Bitcoin (BTC) price fell nearly 1% again today, continuing its downward trend this month with a total drop of 3.6% so far. However, two key indicators have emerged suggesting that selling pressure is gradually easing.

Nevertheless, some analysts warn that weak market demand makes a sharp price increase in the short term quite unlikely.

Key indicators suggest selling pressure on Bitcoin is decreasing.

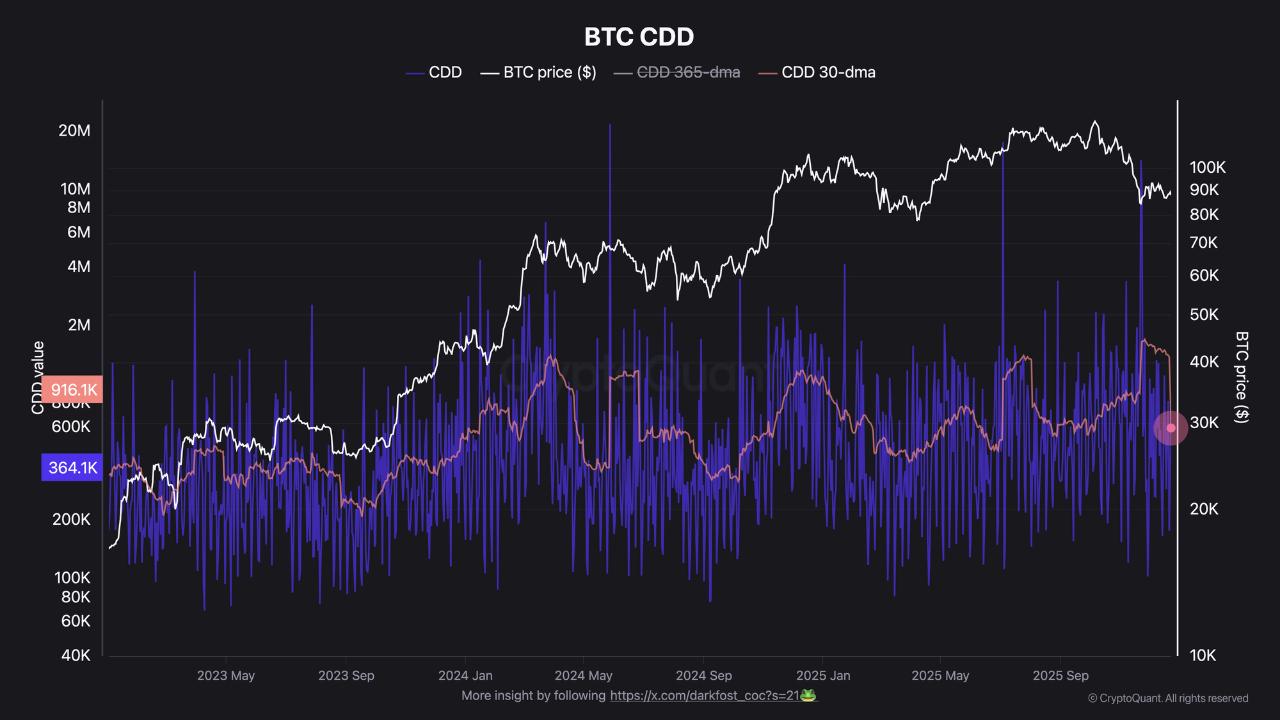

According to data from CryptoQuant, Bitcoin's Coin Days Destroyed (CDD) index has dropped sharply. To put it simply, CDD is an indicator that measures the amount of time Bitcoin remains untransferred until it is traded.

When older coins are moved out, many Coin Days will be destroyed, often indicating that long-term holder are distributing their coins. High CDD figures usually reflect selling pressure from these investors, while low figures suggest that long-term holder are continuing to hold.

“It’s been over a month since the massive Bitcoin transfer from Coinbase. So, the Medium data is gradually returning to normal. If XEM at Coin Days Destroyed (CDD), it’s easy to see that the index dropped sharply after that event. Notably, the current drop is much lower than the previous surge,” Darkfost Chia .

Bitcoin's CDD index has fallen sharply. Source: CryptoQuant

Bitcoin's CDD index has fallen sharply. Source: CryptoQuantAnalysts believe this indicates a cooling of activity among long-term holder , with less Bitcoin being transferred between older wallets than before. Darkfost also suggests this development could significantly impact the overall market.

"The drop in CDD is a positive sign, as long-term holder remain the group most likely to exert selling pressure due to their majority holding of the total coin supply."

Analysts also emphasized that the fact that long-term holder are selling less is helping to ease pressure on the market, and if this trend continues, it is very likely that the market will form a new Dip in the future.

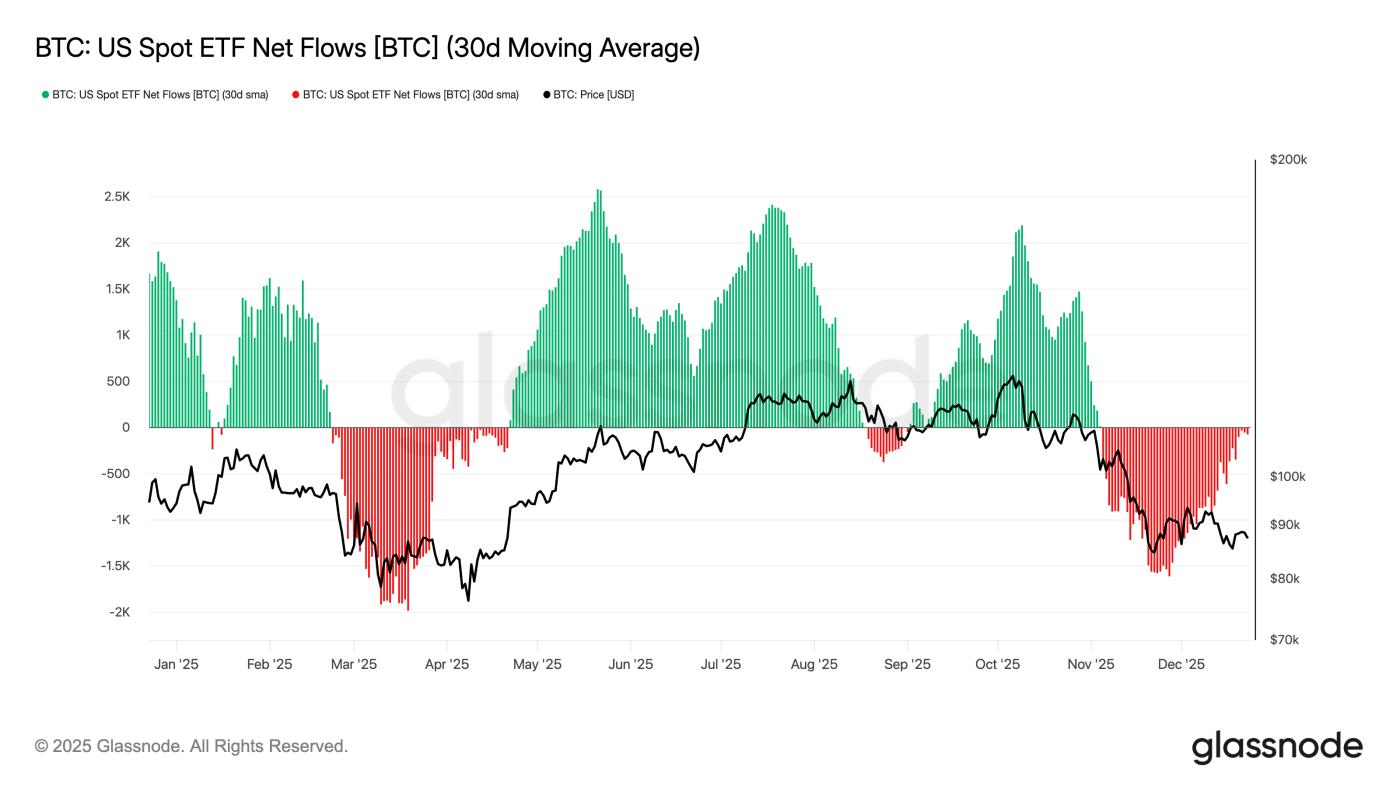

Another indicator comes from the Capital of Bitcoin ETFs. Since the beginning of November, the 30-day moving Medium (30D-SMA) of net Capital into Bitcoin ETFs has been negative, indicating a prolonged Capital trend.

However, the magnitude of these negative numbers is gradually decreasing, and the 30D-SMA is now approaching zero. This suggests that Capital from ETFs have slowed down compared to previous periods.

Net Capital of Bitcoin ETFs. Source: Glassnode

Net Capital of Bitcoin ETFs. Source: GlassnodeData from SoSoValue further illustrates this trend. On December 15, 2024, the total net withdrawal value reached $357.69 million. By December 16, 2024, it had decreased to $277.09 million, and by December 18, 2024, it had further decreased to only $161.32 million.

Withdrawals continued to decline, totaling only $158.25 million on December 19, 2024, and $142.19 million on December 22, 2024. However, despite the decrease in daily figures, a clear reversal of the trend is not yet possible.

Meanwhile, experts at 10x Research have observed a gradual shift in market conditions. The firm, which Capital pessimistic about the market since October, stated that Derivative indices, ETFs, and technical indicators are now showing new developments.

“After a period of pessimism, this is the day, and the specific time, when we will decide to buy Bitcoin. The largest Bitcoin options expiration ever is approaching, with strike prices and open interest revealing where pressure and opportunities will form. Additionally, patterns that typically appear at the end of the year suggest a period of extreme risk aversion, which will most likely give way to a strong reversal in sentiment as we enter the new year and risk funds are re-established. Technical signals have also shifted, showing a balance between selling exhaustion and bullish potential becoming clearer,” according to the post .

Despite the emergence of several new signals, a more significant and stable return of capital is needed for a strong price reversal. BeInCrypto previously reported that the amount of stablecoins on major exchanges has decreased sharply, with a total Capital outflow of nearly $1.9 billion in just the past 30 days.

This Capital outflow indicates a sharp decline in immediate market purchasing power, and investor caution remains very evident. Furthermore, CryptoQuant CEO Ki Young Ju Chia that it will likely take several more months for the market to recover psychologically.