Zcash price has been steadily rising in recent sessions as the coin attempts to break out of a clear bullish pattern. This privacy-focused cryptocurrency is approaching a key milestone, potentially opening up new upward momentum.

Investor confidence, coupled with favorable overall market conditions, is bolstering expectations of a short-term breakout.

Zcash investors demonstrate strength.

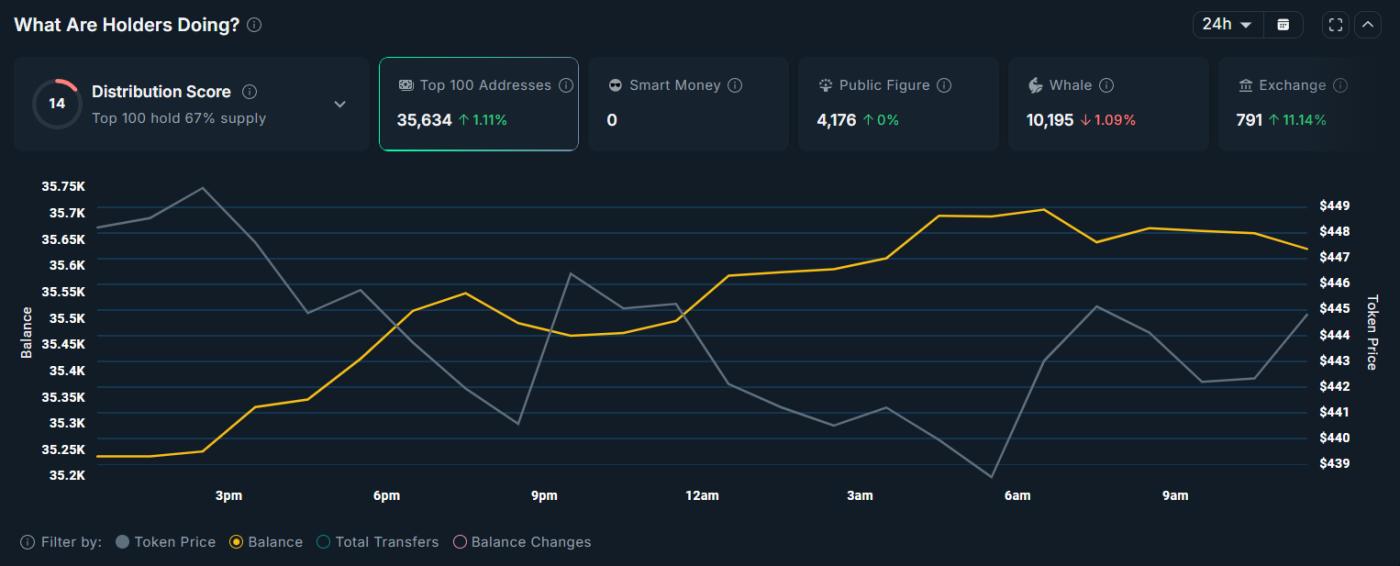

Large investors holding significant amounts of Zcash are showing increased optimism as the price approaches a key resistance zone. Data shows that in the past 24 hours, the total balance of the 100 largest ZEC wallets has increased by 1.11%. While this increase isn't substantial, it reflects confidence in a continuing recovery trend, rather than just short-term profit-taking.

This action shows that Zcash investors still hold onto their confidence. Typically, "whales" accumulate coins when the market is sideways, as they await a strong upward surge later. Their continued buying demonstrates expectations of further price increases and a reduced risk of a price drop, thus reinforcing positive sentiment.

Want to read more analysis of Token like this? Sign up for Editor Harsh Notariya's daily Crypto newsletter here .

Assets held by the top 100 Zcash wallets. Source: Nansen

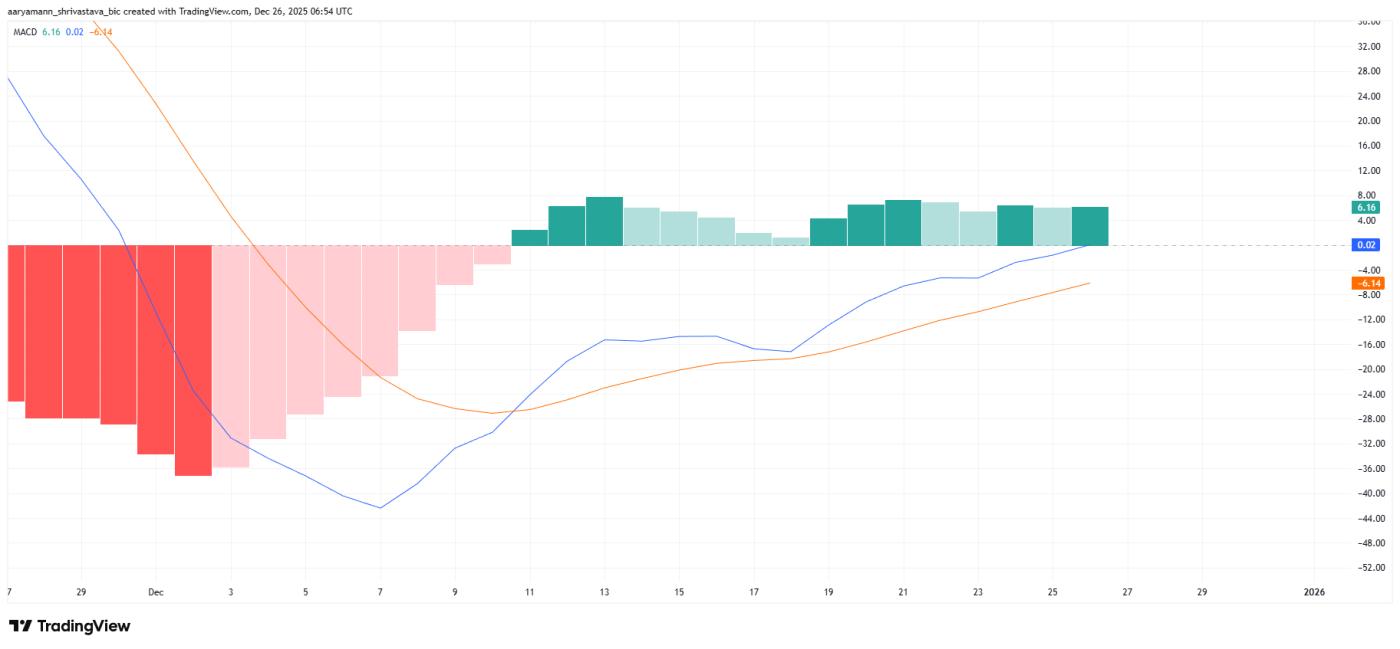

Assets held by the top 100 Zcash wallets. Source: NansenTechnical data is also supporting this positive trend. The MACD indicator has maintained a strong bullish signal for the past two weeks, suggesting that the upward momentum remains solid. This stability indicates the strength of the trend, rather than just a temporary bounce, reducing the risk of a sudden reversal at this time.

External macroeconomic factors also support the stability of ZEC price. Bitcoin remains around $88,000, providing a solid foundation for altcoins. Major indices like the Nasdaq and S&P 500 are also showing slightly positive signals. This consensus boosts confidence in the digital asset class, and Zcash benefits as well.

MACD ZEC indicator. Source: TradingView

MACD ZEC indicator. Source: TradingViewZEC prices are trading sideways.

ZEC is currently trading around $444 at the time of writing, moving within an ascending triangle pattern. This pattern typically signals the potential for further upward movement. If a successful breakout occurs, ZEC could rise by nearly 49%, exactly as projected by the pattern.

The $442 price level needs to be established as solid support. If ZEC decisively breaks above $500, this will be a confirmation signal of the uptrend and affirm a positive position. Based on technical analysis and positive investor behavior, Zcash could very well aim for the area above $500 before the new year.

ZEC price analysis. Source: TradingView

ZEC price analysis. Source: TradingViewHowever, there is still a risk if the upward momentum weakens. If ZEC fails to break through this resistance, the price could continue to fluctuate sideways between $442 and $403. A break below $403 would significantly shift market sentiment to negative. At that point, the price could easily retreat to around $340, negating bullish predictions and increasing the risk of a further sharp decline.