As of 9:10 AM on December 27th, a number of digital assets showed strong upward trends in the virtual asset market. In particular, some stocks, including Clearful (CPOOL), Celestia (TIA), and IOST, led the short-term bull market, recording weekly returns exceeding 100%, centered around the Bitcoin (BTC) market. The trading intensity indicator also showed strong supply and demand dynamics, with several stocks showing buying strength reaching 500%.

[Period-by-period increase rate]

Zerobase (ZBT/KRW) showed the strongest short-term uptrend, with a one-week return of +52.94%. Avantis (AVNT/KRW) also posted a notable performance of +49.74%. Monad (MON/KRW) rose +22.14% over the past week, but its one-month return of -43.66% shows that it is a highly volatile stock. Clearpool (CPOOL/KRW) and ZeroG (0G/KRW) also showed notable short-term uptrends, with +21.01% and +21.97%, respectively.

[Top 10 Weekly Growth Rates]

1st place Clearpool (CPOOL/BTC) +136.67%

2nd place Celestia (TIA/BTC) +119.57%

3rd place: IOST (IOST/BTC) +100.00%

4th place Monad (MON/BTC) +75.00%

5th place: Ray (REI/BTC) +66.67%

6th place: Zerobase (ZBT/BTC) +65.83%

7th place Avantis (AVNT/KRW) +50.90%

8th place: ZeroG (0G/BTC) +50.54%

9th Oasis (OAS/BTC) +50.00%

10th Momentum (MMT/BTC) +46.79%

The stock with the highest weekly gain this week was Clearful (CPOOL/BTC), up +136.67%. Celestia (TIA/BTC) and IOST (BTC) also led the short-term surge, rising +119.57% and +100.00%, respectively. Given that most stocks within the BTC market are ranked high, global supply and demand liquidity appears to be shifting to the BTC market.

[Top 5 Daily Buying Strength]

1st place Blur (BLUR/KRW) 500.00%

2nd place Icon (ICX/KRW) 500.00%

3rd place Big Time (BIGTIME/KRW) 500.00%

4th place: Maple Finance (SYRUP/KRW) 500.00%

5th place Quickchain (QKC/KRW) 500.00%

Based on trading volume, five stocks, including Blur (BLUR/KRW), ICON (ICX/KRW), and Bigtime (BIGTIME/KRW), recorded a daily trading volume of 500.00%, demonstrating concentrated buying activity. These stocks are seeing a significant outflow of buys compared to sells, raising the possibility of continued short-term share price appreciation.

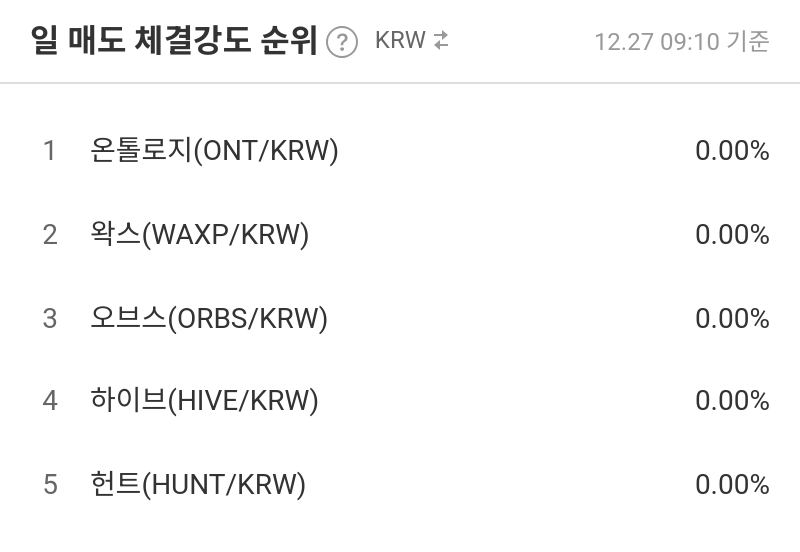

[Top 5 Daily Selling Strength]

1st place Ontology (ONT/KRW) 0.00%

2nd place Wax (WAXP/KRW) 0.00%

3rd place: Orbs (ORBS/KRW) 0.00%

4th place Hive (HIVE/KRW) 0.00%

5th place: Hunt (HUNT/KRW) 0.00%

Meanwhile, the bottom five assets based on sell order strength all recorded 0.00%, demonstrating extreme sell orders. Ontology (ONT), WAX (WAXP), and Orbs (ORBS) all exhibit extremely weak investor sentiment based on sell order strength.

This week, the digital asset market saw a surge in some stocks and strong buying, leading to a concentration of short-term, thematic trading. However, numerous stocks were also experiencing extremely high selloffs or exhibiting poor long-term cumulative returns, necessitating investors to be vigilant in managing volatility.

Get real-time news... Go to TokenPost Telegram

Copyright © TokenPost. Unauthorized reproduction and redistribution prohibited.