Welcome to US Crypto News' Morning Bulletin—your quick update on the most important developments in the crypto world today.

Brew a cup of coffee and watch: while gold prices are soaring to new highs, indicating a shift in Capital toward safe-haven assets, Bitcoin remains trapped below $90,000. A $300 million options structure has curbed Bitcoin's price volatility, but after this major options event concludes, this calm could easily give way to more significant fluctuations.

Crypto news of the day: Bitcoin's "Gamma Cage" gets attention after options contracts expire today.

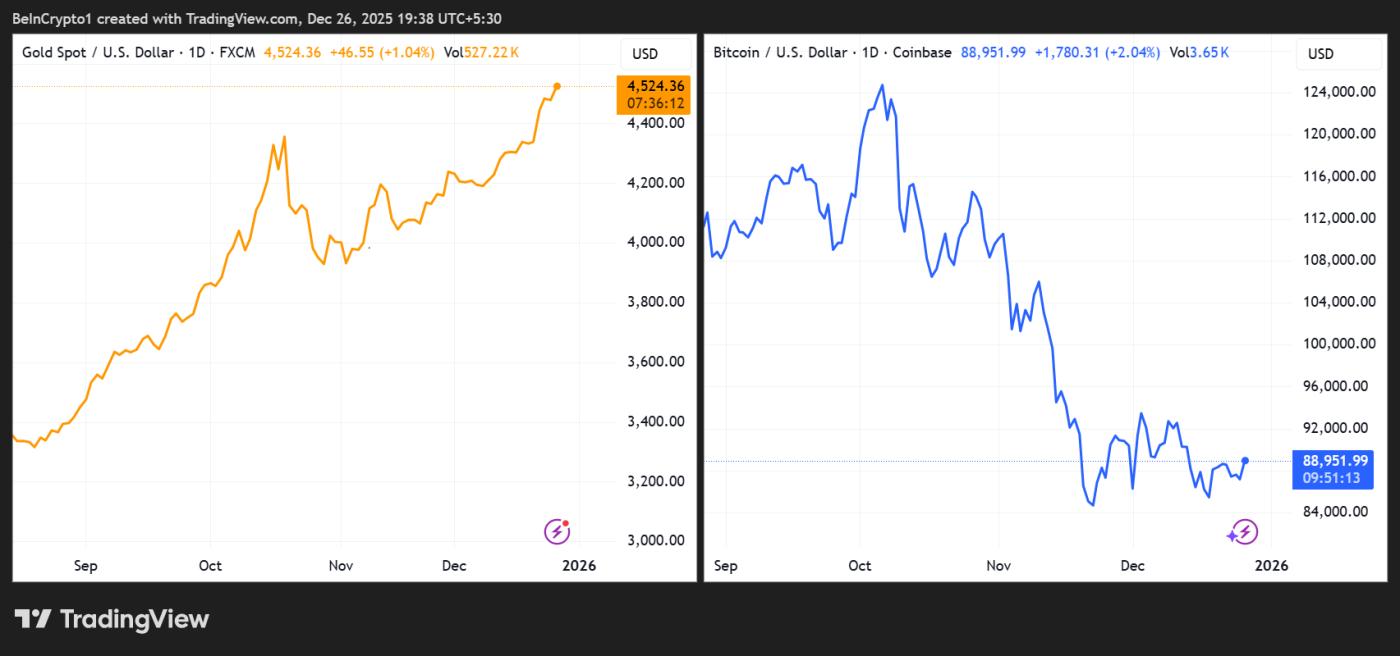

Gold has surged to new highs, breaking through multi-year resistance levels and continuing to assert Vai as an early indicator as market Capital shifts toward safe-haven assets.

Meanwhile, Bitcoin has not reacted similarly. The world's largest cryptocurrency remains stuck below the $90,000 mark.

Some recent analyses suggest that the reason is not a decrease in demand, but rather that the large-scale Derivative structure has inadvertently "tied down" the price of Bitcoin, preventing it from fluctuating wildly.

"Gold is the frontrunner. Bitcoin is still preparing," analyst Crypto Tice Chia .

According to this analyst, whenever gold breaks out, it's usually when market liquidation starts to shift, while Bitcoin only reacts when investors' risk appetite returns.

“Gold typically rises before money seeks safe havens. Bitcoin, on the other hand, usually only surges when investors are willing to take on more risk,” CryptoTice noted, emphasizing that such periods of compression “don’t last slowly” but usually end with strong moves that restart a new cycle for the market.

This analysis aligns well with a recent report by BeInCrypto, which indicated that a rise in gold often paves the way for a Bitcoin breakout .

For Bitcoin currently, this "condensation" stems from the so-called $300 million "gamma trap" in the Derivative market.

According to David, a market structure expert, Bitcoin is "stuck in a narrow price range" due to the dominance of excessively large options positions.

Below, there is a put level at $85,000 with gamma put volume reaching nearly $98.8 million Vai as resistance, while above is a call level at $90,000 with approximately $36.2 million in gamma call volume, creating a "trap" boundary for Bitcoin's price. This leads to a negative chain reaction in the gamma market.

According to the analysis, whenever the price of Bitcoin approaches the upper zone, traders holding call Call Option will have to sell Bitcoin to hedge against risk. Conversely, when the price retreats near the Dip zone, they are forced to buy to protect their put option positions.

“The result: Prices are trapped in a cage,” David observed , emphasizing that the market is being dominated by “the mathematical hedging requirements of market makers” rather than sentiment or news.

Could today's gamma-ray burst trigger the next major Bitcoin price swing?

However, this stability is only temporary. Approximately $300 million worth of gamma, equivalent to 58% of the total gamma supply, expired in a major options event earlier today . David called this a "breakout from the grip," warning that as soon as the options expire, the momentum Peg Bitcoin's price in the $85,000-$90,000 range will disappear almost immediately.

Market history shows that such "Dump offs" often lead to very strong price fluctuations as the market searches for a new equilibrium point.

Currently, the gamma flip index, considered very important, is at $88,925. This is slightly higher than the price of Bitcoin at the time of writing, which is $88,724, according to BeInCrypto data .

Bitcoin (BTC) price performance. Source: BeInCrypto

Bitcoin (BTC) price performance. Source: BeInCryptoIf Bitcoin can steadily rise above this level, the risk-averse flow of market makers could shift from a price-cushioning trend to one that amplifies volatility. This could force market makers to buy on price increases instead of selling as they have in the past.

Systemic tensions escalate as Bitcoin lags behind precious metals.

The current difference between gold and Bitcoin also stems from a tense macroeconomic environment. Economist Mohamed El-Erian recently highlighted that gold has risen more than 40% year-to-date, its strongest gain since 1979. In contrast, Bitcoin has fallen by approximately 20% since the beginning of the year after reaching an early peak in this cycle.

At the same time, many analysts are warning that the simultaneous rise in the prices of gold, silver, copper, and energy markets signals increasing pressure on the financial system. This aligns with recent reports suggesting that the metal price surge may be foreshadowing systemic risk .

Nevertheless, many crypto market Watcher believe that Bitcoin's sideways movement is merely a technical issue and not a negative sign.

With the “gamma trap” drawing to a close and gold signaling strain in the financial system, Bitcoin’s prolonged accumulation could be the preparation for its next breakout.

Daily chart

Gold (XAU) and Bitcoin (BTC) price movements. Source: TradingView

Gold (XAU) and Bitcoin (BTC) price movements. Source: TradingViewAlpha is concise.

Here's a summary of some of the most noteworthy cryptocurrency news in the US today:

- Is Bitcoin about to lock itself in place? The "The Cat" proposal is causing controversy in the community.

- 40% of Ethereum's supply is at a loss as whales hold opposing positions .

- Should you choose Bitcoin or Copper? Investors are reconsidering their options as the metals group surpasses cryptocurrency performance in 2025.

- Money flows into XRP ETFs for 7 consecutive weeks – Why is the price still struggling to rise?

- Crypto investment funds made profits in December despite the overall market remaining weak.

- Hundreds of unlicensed crypto businesses in Europe could be shut down next week .

- TRON network achieved record user growth, while TRX price recorded its worst fourth quarter ever.

Overview of the crypto stock market before the market opens.

| Company | ||

| Strategy (MSTR) | 158.71 USD | 159.72 USD (+0.64%) |

| Coinbase (COIN) | 239.73 USD | 240.40 USD (+0.28%) |

| Galaxy Digital Holdings (GLXY) | 24.43 USD | 24.68 USD (+1.02%) |

| MARA Holdings (MARA) | 9.94 USD | 9.99 USD (+0.50%) |

| Riot Platforms (RIOT) | 13.92 USD | 14.02 USD (+0.72%) |

| Core Scientific (CORZ) | 15.57 USD | 15.63 USD (+0.39%) |