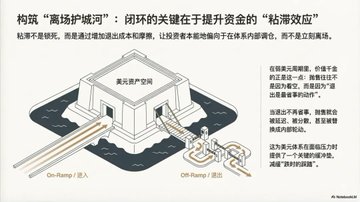

Reposting my WeChat article: Stablecoins and the RWA Loop Will Become the New Moat for the US Dollar (This article is AI-assisted. Feedback on style, readability, and visuals is welcome.) This December, Wall Street was hit by an unexpected M&A boom, forcing many to cut short their Christmas holidays, stay close to home, and stay online at all times. More people than usual chose to remain in New York, resulting in far more intense networking and discussions than in previous holiday seasons. One topic dominating the chatter: the "Market Structure Bill." Many believe the bill will see its first vote as early as January 2026, with a good chance of passing within Q1. This buzz isn't just tech curiosity—it's a gut-level sensitivity to an imminent power shift. We’re at a delicate macro moment: the dollar is entering a depreciation cycle, driven by a complex mix of factors. By-the-book, the Fed should be hiking rates to anchor global liquidity and stem capital flight as the dollar weakens. But with federal interest payments now a fiscal millstone, "rate hikes to hold capital" are more expensive and unsustainable than ever. Wall Street elites sense the toolkit is evolving: when the price tool (rates) hits its limit, the only way forward is to upgrade the infrastructure for distributing US assets. Contrary to popular belief, the Market Structure Bill isn’t about reining in the wild crypto markets after a decade of chaos. It’s about opening the floodgates for US RWA (real-world asset) tokenization, merging stablecoins and RWAs to form a "first-mover closed loop": stablecoins as the on-chain dollar settlement layer, RWAs as the yield and collateral layer. Together, they create a frictionless, ever-expanding "US dollar asset space" that can absorb global capital more smoothly. In a weak dollar cycle, the real value here isn’t an immediate dollar pump, but the "stickiness effect"—reducing tail risk from mass dollar/Treasury selloffs by keeping capital circulating within the system, enabling reallocation instead of outright exit. At the same time, it gives the US and its companies a scalable, cross-timezone global funding and asset distribution mechanism—so America can keep absorbing capital, growing its balance sheet, and investing in innovation, all without needing ever-higher Treasury yields to stay attractive. The dollar is weakening: the DXY is down over 9% YTD, one of its worst years in recent memory. The reasons are complex—debasing to dilute debt, stimulating manufacturing, or just structural decline—none of which fully capture the story. What matters isn’t "why is the dollar down," but whether a "dollar exodus" will follow the weak dollar narrative. If the past 20 years of dollar management were about "controlling the tap" (i.e., rates), then the tap is reaching its limit. Rate hikes boost nominal returns and attract capital in the short run, but now, higher rates mean ballooning fiscal costs and erode faith in long-term sustainability. Clearly, the dollar’s policy toolbox needs an upgrade. That’s where stablecoins and RWAs come in. This is the intuitive logic behind merging stablecoins and RWAs. Stablecoins = "on-chain dollar chips": not issued by the Fed, but functionally cash for on-chain trading and settlement. RWAs = tokenized US Treasuries, money market fund shares, private credit, receivables, even equity—turned into transferable, divisible, and instantly settled digital certificates via compliant structures and tech. With only stablecoins, the main use case is "crypto trading." A16Z estimates that by 2025, stablecoin transaction volume will hit $50T, with $41T (82%) coming from trading. But when RWAs enter the mix, the new loop looks like this: fiat/bank deposits → stablecoins → buy RWAs for yield or collateral → leverage/redeploy for higher capital efficiency → exit via redemption/FX back to fiat. The value isn’t conjured from thin air, but from transforming the "buyability, usability, and collateralizability" of US assets into real infrastructure: lower barriers, shorter pipes, faster settlement, smoother cross-timezone flow. The Market Structure Bill is about opening the RWA floodgates and building this loop. In TradFi, issuance, trading, custody, and clearing each have well-defined compliance frameworks. On-chain, the lines blur: are tokenized assets securities or commodities? Who can issue/distribute? What obligations do platforms have? How do custody and client asset segregation work? What’s the liability chain in a dispute? The core value of market structure legislation is to "draw the lanes and post the signs," so institutions know which regulatory track they're on, and are willing to supply real assets, provide liquidity, and run compliant operations. Meanwhile, stablecoin regulation (reserve assets, redemption rights, audit and disclosure) makes "on-chain dollar chips" a trustworthy settlement layer—naturally channeling investor demand for yield into RWAs and on-chain money markets, rather than forcing the US to rely solely on higher Treasury rates to stay attractive. In this sense, the dollar’s toolkit is shifting from "rate-driven" to "asset-infrastructure-driven." Some think the Market Structure Bill is a "green light for crypto"—that’s a misread. It’s about laying the institutional rails for large-scale asset tokenization: who regulates, what’s the asset class, who can issue, who can trade and match, what are brokerage and custody duties, how are client assets segregated, what are the disclosure/risk standards. For Wall Street, this clarity is more valuable than any tech breakthrough—when gray areas become predictable, legal uncertainty costs drop, and capital, products, and workflows can migrate on-chain. Once institutional supply flows in, on-chain markets evolve from scattered experiments to sustainable liquidity and credit pools, giving the stablecoin-RWA loop a robust legal foundation. When you map stablecoins and RWAs together, you see a "liquidity pump station," not two isolated innovations. The pump’s core structure is simple: fiat/bank deposits flow into stablecoins (bringing "off-chain" dollars on-chain as instantly settleable chips); stablecoins flow into RWAs (allocating on-chain cash to yield/collateral assets); then, RWAs’ "circulation" kicks in—they’re not just for collecting yield, but can be pledged, borrowed against to mint new stablecoins, and used to buy more assets or join other pools—turning a one-off investment into a circular capital loop; finally, the main friction is at "exit": redeeming stablecoins for fiat means passing through banks, compliance, and channel costs—a narrow, expensive gate, so in many cases, capital prefers to stay and reallocate within the on-chain system rather than fully exit. Stitch these steps together: easy entry, rich allocation, high turnover, friction at exit—that’s the pump station model. To really understand the "pump," you need to see where RWA’s incremental value comes from. Many assume it’s just tokenized Treasuries—a "buy US debt on-chain" play. That’s the first, and easiest, layer: making short-term safe assets into on-chain cash management tools, so stablecoins don’t sit idle at zero yield, and on-chain lending/clearing gets standard, reputable collateral. But if RWA gets stuck at this layer, it’s just a new pipeline: channeling global liquidity into short-term US assets, strengthening the dollar’s base, but not explaining Wall Street’s excitement about the Market Structure Bill. In a true tech revolution cycle, national competitiveness isn’t about selling more Treasuries—it’s about channeling capital to innovation sectors (AI, advanced manufacturing, biotech, energy, defense) with less friction and without ballooning government interest costs. The real second layer is distribution of risk assets: stocks, corporate bonds, private credit, receivables, fund shares, even structured products and equity. This is about "corporate funding" and "risk pricing"—not just bringing Treasury yields on-chain, but directly matching US corporate funding needs with global capital. Assets previously accessible only to a few, with complex procedures and illiquid trading, can now be fractionalized, sold globally, and settled instantly, unlocking new capital sources. More importantly, it enables risk redistribution: as more capital flows into US corporate and credit assets via on-chain RWAs, the risk capital for US innovation/expansion shifts away from the federal balance sheet and from "higher Treasury yields," instead spreading globally via market-driven risk premiums—higher yields, real risk, with the burden moving from "US Treasury" to "global capital." That’s the core of RWA’s value in a tech revolution window: advancing the dollar from just a currency and Treasury system to a global financing and risk-sharing network, letting US firms continuously tap global capital while spreading innovation risk far and wide. The pump’s ability to scale funding doesn’t rely on financial alchemy, but on three systemic advantages. First, distribution efficiency: finer asset splits, lower entry thresholds, broader reach, especially tapping cross-timezone long-tail capital; for issuers, that means a bigger potential investor base and lower "friction tax" on fundraising. Second, collateralization: standardized on-chain RWA certificates are easier to use as collateral, unlocking lending and reallocation; in TradFi, non-standard assets can be pledged too, but with more paperwork, longer cycles, and info asymmetry—on-chain’s ambition is to automate, streamline, and compose these flows. Third, 24/7 settlement and automation: less capital sits idle across time zones, transaction and delivery time cost drops, capital efficiency rises—but this double-edged sword means risk transmission, redemptions, deleveraging, and volatility can also accelerate beyond TradFi norms. One key point that’s often misunderstood: this isn’t "interest-free global fundraising," nor has the US government found a "free capital" cheat code. "Not relying on higher rates to keep capital" doesn’t mean the Fed can ignore economics or that assets stop paying yield. The core logic is yield structure substitution: in the RWA system, Treasuries and stablecoins become more like "infrastructure" and "settlement layer," providing safe liquidity. The "excess yield" that attracts global capital...

This article is machine translated

Show original

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content