Canton's CC Token became the strongest performing Token in the cryptocurrency market during the Christmas season, surging over 25% in just 24 hours, despite a generally quiet market and pessimistic sentiment. This surge helped CC surpass other major coins and even prominent privacy Token .

This price surge doesn't stem from retail investor excitement or holiday season expectations. Instead, it reflects a trend that major financial institutions are focusing on: Tokenize of real assets (RWA) and regulatory clarity – two topics that have become hot topics towards the end of this year.

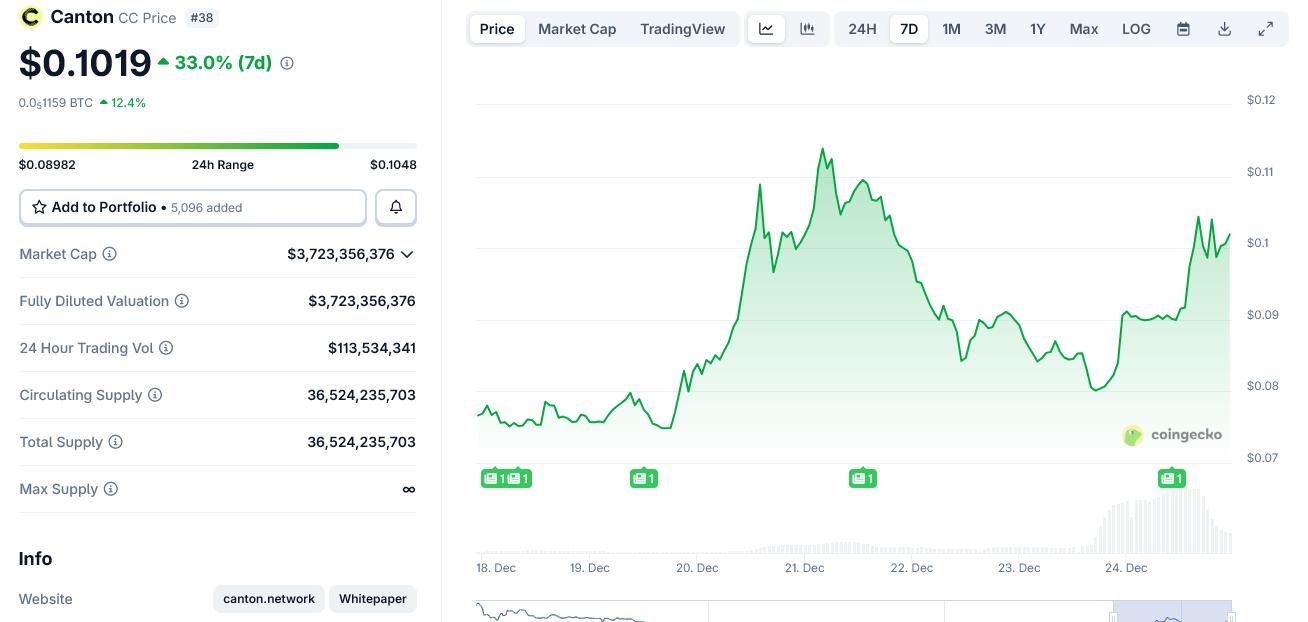

Token surged in the crypto market during Christmas 2025. Source: CoinGecko

Token surged in the crypto market during Christmas 2025. Source: CoinGeckoInstitutional Tokenize is fueling the rise of the Canton Token.

At the heart of this price surge is the Canton Network – a privacy-focused Layer-1 blockchain developed specifically for tightly regulated financial institutions.

Unlike public DeFi platforms, Canton allows institutions to trade directly on the blockchain while ensuring sensitive data remains confidential. This is crucial for banks, payment organizations, and large asset managers.

CC is the Utility Token of the Canton project and is used to pay transaction fees, ensure network security, and reward validators. The value of CC does not depend heavily on the participation of small retail investors but is closely tied to the actual use by large organizations.

For that reason, CC prices often fluctuate sharply whenever there are changes related to network infrastructure.

The upward momentum intensified after DTCC (Depository Trust & Clearing Corporation) confirmed progress in Tokenize US government bonds held by DTC, directly on the Canton Network.

This project was launched after receiving approval from the US SEC . The SEC sent a letter confirming no objections, allowing DTCC to deploy its Tokenize system on the Canton platform.

This is one of the clearest indications that regulatory bodies support the digitization of government bonds on the blockchain.

Therefore, the market has begun to re-evaluate Canton as a core infrastructure platform rather than just a speculative blockchain project as before.

In early December 2025, Canton further expanded the RWA ecosystem by partnering with RedStone , selecting RedStone as the primary oracle provider for the system.

This integration allows Canton to connect accurate and real-time Tokenize asset price data to institutions, bridging the gap between traditional markets and DeFi without privacy concerns.

These advancements are positioning Canton as a crucial settlement layer for trillions of dollars worth of traditional financial assets in the future.

According to industry estimates, more than $300 billion worth of transactions are processed daily through applications built on the Canton Network.

Weekly price chart of Canton's CC Token . Source: CoinGecko

Weekly price chart of Canton's CC Token . Source: CoinGeckoNotably, the sharp increase in CC occurred during a holiday period with extremely low liquidation . This further highlights the trend of capital flows concentrating on regulatory-compliant Tokenize platforms, even as we approach 2026.

While the crypto market as a whole remains cautious, CC's performance shows a clear difference.

Investors are increasingly distinguishing between speculative Token and projects or protocols that are linked to the acceptance of large, clearly regulated financial institutions.

During the Christmas season, Canton clearly belonged to the group of projects with real value – and the market reacted very positively.