XRP price is quietly falling into a rather uncomfortable zone. It has dropped approximately 9% in the last 30 days, the upward momentum seems to have stalled, and the positive discussions about the Token on social media have noticeably turned more negative. At first glance, this seems like a bad sign. However, in reality, XRP often experiences strong surges when community enthusiasm fades.

This time, the factor contributing to the pessimistic sentiment could also be the very condition that opens up the next price increase opportunity, possibly led by a large group of holder .

Problem: Positive sentiment collapses as short-term investors withdraw.

The core issue right now isn't the price. It's market sentiment.

Positive sentiment towards XRP has fallen to its lowest level in three months, a sharp decline after a recent rally. This index tracks how positively XRP is mentioned on social media platforms. The sharp drop suggests crowd fatigue rather than panic buying.

History shows that this point is very important.

In mid-October 2023, a sharp drop in sentiment occurred before XRP surged approximately 15% in the following days. In early November 2023, as positive sentiment hit a local Dip , the price rebounded by 17% in just one week. The same scenario repeated itself at the end of November 2023, with the price rising around 14% after sentiment hit its lowest point.

Positive mindset plummets: Santiment

Positive mindset plummets: SantimentWant more Token analysis like this? Sign up for editor Harsh Notariya's daily Crypto newsletter here .

This time, the level of negative sentiment decreased even more significantly than in previous instances.

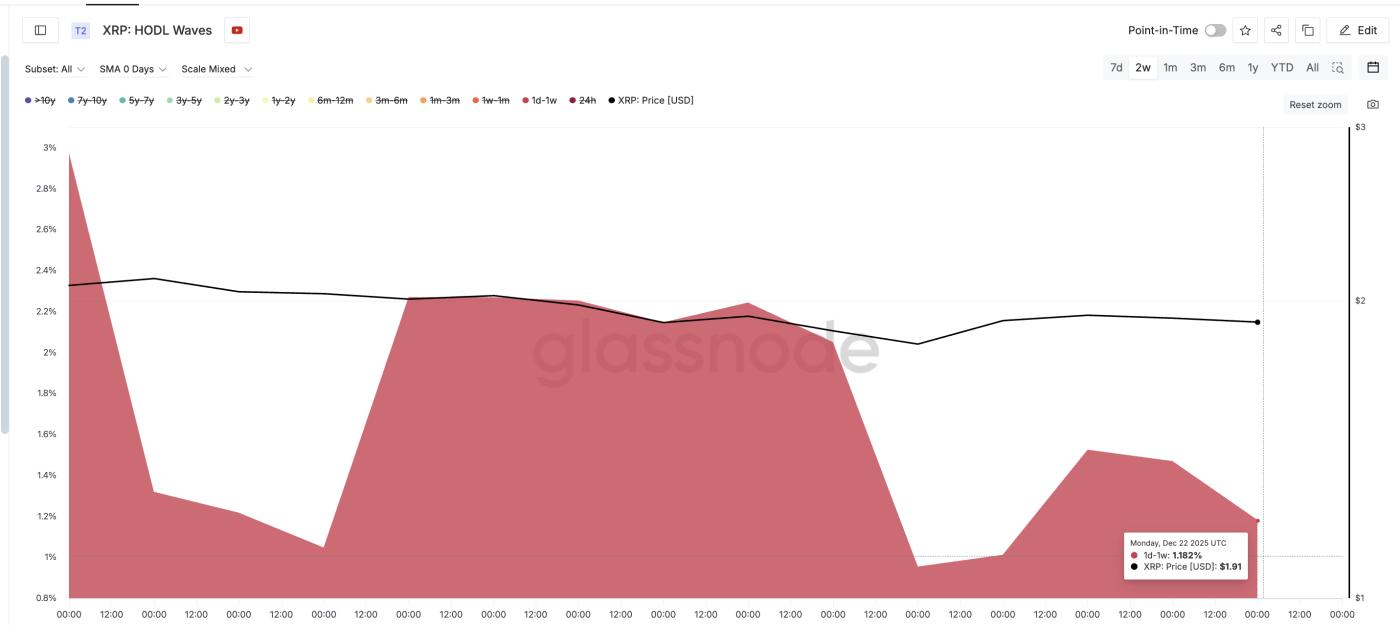

This drop in sentiment may stem from short-term holder . Based on the HODL Waves index, which tracks coin holding duration, it can be seen that wallets holding XRP for one day to one week have significantly reduced their holdings. At the beginning of this month, this group accounted for approximately 2.97% of the total supply. This figure is now only about 1.18%, a decrease of over 60%.

Short-term holder are experiencing negative sentiment: Glassnode

Short-term holder are experiencing negative sentiment: GlassnodeTo put it simply, the rapid flow of money, possibly from retail investors, has eroded interest in XRP , leading them to choose to exit. This is the reason for the gloomy sentiment surrounding XRP . The following section will explain why this isn't actually such a bad thing.

Solution: Long-term investors are selling less, not more.

This is where the story takes a different turn.

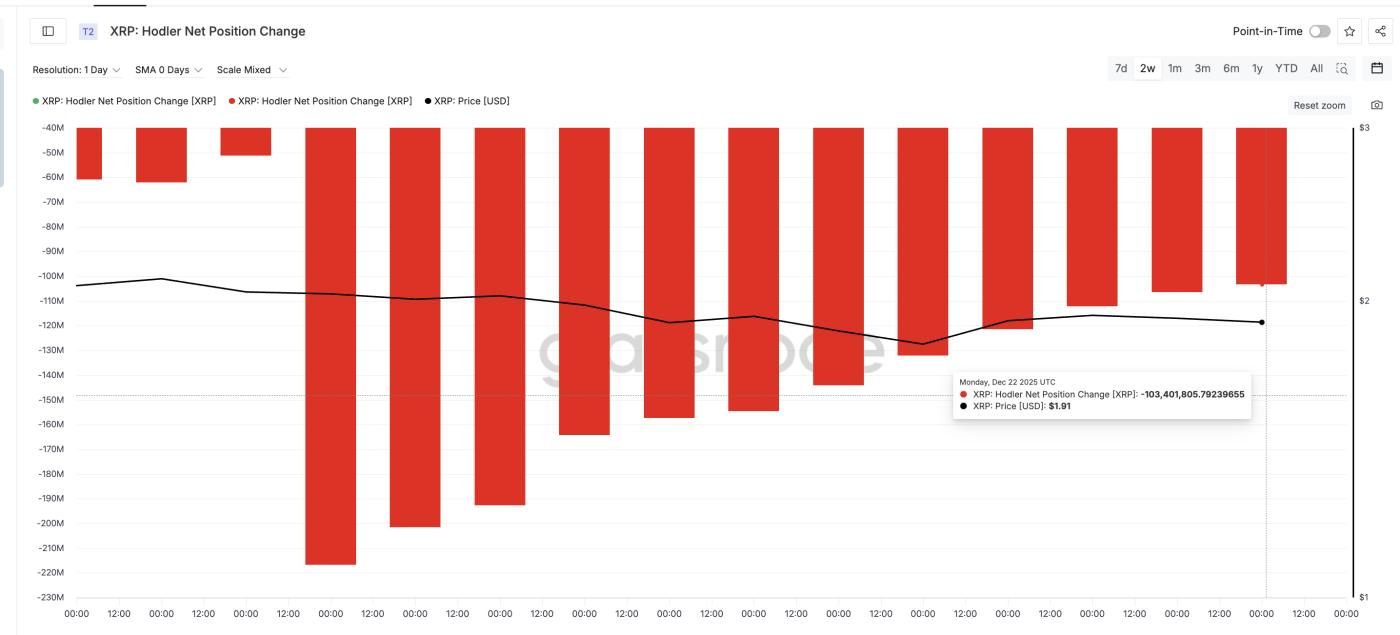

While short-term holder are exiting, long-term holders are doing the opposite. Data tracking the net position change of long-term holder shows that selling pressure from these wallets has decreased significantly.

Earlier this month, long-term holder were selling approximately 216 million XRP per day . Currently, that number has gradually decreased to around 103 million XRP , meaning selling activity has dropped by more than 50%.

Long-term XRP holder do the opposite: Glassnode

Long-term XRP holder do the opposite: GlassnodeThis makes sense because long-term holder often act earlier than the market majority. When they are slow to sell during periods of weak sentiment, it's often a sign of quietly accumulating holdings or a patient strategy.

The problem with XRP right now is the indifference from the crowd. But the good news is that experienced holder are no longer selling, preventing the supply from being driven by "herd mentality selling."

XRP prices will determine whether the solution is effective.

If this psychological scenario continues to repeat itself, the XRP price will quickly reflect that.

If there is a bounce, the price could immediately move towards the next resistance zone at $2.03, representing an increase of approximately 8% from the current level. If it breaks through this zone, the price could gain further momentum towards higher resistance levels such as $2.09 and $2.17, where the price has previously stalled.

Conversely, XRP needs to hold the crucial support level at $1.77. If this support is breached, the bullish scenario based on sentiment will no longer hold true and could signal that long-term holder are no longer supporting the supply.

XRP Price Analysis: TradingView

XRP Price Analysis: TradingViewAt this time, XRP 's current positive structure remains intact.

The biggest problem for XRP right now is that the positive sentiment has disappeared. However, history shows that whenever optimism fades, weak retail investors are the first to leave the market, and long-term, stable investors will enter. If this scenario repeats, the very problem holding XRP price back today could become the solution that propels XRP price forward in the next phase.