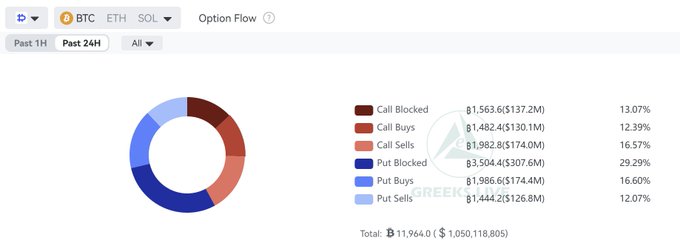

With the year-end approaching, over half of the total open interest will expire this Friday the 26th. Rollover trading is currently the dominant activity. This will introduce a lot of signal noise. It's not advisable to use options data as trading signals in the coming days. For example, today's put volume reached 30%, but this isn't a bearish signal. Many deep out-of-the-money and in-the-money put options were traded, and this shouldn't be interpreted as institutional price levels. Because many institutions are rolling over their positions early to mitigate the risk of large-scale expirations, catching these institutions' dumped options is actually very cost-effective, with very favorable prices. There's been a lot of negative slippage these past few days; using smart trading can provide even better quotes. This is experience gained through real money! 😁

This article is machine translated

Show original

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content