In 2025, the prediction market will accelerate its move into the mainstream: brokers, sports platforms, and crypto products will all enter the market simultaneously, and demand will be validated. The real watershed will no longer be product innovation, but the ability to scale within a regulatory framework.

Article author and source: MarsBit

This article uses a comparison of global regulations, the divergence between on-chain and compliance paths, and the 2026 World Cup as a "system-level stress test" to point out that the prediction market is entering an elimination phase centered on compliance, settlement, and distribution. The winners will be platforms that can operate stably under peak loads and stringent regulations.

The following is the original text:

The US event contracts market is expected to accelerate significantly in 2025, coinciding with the approach of a "generational" catalyst.

Kalshi's valuation has doubled to $11 billion, and Polymarket is reportedly seeking an even higher valuation. Meanwhile, mass-market platforms—including DraftKings, FanDuel, and Robinhood—are launching compliant prediction products ahead of the 2026 FIFA World Cup (to be held in North America). Robinhood estimates that the event market has generated approximately $300 million in annualized revenue, making it its fastest-growing business line, demonstrating that "opinion-based trading" is scaling into the financial mainstream.

However, this growth is clashing head-on with regulatory realities. As platforms prepare for the World Cup-driven participation surge, prediction markets are no longer just a product issue, but increasingly a matter of "regulatory design." In reality, teams are shifting their focus from simply meeting user needs to designing legal definitions, jurisdictional boundaries, and settlement standards. Compliance capabilities and distribution partnerships are gradually becoming as important as liquidity; the competitive landscape is also being shaped more by "who can operate at scale within the permitted framework," rather than who can launch the most markets.

Intertwined forces of regulation

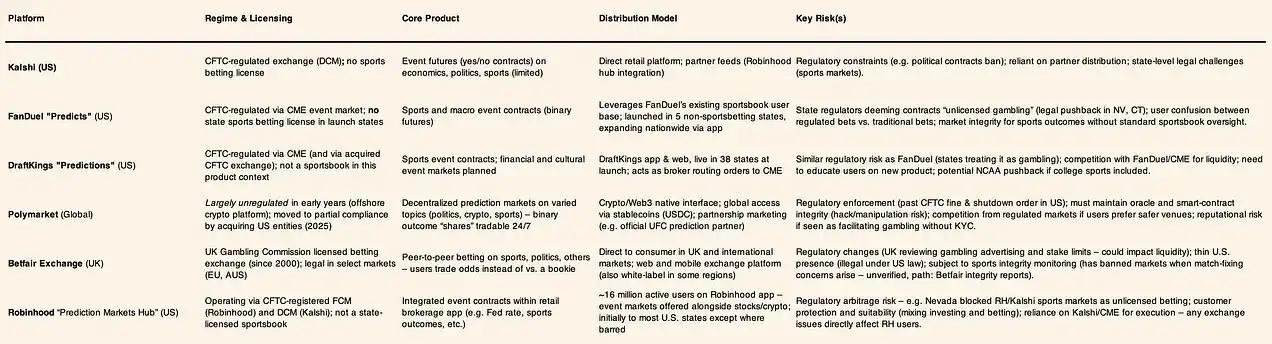

The U.S. Commodity Futures Trading Commission (CFTC) allows only a small class of event contracts linked to economic indicators, while deeming other types unacceptable gambling. In September 2023, the CFTC blocked Kalshi's attempt to launch political futures; however, a subsequent court challenge granted limited approval to contracts related to the presidential election.

At the state level, regulators are taking a tougher stance on the "sports-like" market. In December 2025, Connecticut's gambling regulator issued stop-loss orders to Kalshi, Robinhood, and Crypto.com, determining that their sports event contracts constituted unlicensed gambling; Nevada also sought legal action to halt similar products, forcing the relevant platforms to remove them from the state.

In response, established giants like FanDuel and DraftKings have restricted prediction-based products to jurisdictions where sports betting is not yet legally permitted, highlighting that distribution strategies are being driven by regulatory boundaries rather than user demand. The core message is clear: scale is determined not by product innovation, but by regulatory tolerance. Contract design, settlement terms, marketing wording, and geographic expansion paths are being systematically engineered to pass legal scrutiny; platforms that can operate within an acceptable regulatory framework will gain a more sustainable advantage. In this market, regulatory clarity itself constitutes a moat, while uncertainty directly limits growth.

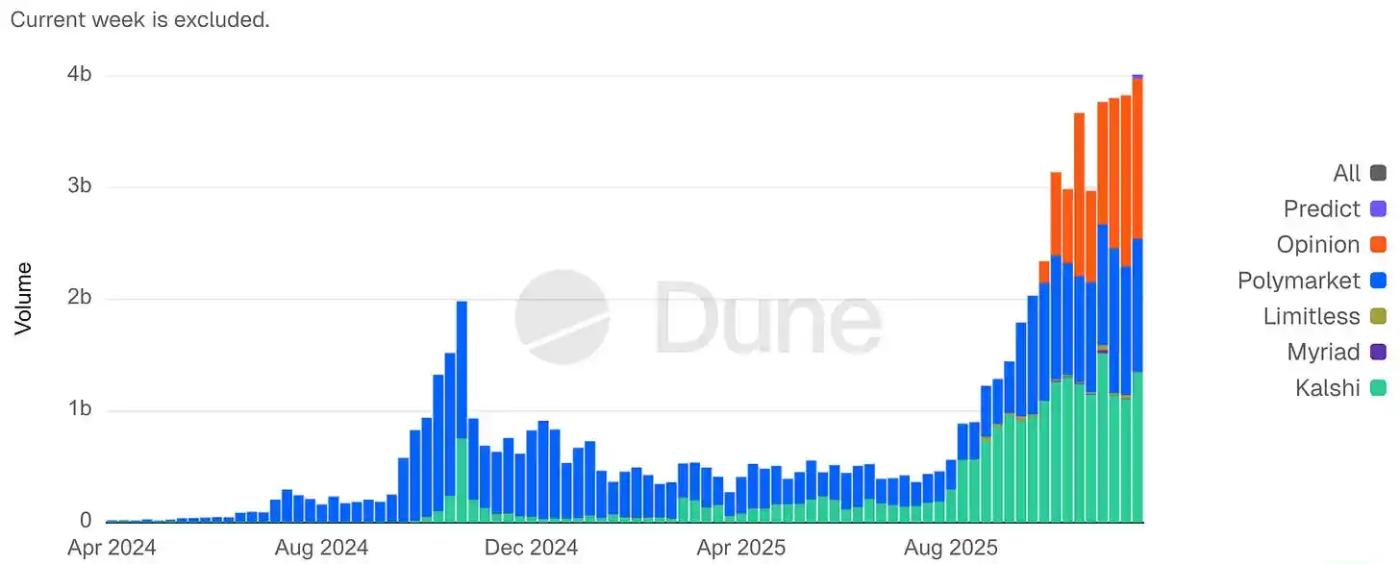

Weekly Prediction Market Notional Volume

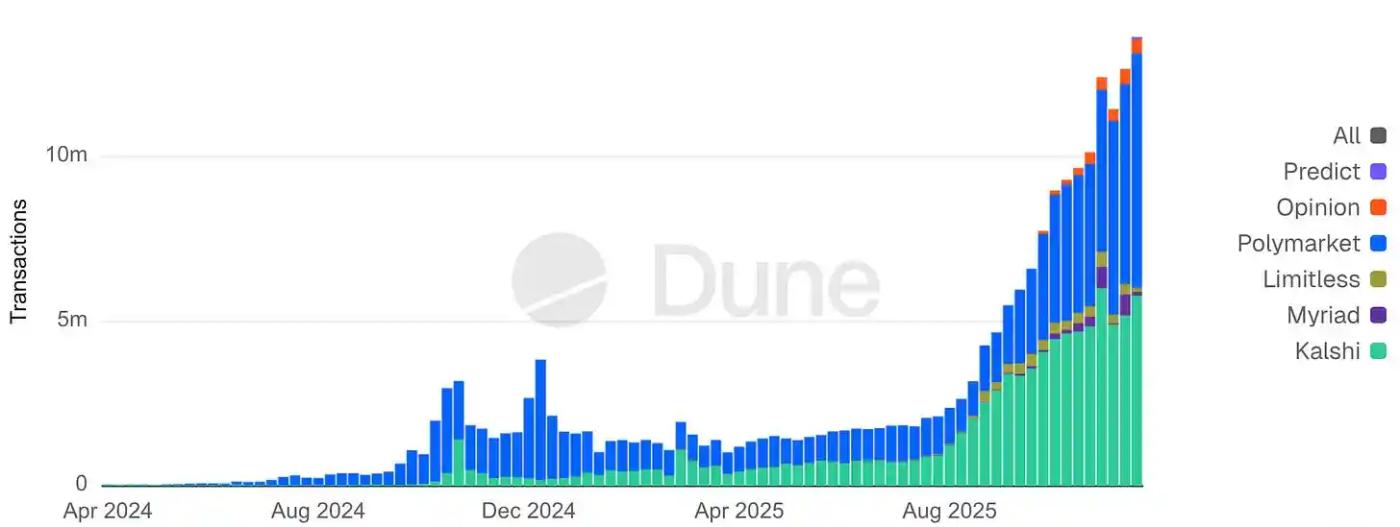

Weekly Prediction Market Transactions

Global Comparable Cases

Outside the US, established betting platforms and newer licensing regimes demonstrate that while event-driven markets can achieve liquidity under regulation, their economic viability and product boundaries are significantly constrained. The UK's Betfair Exchange proves that market depth can be achieved within a gaming license framework, although stringent consumer protection rules limit profitability. In Asia, betting is largely handled by state monopolies or offshore platforms, reflecting both strong underlying demand and long-standing challenges related to enforcement and impartiality. Latin America is moving towards formalization: Brazil plans to open its regulated gaming market in January 2025, attempting to transform a long-standing gray area into a taxable, regulated activity.

A consistent trend across regions is that regulators are closing loopholes. Sweepstakes and social casino models relying on "free tokens + prize mechanisms" have been restricted or banned in multiple jurisdictions, significantly raising the compliance threshold for any product skirting the line of gambling. The global direction is towards stricter regulation, not tolerance of the gray area.

On-chain platform vs. compliance

Decentralized prediction markets have traded faster, more global access for a lack of compliance. Take the crypto platform Polymarket as an example: in January 2022, it was fined $1.4 million by the Commodity Futures Trading Commission (CFTC) for unregistered event swaps and was forced to implement geo-blocking for US users. Polymarket subsequently reversed course: strengthening internal controls (bringing in a former CFTC advisor) and acquiring a licensed entity in 2025, allowing it to re-enter the US in November 2025 on a test basis. Its trading volume subsequently surged—reportedly reaching $3.6 billion in betting on a single election question in 2024, with monthly trading volume reaching $2.6 billion by the end of 2024; and in 2025, it attracted blue-chip investors at a valuation of approximately $12 billion.

On-chain platforms rely on oracles for rapid market creation and settlement, but face a trade-off between speed and fairness: governance and oracle disputes may delay results, and anonymity raises concerns about manipulation or insider trading. Regulators are also vigilant: even with decentralized code, organizers and liquidity providers may still become targets of enforcement (as seen in the Polymarket case). The challenge in 2026 is to combine the innovation of 24/7 global markets and instant crypto settlement with sufficient compliance without sacrificing openness.

User Behavior and Transaction Trends

In 2025, the prediction market is expected to surge simultaneously across both sporting and non-sporting events. Industry estimates indicate that total nominal trading volume will expand more than tenfold compared to 2024, reaching approximately $13 billion per month by the end of 2025. The sports market will become the primary "trading engine," with high-frequency events generating a steady stream of small transactions; while the political and macroeconomic markets will act as "money magnets," with fewer transactions but larger individual deals.

The structural differences are clearly visible: In Kalshi, sports contracts contribute the majority of cumulative trading volume, reflecting repeated participation from entertainment-oriented users; however, open interest is more concentrated in politics and economics, meaning that individual positions are heavier. In Polymarket, the political market also dominates open interest, although trading frequency is lower. Conclusion: Sports maximizes turnover, while non-sports concentrate risk.

This results in two types of participants:

Sports users: more like "traffic traders", making multiple small transactions driven by entertainment and habit;

Political/Macro Users: More like "capital allocators," investing small amounts but in large quantities, seeking information advantage, hedging, or narrative influence.

The platform therefore faces a dual challenge: maintaining traffic participation while providing credibility and fairness to a capital-driven market.

This also explains the concentration of risk: the controversies in 2025 primarily occurred in non-sports areas, including opposition from US college sports regulators to student-athlete contracts. The platform's swift removal of these contracts indicates that governance risk increases with the concentration of funds and information sensitivity, rather than with pure transaction volume. Long-term growth depends on enabling high-impact non-sports markets to operate without crossing regulatory or reputational red lines.

2026 World Cup: System-level stress test

The FIFA World Cup, co-hosted by the United States, Canada, and Mexico, should be seen as a full-stack stress test for event trading and compliant betting infrastructure. Historical comparisons show:

The 1994 FIFA World Cup in the United States primarily tested physical infrastructure and venues; the 1996 Atlanta Olympics shifted the critical path to communications, information distribution, and emergency response. IBM's "Info '96" centralized timing and results processing, telecom operators expanded cellular networks, and Motorola deployed a large-scale intercom system. The explosion at the Centennial Olympic Park on July 27th of the same year highlighted the importance of shifting from throughput to integrity and resilience under high pressure.

The pressure point in 2026 will clearly be at the digital + financial coupling layer: the tournament will expand to 48 teams, 104 matches, and 16 cities, with multiple concentrated bursts of attention and transaction flows within approximately five weeks. The global betting volume for the 2022 World Cup is widely estimated at tens of billions of dollars, with the peak window bringing extreme short-term liquidity and settlement loads.

The North American compliance track will carry a larger proportion of activity—38 U.S. states, plus Washington D.C. and Puerto Rico have legalized sports betting to varying degrees, and more funds will flow through KYC, payment, and monitoring systems rather than offshore channels. App-based distribution is further tightening the coupling: live streaming, real-time contracts, deposits, and withdrawals are often completed within a single mobile session.

For event contracts/prediction markets, observable operational stressors include: liquidity concentration and volatility during the game window; settlement integrity (data delays, dispute resolution); cross-federal/state product and legal design; and scalability under peak demand for KYC/AML/responsible gaming/withdrawals.

The same set of regulations and technology stack will also be tested again by the 2028 Los Angeles Olympics, so the 2026 World Cup is more like a screening event: it may trigger regulatory intervention, platform consolidation or market exit, distinguishing the infrastructure built for a phased peak from a sustainable, compliant and scalable platform.

Payment and Settlement Innovation

Stablecoins are transitioning from speculative assets to operational infrastructure. Most crypto-native prediction markets use USD stablecoins for deposits and settlements, and regulated platforms are testing similar channels. In December 2025, Visa launched a pilot program in the US allowing banks to use Circle's USDC for on-chain settlements 24/7, continuing its cross-border stablecoin experiment that began in 2023. In event-driven markets, stablecoins (where permitted) offer advantages such as instant access, global coverage, and settlement matching with continuous trading hours.

In practice, stablecoins function more like settlement intermediaries: users use them as faster deposit and withdrawal tools; operators benefit from lower failure rates, improved liquidity management, and near-instant settlement. Therefore, stablecoin policies have a second-order impact on prediction markets: restricting stablecoin channels increases friction and slows withdrawals; clear regulation facilitates deeper integration with mainstream gaming and brokerage platforms.

However, headwinds exist. Christine Lagarde warned of the monetary stability risks of privately-owned stablecoins in 2025 and reiterated her support for a central bank digital euro. The European Central Bank, in its November 2025 Financial Stability Review, also cautioned that the expansion of stablecoins could weaken bank funding sources and disrupt policy transmission. A more gradual consolidation is likely in 2026: more gaming platforms will accept stablecoin deposits, payment institutions will bridge the gap between cards and crypto, and licensing, reserve audits, and disclosures will be strengthened, rather than a full endorsement of native crypto payment systems.

Macro liquidity background

A skeptical assessment of the 2025 boom is warranted: loose monetary policy will amplify speculation. The Fed's shift towards ending quantitative tightening at the end of 2025, or a slight improvement in liquidity in 2026, will have a greater impact on risk appetite than on policy direction. For forecasting markets, liquidity affects participation intensity: ample funds → increased trading volume; tightening → marginal cooling of speculation.

However, the growth in 2025 occurred in a high-interest-rate environment, indicating that the forecasting market is not primarily driven by liquidity. A more reasonable framework is to view macro liquidity as an accelerator rather than an engine. Long-term factors—mainstream distribution of brokerage/gambling services, product simplification, and increased cultural acceptance—better explain baseline adoption. Monetary conditions affect amplitude, but do not determine whether it occurs.

"Missing Elements": Super App Distribution and Competitive Advantage

The key question is: who controls the user interface for integrated trading/gambling?

A consensus is forming: distribution is king, and the real moat lies in the user relationships of a super app.

This has led to a surge in collaborations: exchanges want retail users (such as the partnership between CME Group and FanDuel/DraftKings), and consumer platforms want differentiated content (such as the partnership between Robinhood and Kalshi, and DraftKings' acquisition of a small CFTC exchange).

The model is similar to that of a comprehensive brokerage: stocks, options, crypto, and event contracts are offered side by side, and users do not need to leave the platform.

Prediction markets are exceptionally sensitive to liquidity and trust: thin markets fail quickly, while depth compoundes. Platforms with existing users, low customer acquisition costs, and readily available KYC and funding channels are naturally superior to independent venues that need to build depth from scratch. Therefore, it's more like options trading than a social network: depth and reliability outweigh novelty. This is also why the "feature vs. product" debate is increasingly decided by distribution rather than technology.

Robinhood's early success supports this assessment: its launch of event trading to select active traders in 2025 led to rapid growth; ARK Invest estimates its year-end recurring revenue at $300 million. The competitive advantages are clear: even independent prediction markets (through reinvention) struggle to compete with existing users. For example, FanDuel, with over 12 million users, quickly built liquidity and trust in five states by integrating CME event contracts; DraftKings replicated a similar path in 38 states. In contrast, Kalshi and Polymarket spent years building depth from scratch and are now more actively seeking distribution partnerships (Robinhood, Underdog Fantasy, and even UFC).

Possible outcomes: A few large aggregation platforms will gain network effects and regulatory backing; smaller platforms will either specialize (e.g., focusing solely on crypto events) or be acquired. Meanwhile, the convergence of fintech and media super apps is imminent: PayPal and Cash App may one day offer prediction markets alongside payments and stocks; Apple, Amazon, and ESPN have already explored sports betting partnerships between 2023 and 2025, potentially evolving into broader event trading. The real "missing element" might be the moment when tech giants fully embed prediction markets into their super apps—merging news, betting, and investment into one, creating a moat few competitors can match.

The race to lock in users among exchanges, betting companies, and brokers will continue until then. A key question for 2026 is: will prediction markets become a feature of large financial apps, or will they continue to exist as a standalone vertical? Early evidence points to integration.

However, regulators may also remain wary of super apps that seamlessly switch between investment and gambling. Ultimately, the winners will be platforms that can convince both users and regulators—their competitive advantage will come not only from technology and liquidity, but also from compliance, trust, and user experience.

Opinion Trade (Opinion Labs): A Macro-Focused On-Chain Challenger

Opinion Trade (launched by Opinion Labs) positions itself as a "macro-first" on-chain prediction trading platform, with a market structure closer to an interest rate and commodity dashboard than a betting product driven by entertainment events. The platform launched on BNB Chain on October 24, 2025, and as of November 17, 2025, its cumulative notional trading volume exceeded $3.1 billion, with an early-stage daily notional trading volume of approximately $132.5 million.

Between November 11 and 17, the platform's weekly notional trading volume was approximately $1.5 billion, ranking among the top major prediction market platforms; as of November 17, its open interest reached $60.9 million, which at the time lagged behind Kalshi and Polymarket.

At the infrastructure level, Opinion Labs announced a partnership with Brevis in December 2025 to introduce a zero-knowledge proof-based verification mechanism into the settlement process, aiming to reduce the trust gap in market outcome determination. The company also disclosed the completion of a $5 million seed funding round, led by YZi Labs (formerly Binance Labs), with participation from other investors. This not only provided financial support but also strategically forged a close connection with the BNB ecosystem.

Furthermore, the platform's explicit geographical blockade of the United States and other restricted jurisdictions highlights a key trade-off facing on-chain prediction markets in 2025–2026: how to achieve rapid global liquidity aggregation under regulatory constraints.

Consumer-grade prediction markets serve as distribution channels for "ICO 2.0".

Sport.Fun (formerly Football.Fun) provides a concrete example of how consumer-grade prediction markets can evolve into next-generation token distribution infrastructure. This emerging "ICO 2.0" model is directly embedded into consumer-grade applications with real revenue. Sport.Fun launched on Base in August 2025, initially focusing on event trading similar to football fantasy games, and later expanding to NFL-related markets.

As of the end of 2025, Sport.Fun disclosed that its cumulative trading volume had exceeded $90 million and platform revenue had exceeded $10 million, demonstrating that the product had proven a clear product-market fit before any public token issuance.

The company has completed a $2 million seed funding round, led by 6th Man Ventures, with participation from Zee Prime Capital, Sfermion, and Devmons. This investor structure reflects the growing market interest in consumer-facing crypto applications—projects that combine financial primitives with entertaining engagement methods, rather than simply betting on underlying infrastructure. More importantly, this funding round was initiated after user activity and monetization capabilities had been validated, disrupting the traditional order of "selling tokens first, then finding users" in the early ICO cycle.

Sport.Fun's public token offering further confirms this shift.

The public sale of $FUN took place from December 16th to 18th, 2025, through the Kraken Launch platform and combined with the contribution- and seniority-based Legion distribution path. The sale attracted over 4,600 participants, with total subscriptions exceeding $10 million; the average participation size per wallet was approximately $2,200. Demand exceeded the $3 million soft cap by approximately 330%.

The project ultimately raised $4.5 million, with the token priced at $0.06, corresponding to a fully diluted valuation (FDV) of $60 million. After exercising the greenshoe option to increase the supply, a total of 75 million tokens were sold.

The token economic model is designed to strike a balance between liquidity and post-launch stability.

According to the plan, 50% of the tokens will be unlocked at the Token Generation Event (TGE) in January 2026, with the remainder released linearly over six months. This structure is significantly different from the "immediate full unlock" common in early ICO cycles, reflecting a learning from and correction of past experiences driven by volatility that ultimately led to price collapses. Functionally, this token issuance is less like a purely speculative fundraising and more like a natural extension of the existing consumer market—allowing users already actively trading on the platform to "invest" in the product they are using.

in conclusion

By the end of 2025, prediction markets had evolved from fringe experiments into a credible, mass-market category. Their growth was driven by mainstream distribution channels, product simplification, and clearly identifiable user needs. The core constraint was no longer "adoption," but rather how to design within a regulatory framework: legal characterization, settlement integrity, and cross-jurisdictional compliance determined who could achieve scale.

The FIFA World Cup should not be simply understood as a growth narrative, but rather as a systemic stress test under peak load—a comprehensive examination of liquidity, operational capabilities, and regulatory resilience. Those platforms that pass the test without triggering enforcement risks or suffering reputational damage will define the next phase of industry consolidation; those that fail will accelerate the industry's move towards higher standards, stronger regulation, and fewer but larger winners.