As December draws to a close, retail investors holding Ethereum (ETH) continue to face challenging market conditions. on-chain data indicates that currently over 40% of circulating Ethereum is at a loss.

Notably, retail investors are reacting differently to the increasing selling pressure: some have sold to cut their losses, while others continue to accumulate ETH despite significant unrealized losses.

Ethereum investors' positions are declining as ETH price falls.

Ethereum has just experienced three consecutive months of price declines, with a sharp drop of 22.2% in November alone. In December, ETH continued to fluctuate with many erratic ups and downs.

Despite briefly regaining the $3,000 mark, ETH failed to hold steady and continued to fall below this crucial threshold.

At the time of writing, Ethereum is trading at $2,973.78, up 1.10% in the last 24 hours, a move quite similar to the overall trend of the cryptocurrency market.

Ethereum (ETH) price performance. Source: BeInCrypto Markets

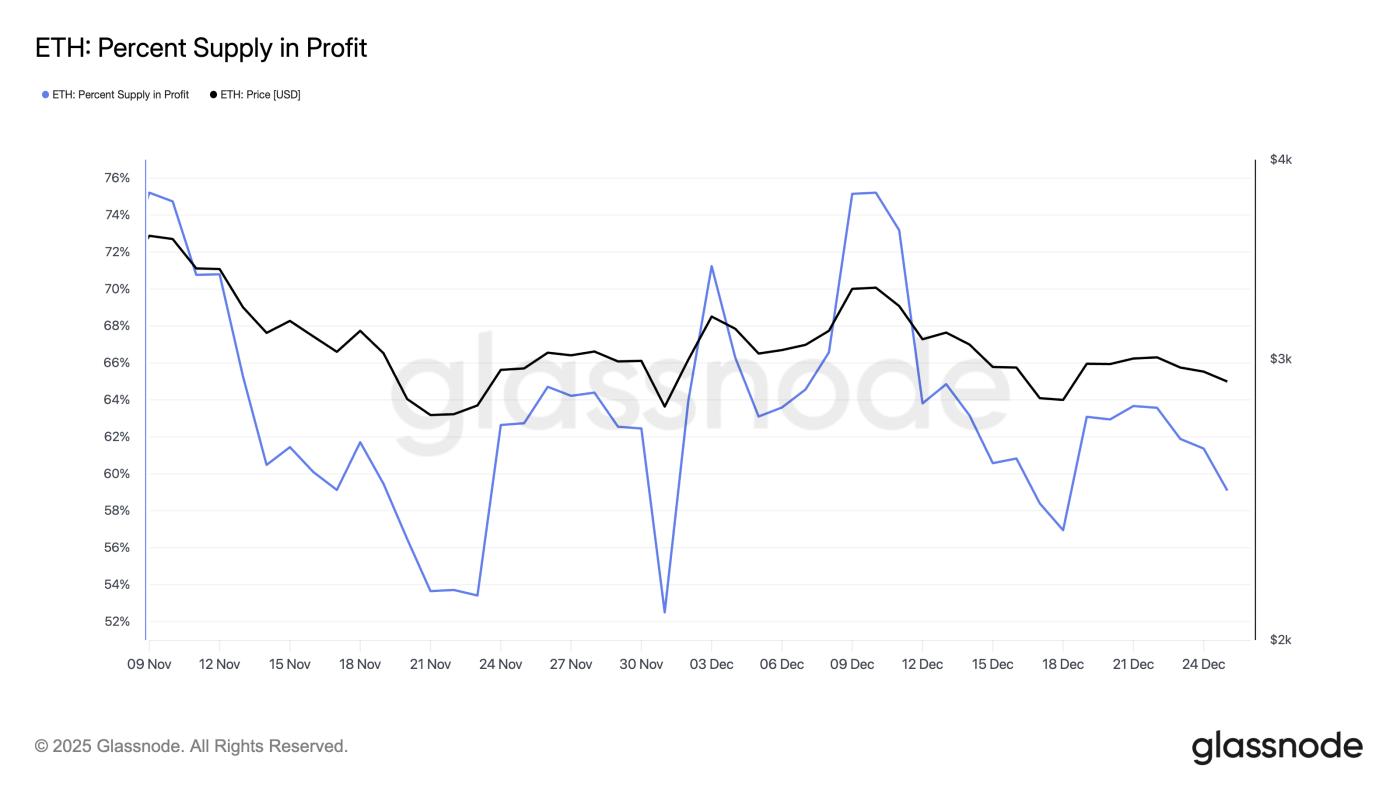

Ethereum (ETH) price performance. Source: BeInCrypto MarketsHowever, the recent sharp drop in ETH price has significantly impacted the percentage of investors making a profit. According to data from Glassnode, at the beginning of this month, over 75% of circulating ETH were still profitable; currently, that number has dropped to just 59%, indicating a growing number of losing positions.

Ethereum is still profitable. Source: Glassnode

Ethereum is still profitable. Source: GlassnodeEthereum whales react differently to mounting losses.

Against this backdrop, some major investors have begun readjusting their portfolios. Lookonchain reports that Erik Voorhees, founder of Venice AI, recently deposited 1,635 ETH (approximately $4.81 million) into THORChain to exchange for Bitcoin Cash (BCH).

This move follows a similar transaction earlier this month, when Voorhees also converted ETH to BCH from a nearly nine-year-old inactive wallet – a sign of a major shift in his investment strategy.

Conversely, Arthur Hayes has also moved ETH to an exchange. Chia to Hayes, he is "withdrawing Capital from ETH and investing in high-quality DeFi Token " with the expectation that these Token will outperform ETH if fiat liquidation improves in the future.

In other news, Winslow Strong (a partner at Cluster Capital) transferred 1,900 ETH and 307 cbBTC to Coinbase – a total value of approximately $32.62 million. However, such transfers to centralized exchanges do not necessarily mean immediate selling.

Nevertheless, the flow of funds to centralized exchanges is often XEM by the market as a potential sell-off signal, especially during periods of high volatility and instability.

“This ETH was withdrawn a month ago at an Medium price of $3,402.25, while cbBTC was purchased between August 2025 and December 2025 at an Medium price of $97,936.68. If these amounts are sold off, the total expected loss would be approximately $3.907 million,” said an on-chain data analyst.

Large investors are continuously buying in.

Not all whales have left the market. The whale wallet 0x46DB continued to buy aggressively throughout December; since December 3rd alone, this address has accumulated 41,767 ETH at an Medium price of $3,130.

Currently, this position is showing an estimated loss of over $8.3 million. BitMine – with unrealized losses totaling approximately $3.5 billion – has also seen several notable buy transactions this week .

These conflicting movements indicate that the market is Chia into two opposing viewpoints. BitMine still believes ETH can rebound in the coming months, while the continuous selling pressure from other large investors shows a growing lack of confidence in ETH .

Analysis from BeInCrypto has also pointed out four key warning signs indicating that ETH is at risk of continued downward pressure. These signals include: an increase in ETH volume on exchanges, a high Estimated Leverage Ratio, continued ETF Capital , and the Coinbase Premium Index falling to -0.08, its lowest level in the past month.

The overall picture, with significant losses, high leverage, and Capital outflows, makes Ethereum's prospects bleak as 2025 draws to a close. Some large investors are still buying in with hopeful expectations, but in reality, selling pressure is completely outweighing these individual efforts. Whether market sentiment can reverse in 2026 remains to be seen.