If you were holding OP over the past year, you’re down 85% If you were holding ARB over the past year, you’re down 76% If you were holding AAVE over the year, you’re down 60% If you were holding BRKB over the past year, you’re up 10% If you were holding TSLA over the past year, you’re up 12% If you were holding SP500 over the past year, you’re up 15% A small sample size, and a better sleuth than I could give a full summary of crypto alts performance at large, but the point is that alts have at large failed crypto natives over the past year+, who 1) made money in the previous cycle and want to diversify and 2) have fallen out of favor with the countless altcoins launching with no consumer protections and seemingly unlimited rugs. This is why stablecoins, equity perps, commodity perps, and spot equities have become the narrative as we end 2025 and enter 2026

Ryan Scott (Horse)

@TheFlowHorse

12-17

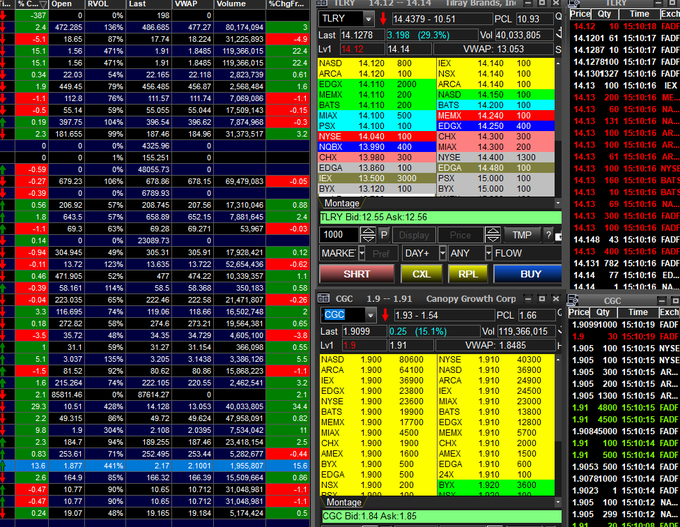

Before I ever came to crypto, I traded single names, then commodity futures. I even tried my hand at managing OPM, which was the childhood dream after watching the movie Wall Street 1000 times by age 13, except the reality hit pretty fast, and it just wasn’t my lane. So yeah, I

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content