Market Update aims to provide readers with the latest market reports and key digital asset data.

Article author: 0xArthur

Article source: ME News

The crypto market as a whole continued its downward trend, with most stocks falling between 2% and 9% in the past 24 hours. Specifically, the NFT sector fell 9.46%, with Pudgy Penguins (PENGU) dropping 4.66%. Audiera (BEAT), which had previously seen significant gains, experienced a correction, falling 41.28%, while ApenFT (NFT) still rose 3.66%. Additionally, Bitcoin (BTC) fell 1.12%, dropping below $88,000; Ethereum (ETH) fell 2.01%, remaining around $3,000.

In other sectors, the PayFi sector fell 1.64% in the last 24 hours, with Telcoin (TEL) rising 2.23% within the sector; the AI sector fell 1.68%, with OriginTrail (TRAC) showing relative resilience, rising 3.89%; the CeFi sector fell 1.78%, with Canton Network (CC) surging 6.14% intraday; the Layer 1 sector fell 1.86%, with Zcash (ZEC) falling 3.16%; the DeFi sector fell 2.22%, with Uniswap (UNI) falling 4.14%; the Meme sector fell 2.25%, with PIPPIN (PIPPIN) bucking the trend and rising 31.03%; and the Layer 2 sector fell 2.30%, with ImmutableX (IMX) rising 2.63%.

The crypto sector indices, which reflect the historical performance of the sector, show that the ssiAI, ssiLayer2, and ssiDeFi indices fell by 3.13%, 2.66%, and 2.38%, respectively.

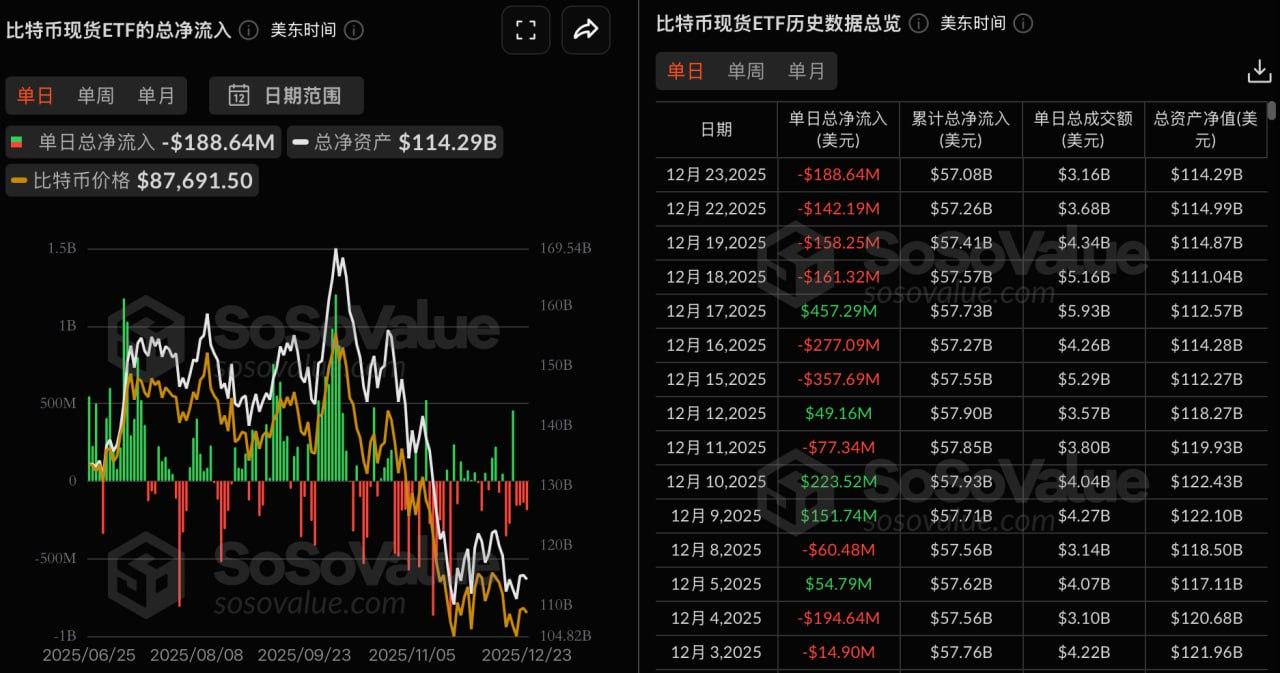

ETF Directional Data

According to SoSoValue data, Bitcoin spot ETFs saw a total net outflow of $189 million yesterday (December 23, Eastern Time).

The Bitcoin spot ETF with the largest single-day net outflow yesterday was BlackRock ETF IBIT, with a net outflow of $157 million. IBIT's total historical net inflow has reached $62.34 billion.

The second largest outflow was from the Fidelity ETF FBTC, which saw a net outflow of $15.2979 million in a single day. The total historical net inflow for FBTC is currently $12.189 billion.

As of press time, the total net asset value of Bitcoin spot ETFs was $114.289 billion, with an ETF net asset ratio (market capitalization as a percentage of Bitcoin's total market capitalization) of 6.53%, and a historical cumulative net inflow of $57.076 billion.

According to SoSoValue data, the Ethereum spot ETF saw a total net outflow of $95.5286 million yesterday (December 23, Eastern Time).

The Ethereum spot ETF with the largest single-day net outflow yesterday was the Grayscale Ethereum Trust ETF (ETHE), with a net outflow of $50.8882 million. The total historical net outflow for ETHE is currently $5.049 billion.

The second largest outflow was from the BlackRock ETF ETHA, which saw a net outflow of $25.0443 million in a single day. ETHA's total historical net inflow has reached $12.647 billion.

As of press time, the Ethereum spot ETF has a total net asset value of $18.021 billion, with an ETF net asset ratio (market capitalization as a percentage of Ethereum's total market capitalization) of 5.03%, and a historical cumulative net inflow of $12.433 billion.

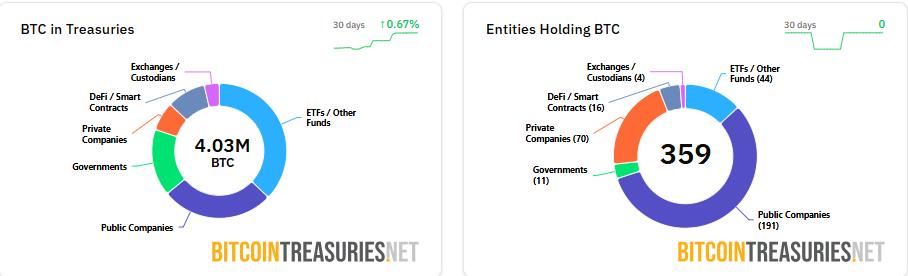

BTC Directional Data

According to data from BitcoinTreasuries, 191 listed companies currently hold a total of 1,087,794 Bitcoins, accounting for 5.18% of the total Bitcoin supply. Among them, Strategy holds the largest amount, with 671,268 Bitcoins, accounting for 61.7% of the holdings of listed companies.

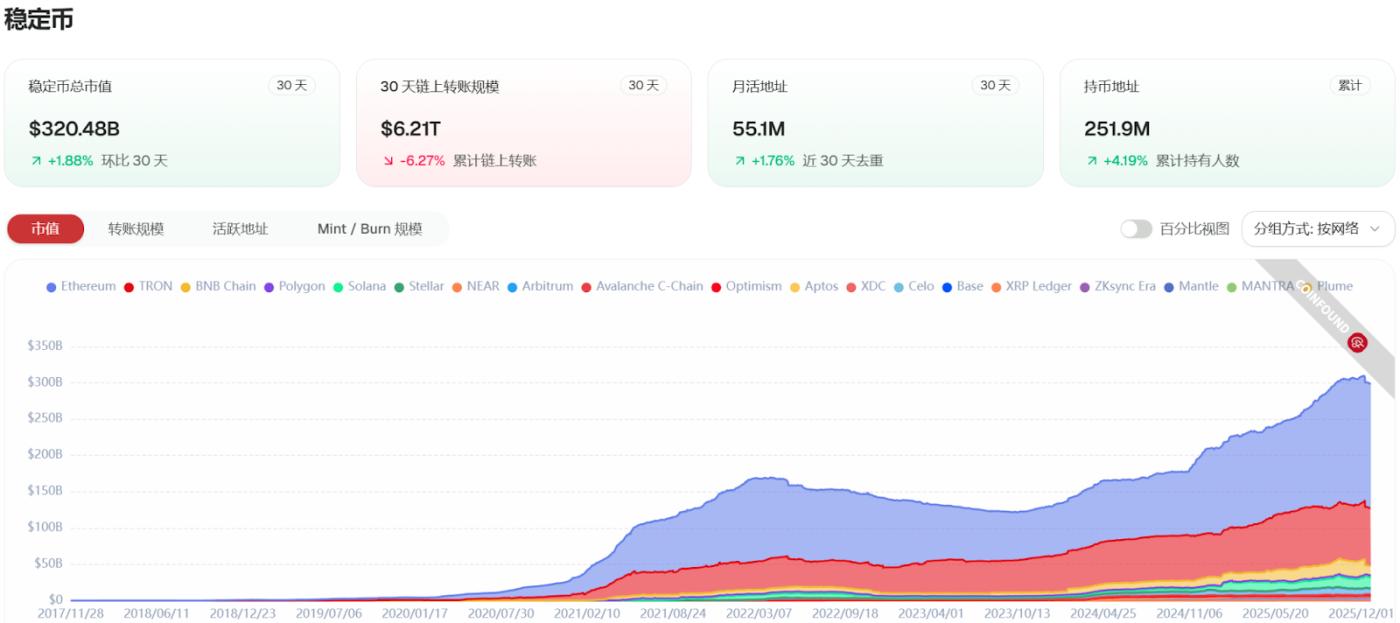

Stablecoin data

According to CoinFound data:

USDT market capitalization: US$199 billion

- USDC market capitalization: $76.81 billion

- USDS market capitalization: $11.23 billion

- USDeS market capitalization: $6.45 billion

- PYUSD market capitalization: $3.87 billion

- USD1 market capitalization: $2.77 billion

Market Dynamics

- Circle: The circulating supply of the Euro stablecoin EURC has exceeded 300 million, and demand is growing.

Ethereum stablecoin trading is trending towards institutionalization, with P2B showing the fastest growth at 167%.

South Korean payment giant BC Card completes stablecoin payment pilot program.

Bitget Wallet, in partnership with Alchemy Pay, has launched a zero-fee USDC fiat currency deposit service in non-mainland China regions such as Hong Kong and Taiwan.

Bloomberg: Russia plans to allow retail investors to participate in domestic cryptocurrency trading.

Binance announced the listing of Kyrgyzstan's stablecoin KGST (1:1 pegged to KGS).

Summarize:

Stablecoins performed steadily, highlighting their role as a safe-haven asset in the market, with ample liquidity. However, trading volume and on-chain transaction activity declined slightly due to the approaching Christmas season.

RWA Directional Data

According to CoinFound data:

Commodity market capitalization: $3.78 billion (7D +1.47%)

- Government bond market value: $1.19 billion (7D -1.17%)

- Institutional fund market capitalization: $2.96 billion (7D +4.53%)

- Private lending market capitalization: $34.74 billion (7D +24.32%)

- Market value of US Treasury bonds: $9 billion (7-day +0.35%)

- Corporate bond market value: $260 million (7D -0.34%)

X-Stock Market Cap: $620 million (7D -3.08%)

Market Dynamics:

- ETHZilla, an ETH treasury stock, announced the sale of 24,200 ETH to pay off debts and will shift its focus to RWA tokenization business. This move marks a significant shift in the crypto space.

The Central Bank of Russia plans to open up cryptocurrency investment and proposes new rules to differentiate investor levels.

Ghana officially legalizes cryptocurrency trading and plans to explore gold-backed stablecoins.

- By 2025, USDC's market capitalization will increase by 75%, EURC's market capitalization will exceed 300 million euros, and USYC's assets under management will increase to US$1.54 billion.

Keith Grossman, president of crypto payments company MoonPay, said that tokenization will transform the financial industry faster than digital technology has impacted traditional media.

Summarize:

- The RWA market was generally calm, with no major news events or price changes. Amid a slight pullback in the broader crypto market, the RWA market capitalization rose slightly from yesterday's $46.18 billion. The further integration of RWA with stablecoins, AI, cross-chain interoperability, and other areas lays the foundation for further utility-driven expansion in 2026.