This article is machine translated

Show original

💯 Why does DeFi lending offer greater sustainable advantages than you think?

Many believe that in the DeFi lending landscape, power and value are increasingly shifting toward vaults, curators, and distributors, while lending protocols are facing increasingly thin profit margins.

However, if we look at the entire on-chain credit value chain and the actual cash flow, the picture is completely different: lending is the layer that holds the biggest sustainable advantage.

The reality on AAVE and SparkLend clearly shows one thing: the interest that vaults pay to the lending protocol is higher than the revenue that the vaults themselves generate. This directly refutes the "whoever controls the distribution wins" principle in lending.

Not only does AAVE earn more money than the vaults built on it, but it also generates more value than asset issuers used in lending such as @LidoFinance or @ether_fi.

-------

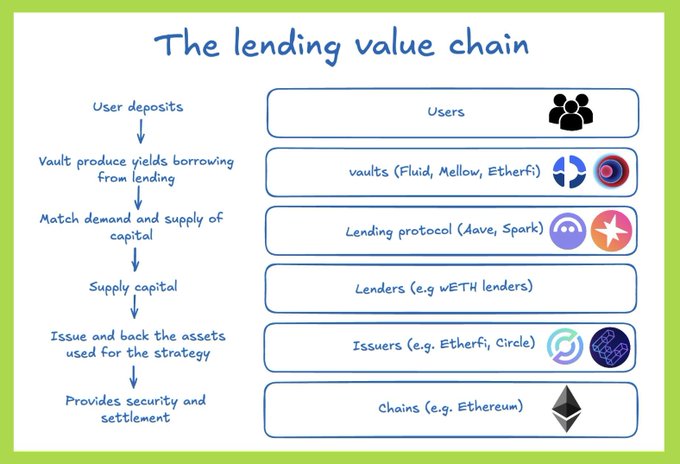

The reason lies in the position of lending within the system. The lending protocol is where the supply and demand for Capital meet, and every leverage strategy is forced to go through this layer:

- Users: deposit assets and find vaults to optimize returns.

- Vault/curator: strategic packaging, loop management, and risk management.

- Lending protocol: provides liquidation and infrastructure, and collects fees directly on loans.

- Asset issuer: issues stETH, weETH… and receives a portion of the yield.

- Blockchain: the infrastructure layer for processing transactions

The key point is that lending protocols charge fees based on the loan size, not on the net profit of the strategy. The more leverage used, the more value flows into lending.

🌟 The clearest example is the http:/Ether.fi vault on AAVE.

This vault borrowed approximately $1.5 billion, but its actual net Capital is only about $215 million. With a platform fee of 0.5%, the vault only generates about $1 million per year, while paying AAVE approximately $4.5 million in interest.

In other words, the lending protocol earns many times more than the vault, even with a large and efficient looping strategy.

This pattern is repeated with several other vaults:

- @0xfluid: borrowed approximately $1.7 billion, vault collected around $4 million, while the lending protocol collected around $5 million.

- @mellowprotocol: Small TVL but high leverage, lending protocols continue to earn more per unit of TVL.

- On SparkLend, large vaults also show similar results when compared by % TVL.

Even when compared to asset issuers, lending protocols still hold the advantage. With the same amount of ETH pledged as collateral, the value generated from ETH interest and stablecoin interest through lending is significantly higher than the performance fees earned by issuers.

According to Silvio - Researcher from Blockworks Advisory

x.com/SilvioBusonero/status/20...…

Upside GM

@gm_upside

11-09

✍️ Một số hiểu lầm và nghịch lý trong DeFi lending

Theo chia sẻ của Stani - Founder Aave, cốt lõi của lending luôn là niềm tin. Toàn bộ hệ thống ngân hàng truyền thống được xây trên nền tảng đó - mất niềm tin là mất vốn, và kết cục có thể là “bank run” x.com/gm_upside/stat…

Please read the quality analysis from admin @TSonn18 ✍️

⚡️ From ETHLend to AAVE v4: What helped AAVE surpass Compound and MakerDAO to become the #1 lending platform? (Part 1)

coin98.net/phan-tich-aave

⚡️Analyzing the true value of AAVE through Aavenomics, GHO & the Avara ecosystem (Part 2)

coin98.net/aave-lending

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content