Market Update aims to provide readers with the latest market reports and key digital asset data.

Article author: Chang

Article source: ME

On December 25th, according to SoSoValue data, the crypto market sector as a whole showed a fluctuating trend. The NFT sector, which experienced a significant drop yesterday, rose 2.33% in the last 24 hours. Within the sector, Audiera (BEAT) stabilized and rebounded, rising 5.31%, while Apecoin (APE) and Pudgy Penguins (PENGU) rose 3.49% and 3.87% respectively. However, APENFT (NFT) fell 4.88%. In addition, Bitcoin (BTC) rose 0.19%, reaching $87,000; Ethereum (ETH) fell 0.39%, still fluctuating narrowly around the $3,000 mark.

In other sectors, the AI sector rose 1.16%, with 0G (0G) up 8.82%; the DeFi sector rose 0.70%, with Hyperliquid (HYPE) up 3.35%; the CeFi sector rose 0.64%, with Canton Network (CC) surging 11.60%; the Meme sector rose 0.55%, with PIPPIN (PIPPIN) up 6.81%; and the Layer 1 sector rose 0.24%, with Zcash (ZEC) up 5.54%.

In addition, the Layer 2 sector fell 0.25%, but Linea (LINEA) rose 5.35%; the PayFi sector fell 0.66%, while Ultima (ULTIMA) surged 3.62% intraday.

The crypto sector indices, which reflect the historical performance of the sector, show that the ssiAI, ssiNFT, and ssiSocialFi indices rose by 1.43%, 1.33%, and 1.30%, respectively.

ETF Directional Data

According to SoSoValue data, the XRP spot ETF saw a total net inflow of $11.93 million yesterday (December 24, Eastern Time).

Yesterday (December 24, Eastern Time), the XRP spot ETF with the largest single-day net inflow was the Franklin XRP ETF (XRPZ), with a single-day net inflow of $11.14 million and a historical total net inflow of $231 million.

The second largest net inflow was for the Canary XRP ETF (XRPC), which saw a net inflow of $790,000 in a single day, bringing its total historical net inflow to $385 million.

As of press time, the XRP spot ETF has a total net asset value of $1.25 billion, an XRP net asset ratio of 0.98%, and a cumulative net inflow of $1.14 billion.

According to SoSoValue data, the Solana spot ETF saw a net inflow of $1.48 million yesterday (December 24, Eastern Time).

Yesterday (December 24, Eastern Time), the SOL spot ETF with the largest single-day net inflow was the Fidelity SOL ETF FSOL, with a single-day net inflow of $1.08 million and a historical total net inflow of $113 million.

The second largest inflow was the VanEck SOL ETF (VSOL), with a single-day net inflow of $400,000 and a total historical net inflow of $17.78 million.

As of press time, the Solana spot ETF has a total net asset value of $931 million, a Solana net asset ratio of 1.35%, and a cumulative net inflow of $752 million.

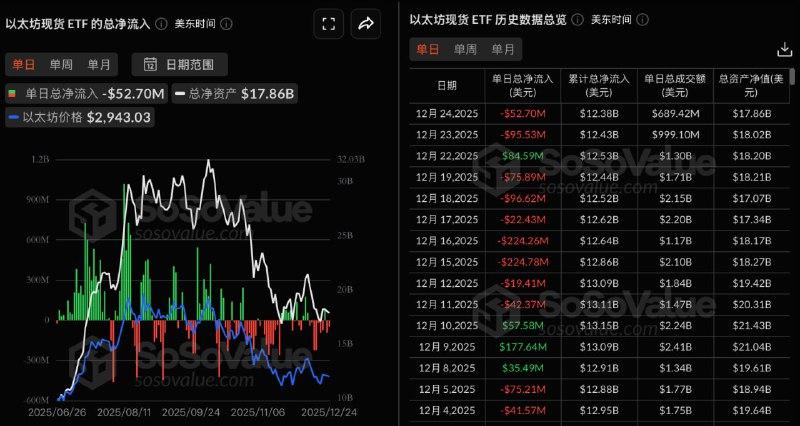

According to SoSoValue data, the Ethereum spot ETF saw a total net outflow of $52.7049 million yesterday (December 24, Eastern Time).

The Ethereum spot ETF with the largest single-day net inflow yesterday was the Grayscale Ethereum Mini Trust ETF (ETH), with a single-day net inflow of $3.3313 million. The current total historical net inflow of ETH is $1.506 billion.

The Ethereum spot ETF with the largest single-day net outflow yesterday was the Grayscale Ethereum Trust ETF (ETHE), with a net outflow of $33.7823 million. ETHE's total historical net outflow has now reached $5.083 billion.

As of press time, the Ethereum spot ETF has a total net asset value of $17.863 billion, with an ETF net asset ratio (market capitalization as a percentage of Ethereum's total market capitalization) of 5.03%, and a cumulative net inflow of $12.381 billion.

According to SoSoValue data, Bitcoin spot ETFs saw a total net outflow of $175 million yesterday (December 24, Eastern Time).

The Bitcoin spot ETF with the largest single-day net outflow yesterday was BlackRock ETF IBIT, with a net outflow of $91.3726 million. IBIT's total historical net inflow has reached $62.249 billion.

The second largest outflow was from the Grayscale ETF GBTC, which saw a net outflow of $24.6211 million in a single day. GBTC's total historical net outflow has reached $25.177 billion.

As of press time, the total net asset value of Bitcoin spot ETFs was $113.833 billion, with an ETF net asset ratio (market capitalization as a percentage of Bitcoin's total market capitalization) of 6.51%, and a historical cumulative net inflow of $56.901 billion.

BTC direction

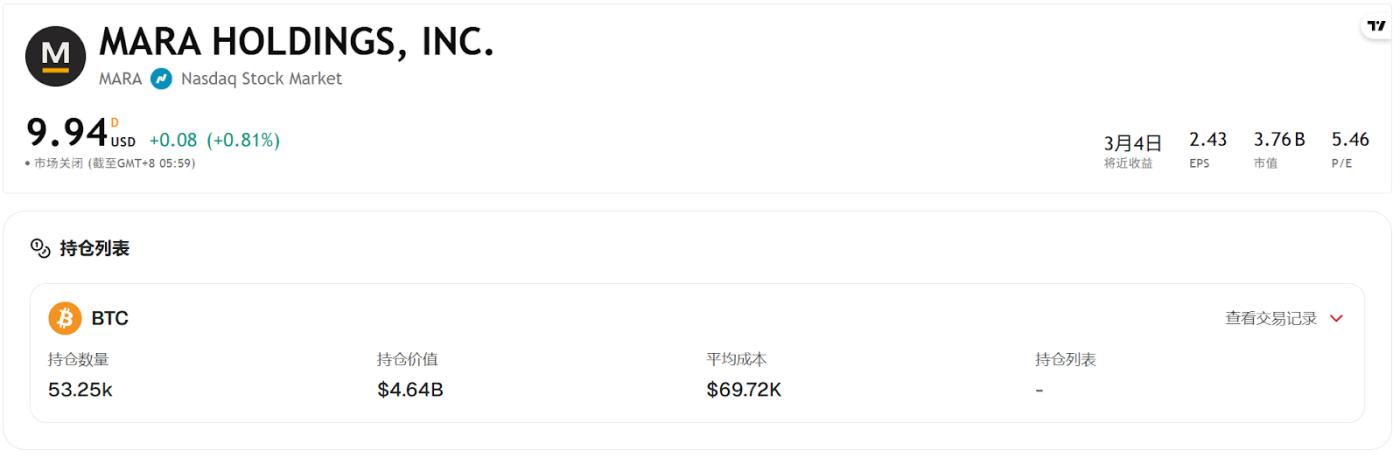

According to CoinFound data, 189 listed companies currently hold a total of 1,123,788 Bitcoins, accounting for 5.65% of the total Bitcoin supply. Among them, MARA Holdings, Inc. holds 53,250 Bitcoins, accounting for 4.7% of the listed companies' holdings, while Strategy holds 671,268 Bitcoins without any increase.

RWA direction

According to CoinFound data:

- Commodity market capitalization: $3.9 billion (7D +4.75%)

- Government bond market value: $1.2 billion (7D -0.65%)

- Institutional fund market capitalization: $2.96 billion (7D +4.22%)

- Private lending market capitalization: $35.28 billion (7D +3.33%)

- Market value of US Treasury bonds: $9 billion (7D -0.09%)

- Corporate bond market value: $260 million (7D -0.34%)

- X-Stock Market Cap: $620 million (7D -3.08%)

Market Dynamics:

- NBCOIN (a next-generation Layer 1 blockchain) launched RWA Connector and the upcoming RWA Marketplace, supporting on-chain tokenization, listing, verification, and trading of real estate, commodities, and corporate assets.

- With gold prices strengthening and RWA gaining momentum, Bybit has become the core entry point for on-chain stocks and gold.

Summarize:

- Despite overall volatility in the crypto market during the Christmas holiday period, RWA demonstrated strong resilience, with its market capitalization rising 1.2% from the previous day, as the overall market remained stable.

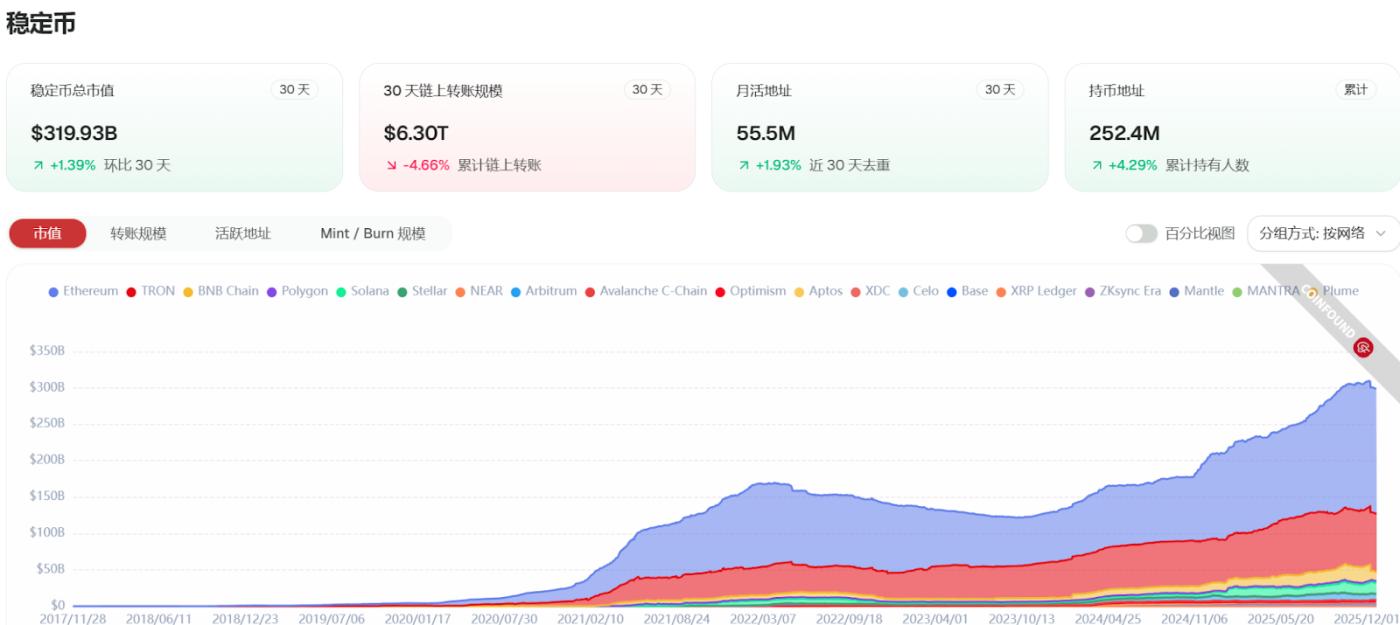

Stablecoin direction

According to CoinFound data:

- USDT market capitalization: US$198.96 billion

- USDC market capitalization: $76.59 billion

- USDS market capitalization: $10.98 billion

- USDe market capitalization: $6.42 billion

- PYUSD Market Cap: $3.87 billion

- USD1 Market Cap: $2.78 billion

Market Dynamics

- On Binance, BTC/USD1 (World Liberty Financial stablecoin) temporarily fell to $24,111 due to liquidity shortage, but quickly rebounded to above $87,000, with no systemic risk.

Avian Labs' Sling Money has been approved by the FCA to provide USDP/EURC transfers and withdrawals in 80 countries on Solana. It is currently in closed testing in the UK.

XDC Network has partnered with Bybit and Circle to enhance stablecoin liquidity.

Streamflow announced the launch of USD+, an on-chain yield stablecoin for Solana, backed by US short-term Treasury bonds, with an annualized yield of approximately 3.6%, distributed daily, and requiring no staking.

Binance has listed the Kyrgyz som stablecoin, as the country accelerates its national-level crypto strategy.

Summarize:

The stablecoin market is currently stable, with low trading volume due to the holiday. The USD1 trading pair experienced a flash crash but recovered quickly. Ecosystem innovation is active, and the market is calm.