The crypto market faced many challenges in December, but a small group of institutional investors ended the year with profits.

New on-chain data from the Nansen analytics platform shows that, despite price pressure, some large crypto funds recorded millions of dollars in profits, but then switched to heavy selling throughout the month.

Large investment funds reap high returns amidst a declining market.

According to Nansen, market maker Wintermute became the highest-performing fund in December, with approximately $3.17 million in profits closed out.

Dragonfly Capital ranked second, with profits distributed across multiple wallets including $1.9 million, $1.0 million, and $990,000.

IOSG and Longling Capital also feature on the list of top-performing funds. This suggests that profits are primarily concentrated in a small group of actively trading institutional investors, rather than simply individual wallets.

"Profits are concentrated in a small group of regularly active funds, not one-time trading wallets," Nansen noted , emphasizing that good order execution and proactive trade management help institutional investors weather difficult market conditions.

Arrington, Pantera, and Polychain also appear in Nansen 's 30-day data across five different blockchain networks, with varying levels of returns.

December 2025 Profit Ranking: Wintermute leads with $3.17 million, followed by several wallets from Dragonfly Capital. Nansen

December 2025 Profit Ranking: Wintermute leads with $3.17 million, followed by several wallets from Dragonfly Capital. NansenDecember is a challenging time for most crypto market participants as volatility increases and community sentiment weakens towards the end of the year .

Nevertheless, Wintermute and Dragonfly Capital were still able to capitalize on short-term spreads and liquidation opportunities in the market.

This impressive result demonstrates how economies of scale, modern trading systems, and the ability to track multiple chains have helped institutional funds control and capitalize on periods of high market pressure .

Dragonfly's strategy stands out due to its diversification across multiple wallets, which both spreads risk and allows it to seize opportunities for price appreciation from various positions.

Meanwhile, Wintermute 's success demonstrates that they are a leading LP , willing to profit from volatility rather than be negatively impacted by it.

IOSG and Longling Capital also delivered outstanding results, ranking among the top-performing funds of the month. Overall, the data reflects the resilience of institutions while the majority of retail investors struggled to stay afloat in the market.

Proactive profit-taking activities influence behavior across the chain .

However, according to Nansen 's on-chain tracking, these successful funds are now tending to sell off, rather than continue accumulating.

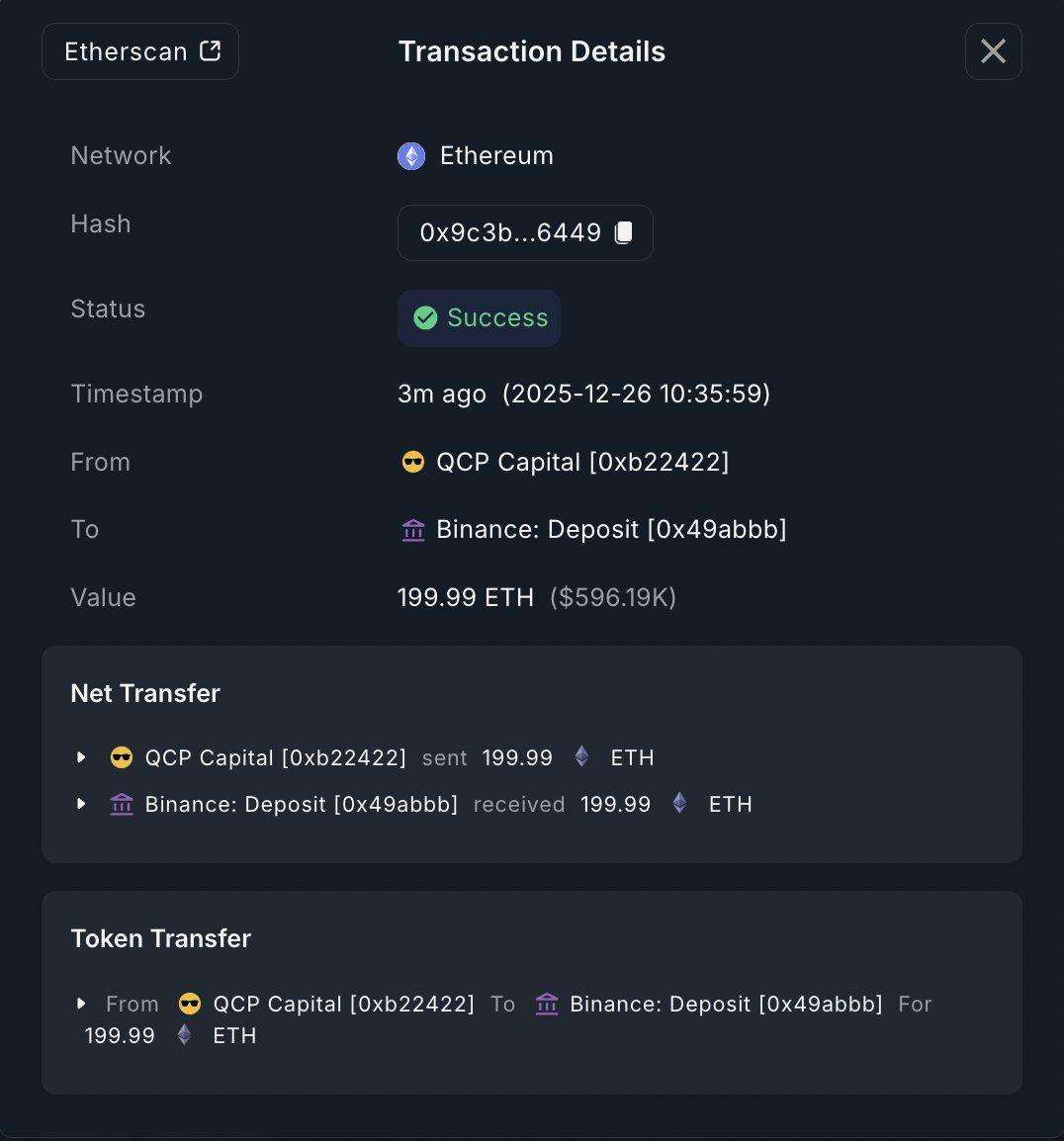

On December 26, 2025, QCP Capital deposited 199.99 ETH, worth approximately $595,929, onto Binance , a move typically made in preparation for a sale.

QCP Capital transferred 199.99 ETH worth $595,929 to Binance on December 26, 2025. Nansen

QCP Capital transferred 199.99 ETH worth $595,929 to Binance on December 26, 2025. NansenWintermute was also very active on the selling side. Although some social media comments suggested that Wintermute was aggressively Dump Bitcoin and Ethereum during the volatile December market, on-chain data confirms that the company reduced its positions after having bought earlier in the month.

These moves primarily indicate a strategy of taking profits and managing risk rather than passively holding the position.

Dragonfly Capital also reduced its position in Mantle (MNT) . Within 7 days in December, the fund deposited 6 million MNT Token, worth approximately $6.95 million, onto Bybit.

Despite Dump some of its holdings, Dragonfly still retains 9.15 million MNT Token, equivalent to approximately $10.76 million, indicating that the fund has only reduced its holdings and not completely exited the market.

The contrast between the large profits in December and the increasing selling pressure reflects the dual strategy of institutions:

- Take advantage of market fluctuations when opportunities arise.

- Reduce risk quickly when the market changes.

For professional funds, selling to take profits at the end of the year can also be a way to rebalance portfolios , protect Capital , or prepare for new investments in early 2026.

While continued selling from leading funds may put short-term price pressure, it also reflects a proactive and assertive approach, rather than a pessimistic view of the market.