accounted for $4.43 million, or approximately 50.08% of this liquidation.

The second most liquidated exchange was Hyperliquid, with $8.42 million (27.45%) of positions liquidated, of which $8.36 million (99.34%) were short positions.

Bybit saw liquidations of approximately $4.9 million (15.98%), with a short position ratio of 51.71%.

OKX saw liquidations of approximately $4.2 million (13.70%), with a higher long position liquidation ratio of 58.37%.

Notably, on Bitfinex, only 100% long positions were liquidated, although the liquidation size was small ($2,550).

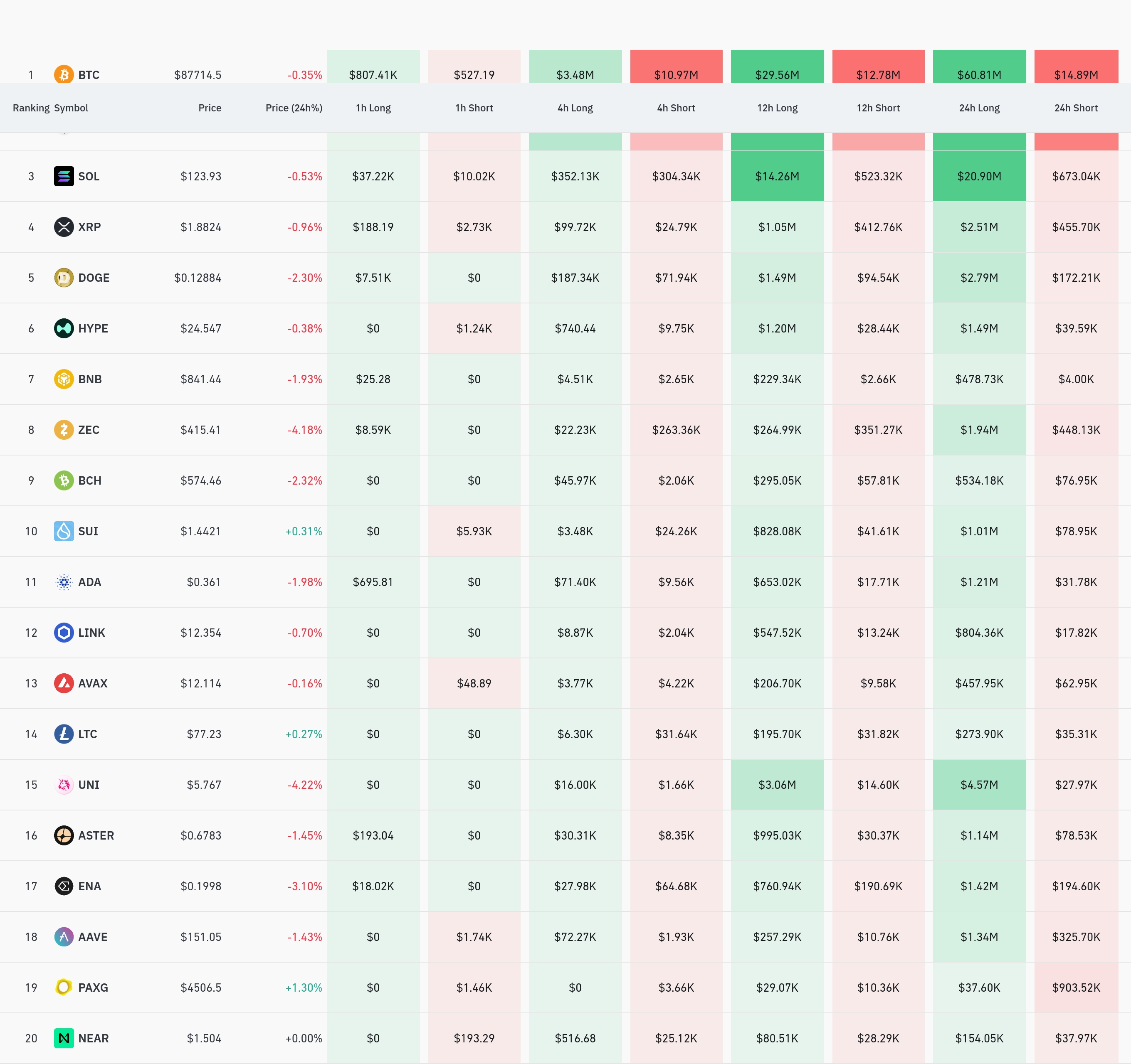

By coin, Bitcoin (BTC) positions saw the most liquidations. Approximately $75.7 million worth of Bitcoin positions were liquidated over the past 24 hours, with $3.48 million of long positions and $10.97 million of short positions liquidated over the past four hours. This was driven by Bitcoin's price fluctuations, currently around $87,714.5.

Ethereum (ETH) saw approximately $62.69 million worth of positions liquidated over the past 24 hours.

Solana (SOL) saw approximately $21.59 million liquidated in the last 24 hours at $123.93, with $352,000 in long positions and $304,000 in short positions liquidated over the last 4 hours.

Notably, FARTCOIN appeared on the list of top liquidated coins with a liquidation amount of approximately $6.88 million.

Dogecoin (DOGE) saw liquidations of $187,000 worth of long positions and $72,000 worth of short positions at $0.12884 in the past 4 hours.

ZEC (Zcash) saw a significant amount of short liquidations ($263,000) at the price of $415.41, while long liquidations were relatively small at $22,000.

It's noteworthy that the cryptocurrency market has seen an unusually high rate of short position liquidation. In particular, the fact that 99.34% of short positions were liquidated on Hyperliquid exchanges suggests recent upward pressure in the market.

Article Summary by TokenPost.ai

🔎 Market Interpretation

Over the past 24 hours, approximately $184.11 million worth of positions were liquidated. Notably, short position liquidations (58.9%) outnumbered long position liquidations (41.1%). In particular, the fact that 99.34% of Hyperliquid positions were short liquidations indicates upward pressure on the market. Liquidations were highest in BTC, ETH, and SOL, in that order, while ZEC saw nearly 12 times more short positions liquidated than long positions liquidated.

💡 Strategy Points

The market is currently experiencing a short-term squeeze, so it's important to monitor the short-term upward trend. In particular, the liquidation of BTC short positions has been more than three times that of long positions, suggesting the potential for further upward movement. However, liquidation patterns vary across exchanges, suggesting divergent positioning among market participants.

📘 Glossary

- Liquidation: A phenomenon in which a position is forcibly closed when the collateral value falls below the maintenance margin in a leveraged transaction.

- Short Squeeze: A phenomenon in which additional price increases occur as short position holders liquidate their positions to prevent losses as the price rises.

- Long Position: A position purchased in anticipation of an asset price rise.

- Short Position: A position sold in anticipation of a decline in asset price.

TokenPost AI Notes

This article was summarized using a TokenPost.ai-based language model. Key points in the text may be omitted or inaccurate.

Get real-time news... Go to TokenPost Telegram

Copyright © TokenPost. Unauthorized reproduction and redistribution prohibited.