Americans are feeling the pressure of rising living costs, but they haven't turned their backs on crypto.

A recent holiday spending survey by Visa Inc. reveals that more and more people are willing to give digital assets as gifts, even as inflation limits disposable income and consumers remain cautious. This contrast reflects a profound shift in how households adjust their spending as finances tighten.

Inflation is gradually decreasing, but the budget remains tight.

Inflation has decreased compared to the post-pandemic period, but prices for many essential goods and services such as housing, food, insurance, and utilities remain high.

Wages have generally kept pace with inflation, preventing a sharp decline in purchasing power. However, this difference is quite small.

After spending on basic needs, many families have less money left to invest or spend freely than they did before 2022.

However, this situation didn't cause people to cut back on spending completely, but rather changed their shopping behavior. Consumers started shopping earlier, comparing prices more carefully, and leveraging technology to save every penny.

Financial confidence remains fragile , but economic activity is sustained. This caution is evident in how people shop and choose products.

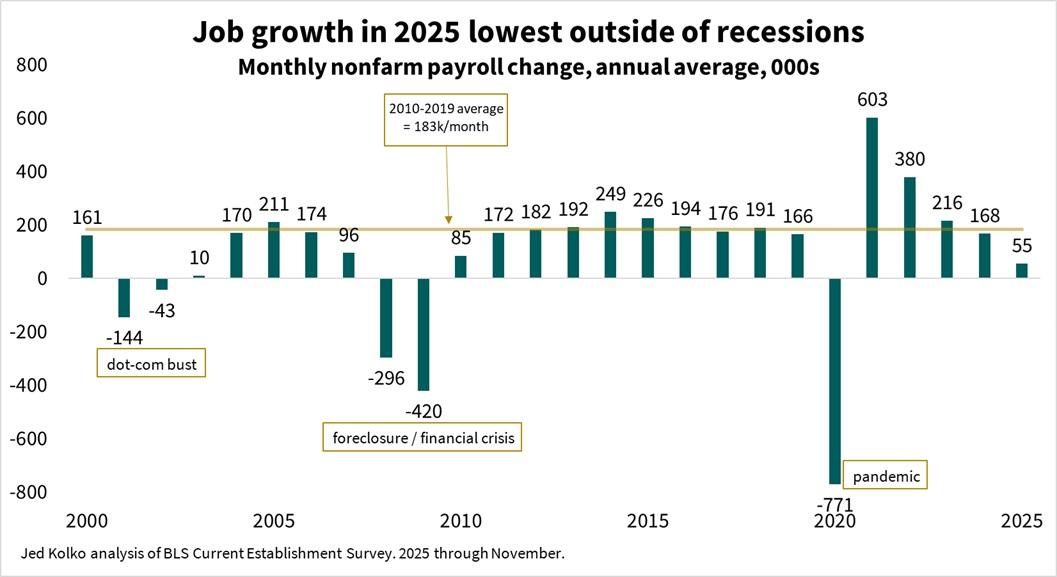

Job growth in the US over the years. Source: X/Jed Kolko

Job growth in the US over the years. Source: X/Jed KolkoCrypto has emerged as a "cost-effective" gift.

A Visa survey in December found that 28% of Americans would be excited to receive crypto as a holiday or Christmas gift, a figure that rises to 45% among Gen Z.

The appeal here isn't about luxury, but rather the preference for assets that are flexible, digitized, and have long-term value potential.

At the same time, 47% of US shoppers said they used AI tools when choosing holiday gifts, primarily to find gift ideas and compare prices. This indicates that consumers now prioritize efficiency and avoid unnecessary purchases.

Young people are leading the new trends. Gen Z uses crypto payments , e-wallets, biometric authentication, and cross-border purchases more than other age groups.

For this generation, crypto has become a natural part of modern digital financial identity.

The data also indicates that gifting crypto doesn't overshadow essential needs. Instead, it replaces traditional gifts at a time when consumers are becoming increasingly discerning.

What does this say about the US economy?

The combination of cooling inflation and sustained spending pressure signals that the US economy is stabilizing but remains cautious.

Americans aren't retreating; they're choosing to adapt. They're still spending, but prioritizing products and tools that offer efficiency, diverse choices, or potential future returns.

The increasing acceptance of crypto as a gift – even with limited spare income – reflects a cultural shift, rather than just a fleeting speculative inclination.

This also explains why digital assets continue to attract attention even during challenging economic times.

For the market, the message is clear. Inflation may have subsided, but public confidence has not fully returned.

Meanwhile, technology and alternative assets are taking on Vai that traditional consumption can no longer fulfill.

Despite feeling pressured by spending habits, Americans still place their trust – cautiously – in the future.