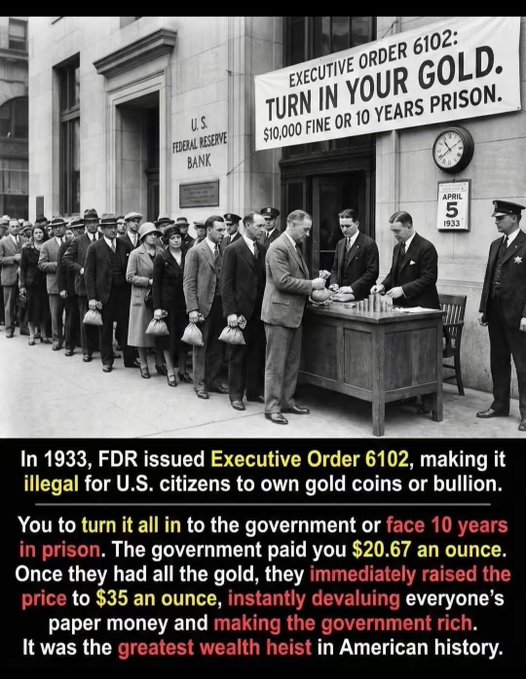

As gold hits a record high of $4,500 per ounce, let's not forget history! 🧐 On April 5, 1933, Roosevelt signed Executive Order 6102 – "Hand over your gold." That day, gold coins and bars held by American citizens ceased to be symbols of wealth, becoming evidence of illegality. The government "purchased" gold from the public at $20.67 per ounce, then immediately raised the official gold price to $35 per ounce, diluting purchasing power overnight while enriching the national treasury. This wasn't economic policy; it was a meticulously planned redistribution of wealth, with ordinary people merely the victims. This is a true historical event! Today, December 24, 2025, Christmas Eve, I sit in front of my screen, watching the price of #BTC fluctuate around $87,000, and a chill runs down my spine. Not because of the volatility, but because history always rhymes. I once thought that #BTC was the "non-sovereign gold" of the digital age—decentralized, censorship-resistant, with a fixed total supply of 21 million coins, it was the last bastion for ordinary people against rampant money printing. It didn't rely on any government credit, nor was it controlled by any central bank. However, with the approval of Bitcoin ETFs, Wall Street's full-scale entry, and even sovereign states beginning to discuss "strategic Bitcoin reserves," I've gradually realized: are we handing digital gold to the eve of a new "Executive Order 6102"? Today, many of us no longer control our private keys. Storing #BTC in Coinbase, Grayscale, or BlackRock ETFs—these "custodial digital gold" are essentially no different from gold coins stored in bank vaults in 1933. Once policy shifts, these assets can be frozen, tracked, and "legally" requisitioned. The true spirit of decentralization is being quietly eroded by convenience and compliance. And what alarms me most is that governments no longer need to "confiscate" Bitcoin. It simply requires pushing for "compliance"—through tax tracking, KYC/AML rules, and on-chain monitoring—to tame free crypto assets into regulated financial instruments. When 90% of BTC circulation relies on centralized entry points, and when "non-custodial" becomes a minority activity among geeks, Bitcoin ceases to be a force resisting the system and becomes part of it. Therefore, I remind myself daily: don't repeat the mistakes of 1933. My #BTC exists only in a cold wallet under my own control. I don't believe in "custodial equals security," because historically, security has never come from institutions, but from sovereignty—absolute sovereignty over one's own assets. People in Roosevelt's era surrendered gold in exchange for paper money and inflation. Will our generation one day surrender our private keys in exchange for a "compliant but utterly unfree" digital financial cage? It's worth reflecting on! 🧐

This article is machine translated

Show original

Rocky

@Rocky_Bitcoin

12-24

铂金这涨的有点离谱了!😅

已经2330+美金/盎司了,创下历史新高!

这一轮算是抓住了白银和铂金,都是提前马前炮推荐给粉丝!🥸 x.com/rocky_bitcoin/…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share